Choosing a bank or credit union can be tough. Alliant Credit Union is one big name in the game. This article looks closely at what Alliant offers, from savings to loans. Keep reading to learn more about Alliant.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Overview of Alliant Credit Union

Alliant Credit Union offers a variety of financial services designed for its members. From banking products to credit cards and loans, Alliant provides competitive rates and a user-friendly digital experience. The membership eligibility requirements are broad, making it easier for many people to access the benefits offered by Alliant Credit Union.

Key features of Alliant Credit Union

Alliant Credit Union stands out as an online-only financial institution, which means it has no physical branches. This setup allows them to offer competitive interest rates and lower fees than many traditional banks.

All accounts with Alliant are insured up to $250,000 by the National Credit Union Administration (NCUA), giving members peace of mind about the safety of their funds.

Their digital banking experience is top-notch, designed for easy use on both computers and mobile devices. Customers can handle all their banking needs remotely, from checking account balances to transferring money and paying bills.

With high interest rates on savings accounts and a variety of loan options available, Alliant combines the convenience of online banking with the benefits you'd expect from a credit union bank near you.

Membership eligibility requirements

After learning about the key features of Alliant Credit Union, it's time to talk about who can join this credit union. People often think that joining a credit union is hard. But for Alliant, it's pretty easy.

Anyone can become a member if they meet just a few simple requirements. First, you need to have $5 to put in a savings account. This might sound like a lot, but here's some good news: Alliant gives you this $5 when you start your membership.

So really, it doesn’t cost anything to join.

Also, although Alliant was first set up for airline employees back in 2003, now they open their doors wide for everyone interested in becoming part of their banking family. So whether you're near an Alliant branch or far away, joining is not limited by where you live or work anymore.

This makes signing up with them more accessible than some people might think.

Alliant Credit Union Banking Products

Alliant Credit Union offers various banking products like savings accounts, checking accounts, and Certificate of Deposit (CD) options. The bank provides competitive rates on their products and features a user-friendly digital experience.

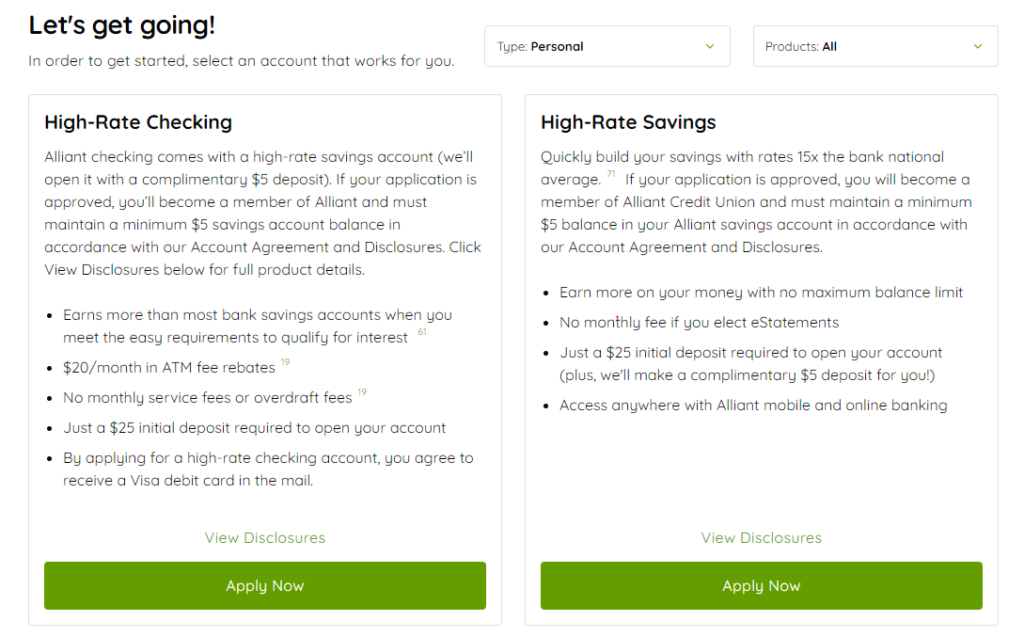

Savings accounts and rates

Savings accounts at Alliant Credit Union offer competitive rates. Here's a detailed look:

