Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Building good business credit is tough for many small owners. One relevant fact is that Nav Prime can significantly help in this process. This article will explain how Nav Prime 2 Tradelines could boost your business credit score by 50% in just three months, offering a clearer path to financial growth and better financing options.

Get ready to learn!

Key Takeaways

- Nav Prime 2 Tradelines report to major business credit bureaus every month, helping increase your business credit score by up to 50% in just three months.

- Using Nav Prime can give businesses access to better financing options and improved loan terms without needing a personal guarantee or undergoing a credit check.

- Regular monitoring of your business credit through services like Nav helps you make informed decisions, maintain good financial health, and grow your company.

Understanding Business Credit Scores and Reports

Understanding Business Credit Scores and Reports is essential for your business's financial health. It involves factors that determine scores and how they are used to make informed credit decisions.

Factors that Determine Business Credit Scores

Understanding your business credit score is crucial for securing financing and maintaining a healthy financial status. These scores depend on several key factors, reflecting your company's creditworthiness.

- Payment History: Financial institutions report your payment behavior to business credit bureaus like Dun & Bradstreet (D&B), Experian, and Equifax. On-time payments improve your score, while late payments can lower it.

- Age of Credit History: Older accounts contribute positively to your business credit score. Lenders view a long history as evidence of stability and reliability.

- Debt Usage: How much debt you have compared to your credit limits affects your score. Lower ratios of debt-to-credit are better for your score.

- Public Records: Bankruptcies, liens, and judgments against your business negatively impact your score. Keeping a clean legal record helps maintain a healthier score.

- Industry Risk: Some sectors are considered riskier than others. Your business's industry can influence its credit score based on these risk assessments.

- Company Size: Larger businesses often have higher scores because they're seen as more stable and capable of handling debt responsibly.

- Credit Card Use: Responsible use of business credit cards, like the Nav Prime Card, contributes positively to your profile by showing regular, on-time payments.

- Official Reports from Bureaus: Regular reporting from major bureaus ensures that all positive financial activities are reflected in your business credit reports.

- Financial Health Monitoring Tools: Using services that offer real-time alerts and financial health monitoring can help you stay on top of changes in your score.

- Tradeline Reporting: through Nav Prime enhances the accuracy of what's reported about your company to the bureaus, ensuring that positive financial behaviors boost your overall score.

Next up, let's explore how Nav Prime 2 Tradelines specifically work to boost those scores effectively.

How Business Credit Scores Are Used

After exploring the factors that determine business credit scores, it's clear they play a crucial role. Lenders and creditors use these scores to decide who qualifies for financing.

A strong business credit score opens doors to a variety of financing options in Nav's marketplace, offering access to over 100 business financing products. This score influences the approval process and also affects loan terms, including interest rates and repayment schedules.

Businesses with high credit scores often enjoy longer payment terms with suppliers and can secure larger credit limits based on their financial stability. These benefits are critical for cash flow management and operational flexibility.

For companies aiming to grow or manage expenses more effectively, maintaining a good credit profile is essential.

How to Get Free Business Credit Scores

Getting your business credit scores without spending a dime is easier than you might think. Companies like Nav offer free access to business credit reports, including from big names such as Experian Small Business and Equifax Small Business. Here's how you can get these scores for free:

- Sign up for a Nav account: Registering with Nav gives you free access to your business credit scores. This includes reports from both Experian Small Business and Equifax Small Business.

