Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Finding money fast is tough when your credit score is low. Green Dollar Loans offers a way out with $5,000 loans for bad credit. This blog will show how to get this easy payday loan without a credit check.

Keep reading to learn more.

Overview of Green Dollar Loans for Bad Credit

Green Dollar Loans offer a lifeline to individuals with bad credit, providing access to much-needed funds. Their flexible terms and minimal eligibility criteria make it an accessible option for those struggling financially.

Features and Benefits

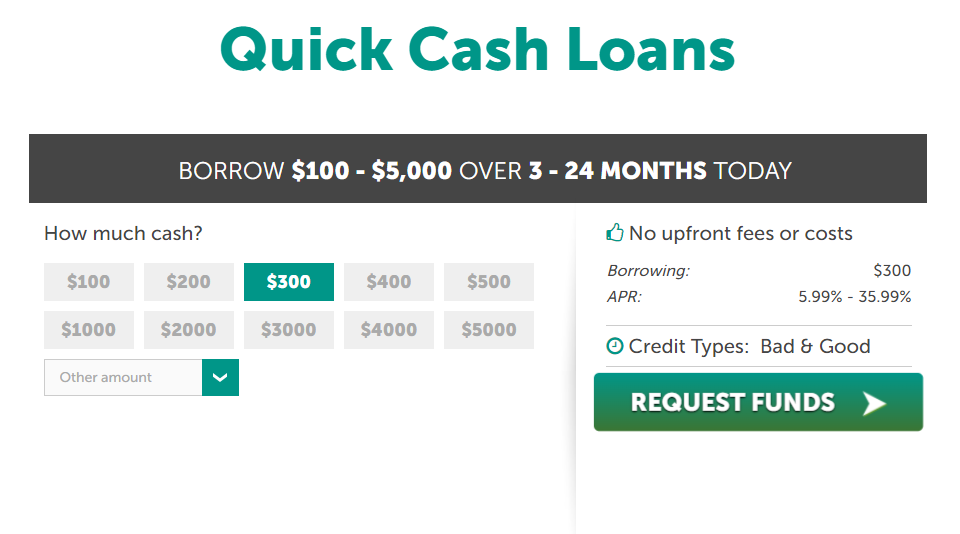

Green Dollar Loans offer a quick application process that stands out. You can get a response in just 15 minutes. If you are approved, the funds could be in your account within one business day.

This makes Green Dollar Loans an easy payday loan option for those who need money fast.

The interest rates on these loans range from 5.99% to 35.99%. It means payments fit better into budgets over time because they are made in installments. Plus, even though Green Dollar Loans might check your credit, they still consider applicants with bad credit for guaranteed payday loans.

Eligibility Criteria

To get a $5,000 green dollar loan, even if you have bad credit, you must meet some rules. You need to be at least 18 years old. Also, you should live in the US or Canada and be a citizen or permanent resident.

It’s important that you have a regular way of making money. When applying for an auto title loan, make sure to have your car’s insurance details ready along with its registration and a clear title.

Having a government-issued ID is also required to confirm who you are when applying for easy installment loans or easy payday loans from best green dollar loans. Checking these things helps Green Dollar Loans make sure they lend money responsibly.

Steps to Apply for a $5,000 Green Dollar Loan

To apply for a $5,000 Green Dollar loan, start by filling out the online application with your personal and financial details. After completing the form, gather the required documentation such as identification and income proof before submitting your application for approval.

If you meet the eligibility criteria and submit all necessary documents, you can expect a quick response regarding your $5,000 Green Dollar loan application.