| Account Type | APY | Minimum Balance to Earn APY | Monthly Fee with eStatements | Supplemental Savings Accounts |

|---|---|---|---|---|

| Alliant High-Rate Savings Account | 3.10% | $100 | No | Up to 19 |

Members benefit from a high APY of 3.10%. You need at least $100 to start earning this APY. There's no monthly fee if you opt for eStatements. You can also open up to 19 supplemental savings accounts. This feature is great for organizing your savings goals.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Checking accounts and features

Alliant Credit Union's checking accounts present a range of convenient features and benefits:

- No monthly fees or minimum balance requirements.

- No overdraft fees, offering added financial security.

- A mere $25 is needed for the initial deposit.

- Access to over 80,000 fee-free ATMs nationwide.

- Account holders can earn interest with eStatements and at least one electronic deposit per month.

- Receive up to $20/month in ATM fee rebates, adding extra value for members.

These exceptional features make Alliant Credit Union's checking accounts highly advantageous for individuals seeking hassle-free banking solutions.

Certificate of Deposit (CD) options and rates

Alliant Credit Union offers a variety of Certificate of Deposit (CD) options. These CDs come with competitive rates. The minimum deposit to start is $1,000. Members can choose term lengths ranging from 3 to 60 months. The dividends from these CDs compound monthly. For those looking for larger investment options, Alliant provides Jumbo Certificates. These require a minimum deposit of $75,000 but come with higher rates. For example, the 12-month Jumbo Certificate has an APY of 4.15%.

| Term Length | APY | Minimum Deposit |

|---|---|---|

| 3-60 Months | 4.25% | $1,000 |

| 12-Month Jumbo Certificate | 4.15% | $75,000 |

These CD options provide flexibility and competitive returns on your investment.

Alliant Credit Union Credit Cards

Alliant Credit Union offers a Cashback Visa Signature Card with rewards and benefits. The credit cards have specific fees and credit score requirements.

Alliant Cashback Visa Signature Card

The Alliant Cashback Visa Signature Card is a popular choice among members. The card offers 2.5% cashback on all purchases in the first year, up to $10,000 spent monthly and 1.5% thereafter.

There's no annual fee for this card, making it an attractive option for those wanting to maximize their rewards without additional costs.

Moreover, the Card has no foreign transaction fees, aligning with Alliant Credit Union's emphasis on cost-effective and transparent financial products. This makes it beneficial for travelers or individuals who frequently make international transactions - as they can earn cashback without incurring extra charges.

In conclusion, the Alliant Cashback Visa Signature Card provides competitive benefits with its high cashback rates and absence of annual fees or foreign transaction charges - positioning it as a favorable option in today's credit card market.

Rewards and benefits

The Alliant Cashback Visa Signature Card offers a range of rewards and benefits, making it an attractive choice for cardholders:

- Unlimited 2.5% cashback: This card provides unlimited 2.5% cashback on all purchases, making it one of the highest flat-rate cashback credit cards available.

- No annual fee: Cardholders benefit from no annual fee, helping to maximize their cashback earnings without incurring additional costs.

- Introductory offer: New cardholders can enjoy a generous introductory offer with 12 months of 0% APR on purchases and balance transfers.

- Additional perks: The Alliant Cashback Visa Signature Card includes benefits such as extended warranty protection, travel accident insurance, and more, enhancing the overall value for cardholders.

- Easy redemption: Cashback rewards are easy to redeem through the Alliant online banking portal or mobile app, offering flexibility and convenience for users.