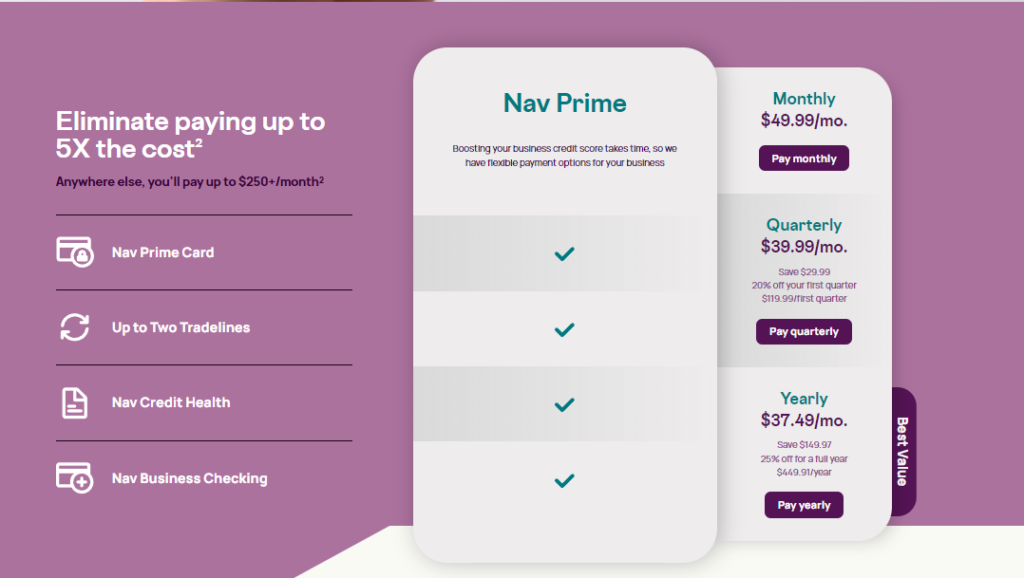

- Nav Prime Membership trial: Take advantage of the Nav Prime subscription's $49.99 per month cost by first exploring if they have a free trial period. During this time, access three business and two personal credit reports at no charge.

- Monitor your email: Once signed up with Nav, keep an eye on your inbox for updates and insights directly related to your business credit score.

- Utilize free tools online: Other than Nav, search for websites that offer no-cost glimpses into your business’s financial health.

- Check with financial institutions: Some banks or financial services provide their customers with periodic credit score updates for free, so ask yours if they offer this service.

- Annual Credit Report Request Service: While this is more common for personal credit, some businesses might qualify to receive a report through this service depending on their circumstances and affiliations.

By following these steps, small businesses can stay informed about their credit health without incurring extra costs, paving the way for better financing options and improved terms on loans or lines of credit.

The Importance of Monitoring Your Business Credit

Regularly monitoring your business credit is vital for maintaining good financial health. Good credit habits can be developed by regularly tracking and managing your business credit, ensuring that it remains strong and reliable.

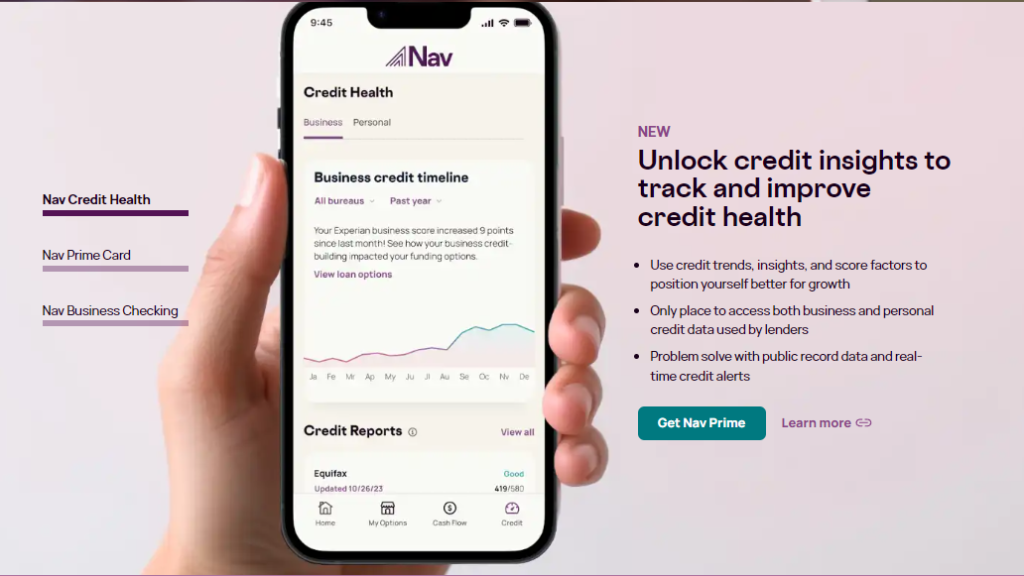

Nav Prime's credit reports provide important insights that empower businesses to make well-informed decisions about their financial stability and future growth. Understanding how factors like UCC filings, industry risk assessment, public records monitoring, and credit insights impact your business credit is crucial in building a strong credit profile and making successful financing choices.