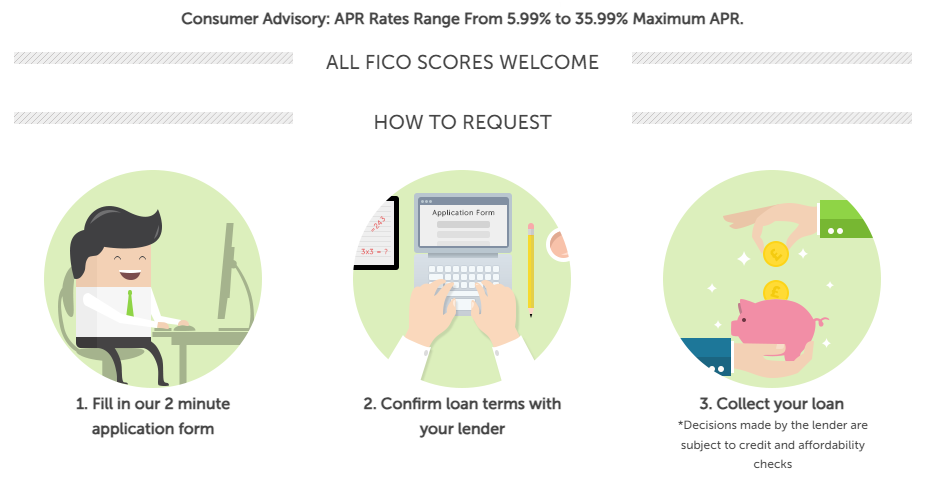

Application Process

Applying for a $5,000 Green Dollar Loan is straightforward. The process kicks off with a quick initial application that only takes about 1 minute to complete.

Here are the steps involved:

- Visit the Green Dollar Loans website and find the loan application form.

- Fill out the form with your personal info, including name, address, employment details, and how much money you need.

- Submit your application online and wait. Applicants usually hear back within 15 minutes.

- If approved, review the loan offer carefully. Make sure it follows state laws.

- Provide any needed documents to support your application. This could be proof of income or identification.

- Read through and sign the loan contract if everything looks good to you.

- Receive your funds. Green Dollar Loans claims they can fund loans on the same day as approval.

This process aims to be fast and simple so that applicants can get help quickly without hassle. It’s important to review every part of your offer to make sure it’s right for you before agreeing to it.

Required Documentation

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

To move from the application process to providing the required documentation, applicants need to have the following items ready:

- A government-issued ID as proof of identity.

- Documentation showing a regular source of income.

- For auto title loans, proof of insurance, vehicle registration, and a lien-free vehicle title.

Comparing Green Dollar Loans with Other Lenders

Green Dollar Loans offer competitive interest rates and flexible loan terms, making them a solid option for borrowers with bad credit. When comparing Green Dollar Loans with other lenders, it’s evident that they prioritize quick approval times and minimal documentation requirements, setting them apart in the lending market.

Interest Rates

Interest rates vary greatly, particularly for loans aimed at individuals with less-than-perfect credit scores. Green Dollar Loans offers options designed for this group, with APRs ranging from 5.99% to 35.99%. This range provides flexibility depending on the borrower’s credit score and the specifics of the loan agreement.

Here’s a simple table for clarity:

| Lender | Loan Amount Range | APR Range | Example |

|---|---|---|---|

| Green Dollar Loans | $5,000 | 5.99% to 35.99% | $5,000 over 48 months at 8% fee = $131.67/mo, $6,320.12 total repayment, 18.23% APR |

| OppLoans | $500 to $4,000 | Varies | Specific rates not provided, but offers same-day processing |

| Fast5kLoans | $100 to $35,000 | Varies | Provides access to a range of lenders, including those considering less-than-perfect credit |

Interest rates are a critical factor in determining your monthly payments and the total amount you will pay back. Selecting an appropriate lender can result in considerable savings over time. It’s recommended to review your options thoroughly before deciding to apply for a loan.