- Security features: The card includes advanced security features such as EMV chip technology and fraud monitoring, providing peace of mind for users against unauthorized transactions.

- Accessible customer support: Alliant Credit Union's customer support is readily available to assist cardholders with any inquiries or issues related to their credit card account.

Fees and credit score requirements

Alliant Credit Union provides competitive options for credit cards, each with its own set of fees and credit score requirements. Here's a simplified overview in HTML table format:

| Alliant Credit Union Credit Card | Fees | Credit Score Requirements |

|---|---|---|

| Alliant Cashback Visa Signature Card | No annual fee for the first year, then $99 | Good to Excellent (670 - 850) |

| Alliant Visa Platinum Rewards Card | No annual fee | Good to Excellent (660 - 850) |

| Alliant Visa Platinum Card | No annual fee | Fair to Good (580 - 850) |

Alliant aims to cater to a wide range of customers through its diverse credit card offerings. They have structured their cards to ensure a fit for various financial situations and credit backgrounds. From cards that reward users for their purchases to ones designed for building or improving credit scores, Alliant Credit Union makes these financial tools accessible with clear, straightforward fees and credit requirements.

Loans Offered by Alliant Credit Union

Alliant Credit Union offers various loan options such as personal loans, auto loans, and mortgage packages. To learn all about the loan products at Alliant Credit Union, check out our complete review.

Personal loans

Alliant Credit Union offers personal loans with a focus on trust and transparency. U.S. News and World Report has highlighted Alliant's competitive interest rates on personal loans, making them an attractive option for individuals seeking financial assistance.

This emphasis on fair evaluation and competitive rates reflects Alliant Credit Union's commitment to providing accessible and affordable lending options to its members. With a user-friendly digital experience, the credit union aims to make the personal loan process straightforward and convenient for its customers, further solidifying its position as a reliable financial partner.

Auto loans

Alliant Credit Union offers auto loans, which come with competitive interest rates. As a solely online operation, the credit union does not have physical branch locations. One of Alliant's significant benefits is the absence of overdraft fees, making it advantageous for auto loan customers looking to minimize extra costs.

However, there are no in-person banking options available for those seeking an auto loan. The overall evaluation of Alliant's services indicates a strong reputation that may reflect on its auto loan offerings.

Mortgage options

Alliant Credit Union offers mortgage loans with competitive interest rates in its loan offerings. Whether you're looking for a new home or refinancing, Alliant provides various mortgage options to suit your needs.

They ensure a straightforward process and personalized support, making it convenient for members to secure a mortgage that aligns with their financial goals.

Furthermore, Alliant Credit Union's mortgage options include fixed-rate mortgages and adjustable-rate mortgages, catering to diverse preferences and financial situations. With the credit union's focus on providing favorable terms and exceptional customer service, members can confidently explore their homeownership journey with Alliant by their side.

Whether you are searching for a primary residence or investment property financing, Alliant's competitive rates make them an attractive option when considering your mortgage choices.

How Alliant Credit Union Compares to Other Banks

Alliant Credit Union stands out for its competitive rates, user-friendly digital experience, and quality customer support. When comparing Alliant to other banks like Chase or Capital One, you can see the distinct advantages in rates and service that set Alliant apart from traditional banks.

Alliant Credit Union vs. Chase

Alliant Credit Union provides higher interest rates on savings accounts compared to Chase. Alliant mandates a minimum balance of $5 for their savings account, while Chase’s savings account necessitates a $300 minimum balance to avoid fees. Alliant's checking account has no monthly fees or minimum balance requirements, whereas Chase typically mandates direct deposits or a specific daily balance to waive the fees. Furthermore, Alliant offers lower loan interest rates than Chase for personal and auto loans. For instance, as of February 2021, Alliant’s auto loan rate begins at 2.74%, while Chase's begins at 4.29%.