Nav Prime 2 Tradelines: Boosting Business Credit Scores

Nav Prime 2 Tradelines can boost your business credit score significantly. To learn more, dive in and explore the benefits for yourself.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

How Nav Prime 2 Tradelines Work

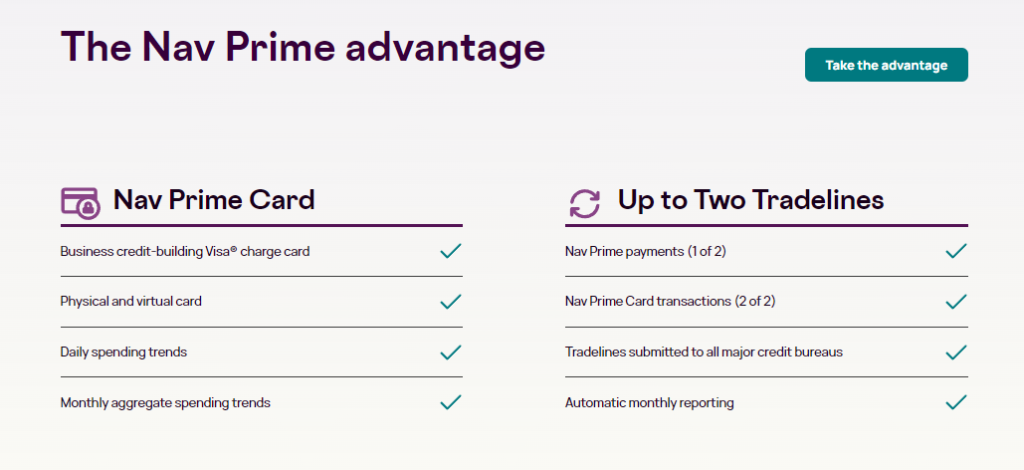

Nav Prime 2 Tradelines work by reporting a tradeline monthly to major business credit bureaus. The Nav Prime Card adds an additional monthly tradeline, contributing to improved business credit scores.

For customers using Nav's Detailed Credit Reports with tradeline reporting, business credit scores can increase up to 50% in the first 3 months. This service is beneficial for small businesses seeking no personal guarantee and daily autopay features while enhancing their credit profile and improving credit utilization.

Moving on to "Benefits of Using Nav Prime 2 Tradelines"...

Benefits of Using Nav Prime 2 Tradelines

Nav Prime 2 tradelines contribute to a significant increase of up to 50% in business credit scores within the first 3 months, as observed with Nav's Detailed Credit Reports. Utilizing these tradelines can help business owners qualify for a broader range of financing options, thanks to stronger business and personal credit scores.

- Access to Financing: Nav Prime 2 Tradelines empower businesses with the ability to access small business financing and improve credit profiles without needing a security deposit or undergoing a credit check.

- Improved Loan Terms: By using Nav Prime 2 Tradelines, business owners can secure better loan terms, longer payment terms, and even qualify for financing without relying on personal credit.

- Continued Positive Impact: The majority of Nav customers leveraging tradeline reporting for at least a year witness sustained positive changes in their business credit scores.

- Enhanced Financial Qualification: Through the use of Nav Prime 2 Tradelines, businesses can gain access to enhanced financial opportunities and products such as business checking accounts and charge cards with no annual fee, thereby strengthening their financial status and resilience.

Testimonials from Satisfied Customers

Some customers have seen their business credit scores increase by up to 50% in just 3 months after using Nav Prime 2 Tradelines, showing the effectiveness of this service. The positive feedback from satisfied users underscores the impact that Nav Prime 2 Tradelines can have on boosting business credit profiles and improving financial credibility with lenders.

This real-world success demonstrates the tangible benefits of utilizing Nav Prime 2 Tradelines for businesses seeking rapid credit score improvement and a stronger financial standing.

Other Ways to Improve and Maintain Business Credit

Build strong business credit with practical tips and the right monitoring service. Understand the differences between business and personal credit cards to make informed decisions.

Tips for Building Strong Business Credit

To build strong business credit, consider the following tips:

- Pay your bills on time: Late payments can significantly impact your business credit score. Aim to settle all dues promptly to maintain a favorable credit history.

- Monitor your credit report regularly: Regularly review your business credit report to ensure accuracy and address any errors promptly. This helps in maintaining a clean and reliable credit profile.

- Keep credit utilization low: Aim to use only a small portion of your available credit, ideally below 30%, to demonstrate responsible credit usage and avoid appearing overextended.

- Establish trade lines with vendors and suppliers: Building positive payment history with vendors and suppliers can positively impact your business credit profile.

- Separate personal and business finances: Maintaining separate bank accounts and credit cards for personal and business use helps in establishing a clear distinction between personal and business finances, aiding in building a strong business credit profile.

- Utilize business credit cards responsibly: Use business credit cards judiciously, ensuring prompt repayment of balances to showcase reliable financial management skills.

- Establish relationships with lenders: Cultivate connections with lenders who specialize in small businesses, as these relationships can facilitate access to financing when needed.

