Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Finding a loan with bad credit can feel impossible. PersonalLoans.com offers a solution for those seeking loans without harsh credit checks. This blog post will review how PersonalLoans.com works, focusing on services for bad credit and no credit check processes.

Keep reading to discover if it's right for you.

Overview of PersonalLoans. com

PersonalLoans.com offers various loan options and unique features. The platform provides a quick application process for those seeking loans.

Services offered

PersonalLoans.com offers a range of services for people looking to borrow money. Users can apply for loans ranging from $250 to $35,000. This makes it easy to find a loan that fits their needs, whether they're covering small expenses or funding big projects.

The process is designed to be quick and simple, with the possibility of getting your funds as soon as the next business day after approval.

They cater to users with different credit backgrounds, including those searching for personalloans.com for bad credit options. Since there's no credit check required during the initial application phase, applying won't hurt your credit score.

This feature opens up opportunities for many who might be worried about their financial history affecting their chances of getting a loan.

Unique features

After talking about the services PersonalLoans.com offers, it's exciting to see what sets them apart. They use advanced data encryption technology to keep your information safe. This means when you apply for a loan, even without a credit check, your personal details are protected.

They also provide access to loans at any time since requests can be made 24/7. This feature is great for those unexpected financial needs. Plus, with flexible terms and amounts available, borrowers have control over their loan choices.

Whether it's late at night or early in the morning, you can get started on securing that much-needed loan right away.

Eligibility Criteria for PersonalLoans. com

To be eligible for a loan from PersonalLoans.com, you need to meet basic requirements. They also offer a no credit check process, making it accessible for those with bad credit.

Basic requirements

Getting a loan from PersonalLoans.com is easy even with bad credit. They have simple basic requirements for applicants.

- You must be 18 years or older. This is the legal age to enter into a contract.

- A valid Social Security Number (SSN) is required. It helps in verifying your identity.

- You need proof of income. This shows you can pay back the loan.

- Having an active bank account is necessary. Lenders send money directly to your account.

- You should be a legal U.S. citizen or permanent resident. This ensures you fall under U.S. laws for lending.

- Your monthly income must meet their minimum requirement. It varies by lender but shows you can handle payments.

- Consent to account checks and marketing communications is needed as per their policy.

These criteria help PersonalLoans.com review applications without doing a hard credit check right away, protecting your credit score from any immediate impact.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

No credit check process

PersonalLoans.com specializes in connecting individuals with bad credit to personal loans. It stands out by offering a no credit check process, making it accessible to those with poor credit scores.

This is crucial as 27% of U.S. adults fall into the bad credit range (350-650). The absence of a credit check opens doors for these individuals when traditional lenders may turn them away.

Pros of Using PersonalLoans. com

PersonalLoans.com offers a wide range of loan options to choose from, making it easy to find the one that suits your needs. The application process is fast, allowing you to get access to funds quickly when you need them.

Variety of loan options

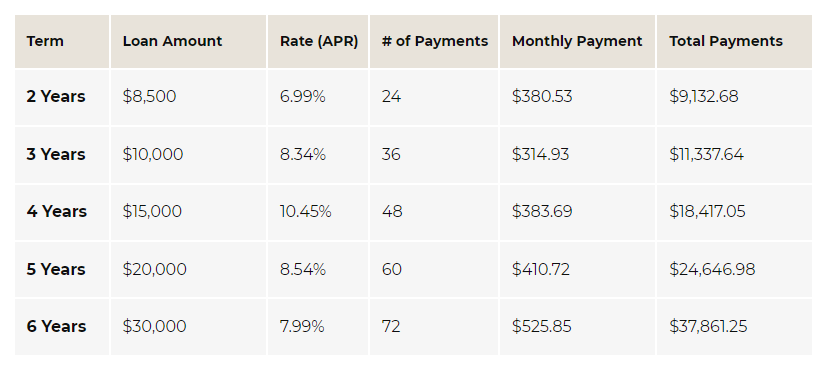

PersonalLoans.com offers a wide range of loan options, from $250 to $35,000. These loans come with flexible terms ranging from 3 to 72 months. The network provides access to diverse lenders, ensuring competitive rates for borrowers.