Alliant Credit Union vs. Capital One

When comparing Alliant Credit Union to Capital One, it's essential to note that both institutions offer diverse banking products and services. Alliant Credit Union is known for its competitive rates, user-friendly digital experience, and quality customer support. On the other hand, Capital One is widely recognized for its extensive network of physical branches and a wide range of credit card options. While Alliant Credit Union excels in providing higher interest rates on savings accounts and CDs, Capital One dominates with a broader selection of credit card offerings. The decision between the two ultimately depends on individual preferences regarding digital banking convenience versus branch accessibility.

In summary, both Alliant Credit Union and Capital One have distinct strengths – from high-yield savings at Alliant to expansive physical presence at Capital One – catering to different consumer needs in today’s financial landscape.

Pros of Alliant Credit Union

Alliant Credit Union offers competitive rates, a user-friendly digital experience, and high-quality customer support. Customers appreciate the ease of access to their accounts, including mobile banking and online services.

Competitive rates

Alliant Credit Union offers very competitive rates for its banking products. For example, their savings account APY is 3.10%, which is significantly higher than the national average.

Moreover, their CD account APY of 4.25% and Jumbo Certificate APY of 4.15% are also quite attractive compared to other financial institutions in the market today. These favorable rates make Alliant Credit Union an appealing choice for individuals seeking high-yield savings and investment options.

Overall, Alliant Credit Union's commitment to offering competitive rates on various accounts makes it an appealing option for those looking to maximize their savings and investments with a reliable credit union.

User-friendly digital experience

Alliant Credit Union offers a convenient digital experience as an online-only financial institution, giving access through online and mobile banking. Members benefit from the monthly compounding of dividends, ensuring their funds work harder for them.

With various services available at their fingertips, such as accessing accounts and making transactions remotely, members can enjoy a seamless and user-friendly digital banking experience without needing to visit physical branches.

This flexibility aligns with modern needs for on-the-go and remote financial management.

Moving on to "Customer support quality"...

Customer support quality

Alliant Credit Union's customer service is crafted for members who favor online banking and transparent communication. Reviews indicate that customer support quality is customized for an online-only banking experience.

Positive ratings from U.S. News suggest high customer satisfaction with their support services. The lack of physical branches may influence customer support preferences for some members.

The credit union stresses accessible and efficient support for various financial services, meeting the needs of its digital-savvy members. Member feedback underscores the significance of responsive online assistance in their overall experience, highlighting Alliant's dedication to providing dependable digital support.

Moving on to "Pros of Alliant Credit Union"...

Cons of Alliant Credit Union

- Limited physical branch locations may inconvenience those who prefer in-person banking services.

- Negative customer service reviews and loan processing complaints have been reported, potentially affecting overall customer satisfaction.

Limited physical branch locations

Alliant Credit Union has no physical branch locations. This means that members primarily access services online or through the credit union's call center. It's necessary to consider this factor when deciding whether it suits your banking needs, especially if in-person banking is a priority for you.

Negative customer service reviews

Despite its favorable rates and user-friendly digital experience, Alliant Credit Union has garnered negative customer service reviews. The credit union operates solely online, limiting in-person banking options.

This has led to complaints about the lack of personalized assistance and prompt resolution of issues. Unfortunately, there are no substantial details available about specific customer service experiences with Alliant Credit Union.

These factors should be taken into account when considering their services.

Allied credit union, Allied federal credit union, Credit unions near me

Loan processing complaints

Some customers have mentioned delays and hiccups during the loan processing at Alliant Credit Union. While some have experienced longer wait times for approval, others have expressed frustration with the lack of clear communication regarding their loan application status.

These complaints suggest that there may be room for improvement in streamlining and expediting the loan processing procedures at Alliant Credit Union, ensuring a smoother experience for its members.

Moving on to customer reviews...

Alliant Credit Union Customer Reviews

Read about real experiences with Alliant Credit Union and decide if it's right for you.