Loan Terms

Green Dollar Loans provides options for those needing financial support, especially with bad credit. Here’s a detailed look at the loan terms for Green Dollar Loans:

| Loan Type | Term Length | Minimum Repayment Period | Maximum Loan Available |

|---|---|---|---|

| Installment Loans | Up to 3 years | 61 days | Post-application details |

| Auto Title Loans | Up to 3 years | 61 days | Post-application details |

With terms extending up to three years, borrowers can find manageable installment plans. Starting with a minimum repayment period of 61 days, these loans cater to immediate financial needs with the flexibility for longer payback times. Details on the maximum amount available for larger installment loans are provided after application, ensuring borrowers receive personalized offers based on their specific financial situations.

Approval Time

Approval times for loans are critical. Fast approval can be a game-changer for many. Green Dollar Loans excel in this. They promise a quick application process. Expect a response within just 15 minutes. If approved, funds could hit your account in as little as one business day. This speed is hard to beat.

| Lender | Approval Time | Funds Availability |

|---|---|---|

| Green Dollar Loans | Within 15 minutes | Same to 1 business day |

| Chime SpotMe® | Instant | Up to $200 |

| EarnIn | Instant for a fee | Up to $750 per pay period |

Approval times are just the beginning. Next, we explore what to do if your loan application is rejected.

What to Do If Your Loan Application Is Rejected

If your loan application is rejected, explore alternative financing options and consider ways to improve your credit score for future applications. This will help you understand the available alternatives and guide you in building a better financial profile for future opportunities.

Alternative Financing Options

When faced with rejection, consider alternative financing options such as local resources, payment extensions, or credit cards. Other options include Cleo cash advances up to $250 with a 3-4 day turnaround, Dave ExtraCash offering loans up to $500 within 3 business days, and Fig Loans providing up to $100 with same-day availability.

Improving Credit Score for Future Applications

To improve your credit score for future loan applications:

- Get a free credit report from annualcreditreport.com annually.

- Ensure timely bill payments to prevent late payments from affecting your score.

- Maintain low credit card balances in relation to the credit limit.

- Avoid opening multiple new accounts within a short timeframe.

- Use caution when considering closing old accounts as it may impact the length of credit history.

- Challenge any inaccuracies found on the credit report with the respective credit bureau.

Keep in mind, positive changes take time, and consistent effort can significantly enhance your credit score over time.

FAQs on Green Dollar Loans

Need answers about Green Dollar Loans? Discover repayment terms and early repayment penalties in our FAQ section. Get the details you need before applying.

Repayment Terms

Green Dollar Loans offers a repayment period of 61 to 90 days, allowing flexibility in returning the borrowed amount. With loan terms ranging from a few months to 3 years, borrowers can select a suitable timeframe for repayment that aligns with their financial situation.

For instance, if you borrow $5,000 over 48 months at an 8% fee, you would make monthly payments of $131.67 totaling $6,320.12 and incurring a total cost of $1,720.12 with an APR of 18.23%.

It’s important to adhere to a budget plan to ensure timely repayments and avoid fees.

Early Repayment Penalties

Before jumping into a loan agreement, it’s crucial to understand early repayment penalties. Green Dollar Loans doesn’t specify these penalties. It’s important to carefully review the loan contract and ensure compliance with state laws.

Pay close attention to the fine print before signing any agreement.

If considering paying off your loan early, reviewing the terms and potential penalties is essential. Ensure that you thoroughly understand any financial implications associated with early repayment before committing to a loan.

It can be helpful for individuals seeking loans to fully comprehend all contractual terms and conditions relating to early repayments in order to avoid unexpected fees or charges down the line.

Conclusion

In conclusion, Green Dollar Loans provides a quick and easy option for individuals with bad credit to secure short-term loans. The loan amounts ranging from $500 to $10,000 feature same-day to one business day turnaround time.

With a simple application process and options for installment or auto title loans, it offers accessible financial solutions despite potential credit challenges. While borrower reviews are currently limited, the transparent privacy policy and secure website contribute to building trust in their services.

Overall, Green Dollar Loans stands as a viable choice for those seeking speedy access to funds without undergoing a traditional credit check.