For example, a $4,000 loan at a 15.0% APR would result in monthly payments of $193.95 over 24 months, totaling $4,654.72.

PersonalLoans.com no credit check

Quick application process

After exploring the variety of loan options, PersonalLoans.com offers a quick and simple online application process open 24/7. Applicants input their personal details and income information to connect with multiple nationwide lenders.

The potential funding is available as soon as the next business day after approval, making it convenient for those in need of swift financial assistance.

Cons of Using PersonalLoans. com

PersonalLoans.com might charge higher APRs for those with poor credit. It acts as a middleman rather than a direct lender, potentially delaying the loan process.

Potential high APRs for poor credit

PersonalLoans.com may have high annual percentage rates (APRs) if you have poor credit, ranging from 5.99% to 35.99%. For instance, a $4,000 loan at 15.0% APR could mean paying around $193.95 monthly for 24 months, totaling about $4,654.72 in the end.

The average U.S. credit score stands at a solid 716; however, if your credit is below 650, it's considered bad.

The maximum loan amount offered by PersonalLoans.com is $35,000 with a minimum APR of 5.99%. This means that borrowers with lower credit scores might face higher interest rates and possibly end up paying more over time compared to those with better credit histories due to their potentially elevated APRs.

Not a direct lender

While PersonalLoans.com is a platform that connects users with loan options, it's essential to note that the company does not directly provide loans. Instead of lending money themselves, they function as a network, linking individuals to various loan offerings from different lending partners.

This means that when you apply through PersonalLoans.com, your request is matched with potential lenders in their network rather than receiving funds directly from the website.

PersonalLoans.com operates more as a marketplace than a traditional bank and discloses that they receive referral fees from partners. It's important to understand that the site doesn't serve as a direct lender; instead, it facilitates connections between borrowers and multiple lending sources for personalized loan options.

Customer Reviews and Feedback

6. Customer Reviews and Feedback: Get insights on user experiences and Trustpilot ratings for a glimpse into how PersonalLoans.com serves its customers. Explore real-world feedback before making your decision.

Summary of user experiences

PersonalLoans.com has received positive user experiences, with a service rating of 4.6 out of 5.0 and a Trustpilot rating of 4.6 out of 5 based on under 20 reviews. Customers appreciate the single application funding process highlighted by Jason Ramin, VP of Business Development at IT Media.

Moving onto the "Trustpilot ratings," it's clear that users find PersonalLoans.com trustworthy and reliable for their financial needs, making it a viable option for those seeking loans with bad credit or no credit check requirements.

Trustpilot ratings

Transitioning from user experiences, we now turn our attention to how PersonalLoans.com is rated on Trustpilot. Customer feedback is a crucial aspect of understanding the effectiveness and reliability of a service. On Trustpilot, this platform has received a commendable rating. Here is a detailed look at the Trustpilot ratings for PersonalLoans.com:

| Trustpilot Rating | Number of Reviews |

|---|---|

| 4.6 out of 5 | Less than 20 |

This rating showcases the positive reception from users. With a score of 4.6 out of 5, PersonalLoans.com stands out for its service, even though the total number of reviews is under 20. This indicates that users who left feedback were generally satisfied with their experience. Adam West, a finance editor specializing in subprime financial products, likely appreciates the diverse network of lenders and competitive rates provided by PersonalLoans.com, contributing to its positive reputation.

Conclusion

Looking for a personal loan with bad credit or no credit check? Consider PersonalLoans.com, which connects users to loans from $250 to $35,000. With a simple online application available 24/7, users can connect with multiple nationwide lenders quickly and easily.

However, be aware that potential high APRs may apply for those with poor credit. Despite this, the service's variety of loan options and a quick application process make it worth considering.

If you're in need of an alternative to traditional lending options due to bad credit or no credit check requirements, PersonalLoans.com offers a user-friendly platform to explore various loans and find suitable lenders without hassle.