Positive customer experiences

Customers of Alliant Credit Union consistently report positive experiences with the institution. Many commend the credit union for its competitive interest rates, which are higher than traditional banks.

The absence of overdraft fees is also a major plus point for members, as well as the access to fee-free ATMs, making it convenient and cost-effective to access their funds. These aspects contribute to high levels of satisfaction among customers.

Overall, Alliant Credit Union's members praise its favorable interest rates and the freedom from common banking fees like overdraft charges. Access to fee-free ATMs further adds value and convenience, contributing positively to customer experiences.

Common complaints and issues

Transitioning from positive customer experiences to common complaints and issues, it is worth noting that Alliant Credit Union has received some constructive feedback. One prevalent concern is the limited physical branch locations, which may inconvenience customers who prefer in-person banking.

Additionally, there have been constructive reviews regarding customer service quality and loan processing times. These factors could potentially impact the overall experience for individuals seeking a more traditional approach to banking.

Some customers have also expressed a desire for money market or business-specific accounts, expanding options for those in need of such services. It's worth considering these aspects when evaluating whether Alliant Credit Union aligns with your specific financial needs.

FAQs About Alliant Credit Union

Looking for information about Alliant Credit Union's credit cards, eligibility requirements, and fees? Check out our FAQs section to learn more. Read on to get all the details.

What credit score is needed for their credit cards?

Alliant Credit Union recommends having a good to excellent credit score for their credit cards. Generally, this implies a credit score of approximately 700 or above. By maintaining a positive credit history and a high credit score, you can enhance your likelihood of approval for Alliant Credit Union's credit card options.

It's crucial to regularly monitor your credit report and strive to enhance your score, if necessary, before submitting an application for a card from Alliant Credit Union.

Now, let’s delve into the different banking products available at Alliant Credit Union.

Can I link my Alliant account to PayPal?

Alliant Credit Union offers members the option to connect their accounts with PayPal. This convenient feature facilitates simple fund transfers between the two platforms, providing flexibility and ease of use.

By connecting your Alliant account to PayPal, you can effortlessly handle your finances and conduct online payments or transfers using either platform. This integration improves accessibility and usability for members, providing a more efficient way to manage their funds across various financial services.

When considering linking your Alliant account to PayPal, the process is simple and meets the requirements of the modern banking landscape for smooth digital transactions. With this capability, members can experience enhanced convenience in managing their finances and conducting online transactions effectively.

What are the fees for international transactions?

If you use an Alliant Credit Union credit card for international transactions, there is a 2% fee added to each transaction. This means that if you spend $100 internationally, you will be charged an extra $2 as a foreign transaction fee.

Moreover, some card networks may impose an extra fee when making purchases abroad. Therefore, it's vital to consider these fees when using your Alliant Credit Union credit card outside the United States.

All in all, if you plan on using your Alliant Credit Union credit card while traveling or making online purchases from foreign merchants, it's wise to factor in the 2% foreign transaction fee and any potential additional charges from the card network.

Is Alliant Credit Union Right for You?

Alliant Credit Union might be right for you if you prefer online banking, with no physical branches. In February 2024, it held $18.5 billion in assets and served 830,000 members. Offering a range of financial services such as checking and savings accounts, CDs, mortgage loans, and auto loans.

The High-Rate Savings Account gives an APY of 3.10% with a minimum balance requirement of $100 to earn interest.

If competitive interest rates and no overdraft fees matter to you, Alliant's checking account may fit your needs with its rating of 4.2 out of 5.

Conclusion

In conclusion, Alliant Credit Union provides a range of financial products and services, including savings accounts, checking accounts, credit cards, and various loans. Their online-only approach means you'll enjoy competitive rates and no overdraft fees.

However, the lack of physical branches may not suit everyone's banking needs. Overall, if you prioritize digital convenience and favorable rates over in-person interactions, Alliant Credit Union might be the right fit for your banking needs.