Choosing the Right Business Credit Monitoring Service

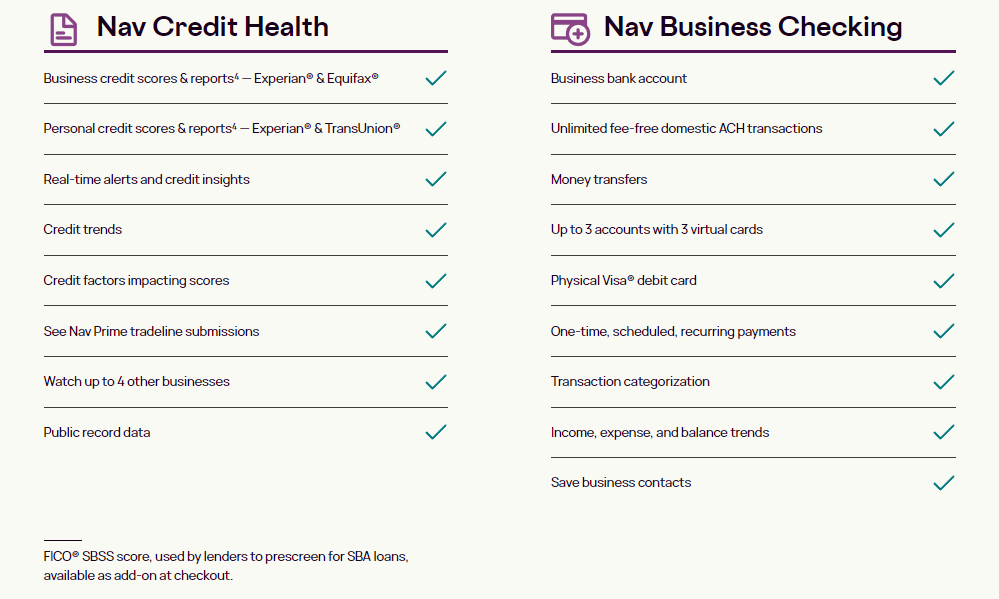

When choosing a business credit monitoring service, consider Nav Prime's $49.99 per month subscription, which provides access to three business and two personal credit reports. These reports help businesses make informed decisions and ensure financial stability.

Nav Prime offers a charge card with no credit check or security deposit, allowing users to instantly create a new tradeline. With these features, you can monitor your business credit effectively while also having the flexibility to make informed credit decisions for your business growth.

Nav Business Credit, nav Business Boost, nav Credit Monitoring

Differences Between Business and Personal Credit Cards

Business credit cards are designed for business-related expenses, while personal credit cards are for individual use. Business credit card activity is reported to commercial credit bureaus such as Experian and Equifax Business, whereas personal credit card activity is reported to consumer credit bureaus like Experian and Equifax Personal.

Business cards often have higher credit limits compared to personal ones.

Moreover, the protections provided by the Credit CARD Act of 2009 do not apply to business credit cards. This means that business owners may be subject to sudden interest rate increases without notice on their business credit accounts.

Additionally, businesses and individuals can enjoy different rewards structures with personalized benefits tailored towards specific financial profiles based on the type of card used: nav business tradelines or nav prime card limit.

When it comes to utilization, a key distinction lies in transaction tracking where companies usually seek more than just expense tracking capabilities from their corporate cards - features that might offer enhanced security controls and detailed reporting ability for better expense management.

Conclusion: The Importance of Good Business Credit and Utilizing Nav Prime 2 Tradelines.

Boost your business credit score by 50% in just 3 months with Nav Prime 2 Tradelines. With the help of this tool, small business owners can enhance their credit history and access better financing options.

Utilizing Nav Prime will provide you with a charge card that doesn't require a credit check or security deposit and is available in most states. By incorporating Nav Prime's detailed credit reports with tradeline reporting, many satisfied customers have seen significant increases in their business credit scores.

Strengthening your business credit foundation and monitoring your credit health is crucial for accelerating the growth of your business.

FAQs

1. What is the Nav Prime 2 Tradeline?

The Nav Prime 2 Tradeline is a business credit card that helps in building your business credit. It offers an improvement to your credit profile without requiring a security deposit.

2. How does the Nav Prime 2 Tradeline boost my Business Credit Score?

By using the Nav business credit card, you can increase both your Experian Intelliscore and Equifax Business Score by up to 50% in just three months.

3. What factors affect my credit score with the Nav Prime Card?

Credit factors such as timely payments, low debt-to-credit ratio, and responsible use of your nav prime card's credit limit can all contribute to boosting your business' overall score.

4. Are there any reviews on the effectiveness of the Nav Prime Card?

Yes, many positive nav prime reviews highlight its effectiveness in aiding businesses with their credit profile improvement quickly and efficiently.