Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Having bad credit can make finding financial help tough. ACE Cash Express offers loans for people with bad credit. This blog will show you services at "ACE Cash Express near me" that could work for you.

Keep reading to see how they might help.

Exploring Key Services at ACE Cash Express for Bad Credit

ACE Cash Express offers various financial services tailored for individuals with less than perfect credit. These include payday loans, installment loans, and prepaid debit cards, providing accessible options to meet diverse financial needs. Whether it's a short-term cash advance or a more flexible payment plan, ACE Cash Express has customized solutions without the requirement of a good credit score.

Payday Loans at ACE Cash Express

Payday loans at ACE Cash Express offer quick cash for those with bad credit. People can borrow money fast, but the amount and terms differ by state. In 2014, the Consumer Financial Protection Bureau (CFPB) found ACE helped make debt cycles worse for payday borrowers.

Military members can't get these loans due to high Annual Percentage Rates (APRs). This rule is because of the 36% Military Lending Act limit.

ACE provides payday loans in several states like Colorado and Texas but not in Austin. Customers have used ace cash express reviews to share their experiences. The company has many stores where people find help when they need money fast before payday.

Installment Loans at ACE Cash Express

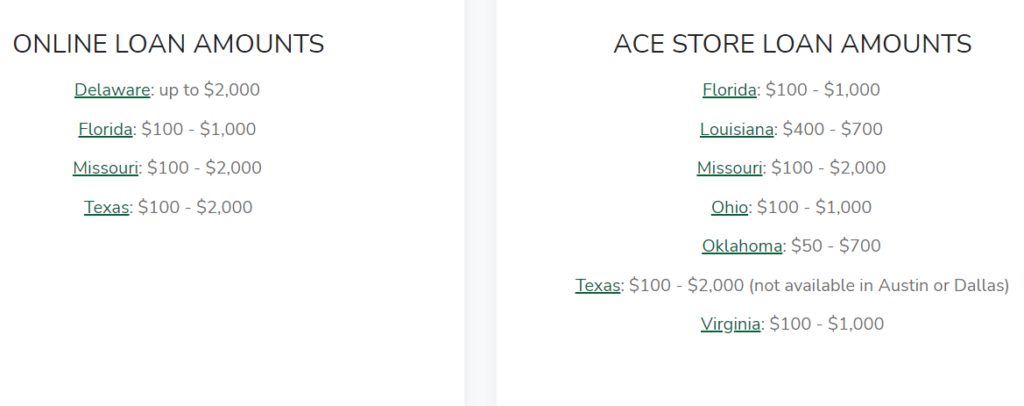

ACE Cash Express offers installment loans for those who need more time to pay back. You can borrow from $100 to $2,000, depending on where you live. This is because each state has different rules for loans.

After getting an installment loan at ACE Cash Express, you have 72 hours to change your mind and return the money without extra costs. But, be aware that these loans can have very high APRs.

You can get your loan money in two ways: pick it up at a local ACE store or have it sent straight to your bank account through direct deposit. People living in Delaware, Missouri, New Mexico, and Texas might get online loans up to $2,000.

In Florida, they offer up to $1,000 online. The exact amount you can borrow changes based on state laws.

Prepaid Debit Cards from ACE Cash Express

Prepaid debit cards from ACE Cash Express include the Elite® Visa® Prepaid Debit Card. This card offers custom options to fit your needs. You can even get a unique card routing number, which is 073972181.

This makes managing money easy and personal. Check your balance online or use their app.

ACE Cash Express also adds features like overdraft protection for those who qualify. Daily withdrawal limits make sure you only spend what you plan to. Plus, keeping track of everything is simple with online access and mobile banking through Pathward, an FDIC member bank.

Finding ACE Cash Express Locations Near You

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

To find ACE Cash Express locations near you, use the store locator feature on their website or mobile app. Here's how to do it:

- Go to the ACE Cash Express website or download their mobile app.

- Use the store locator feature to search for nearby locations based on your ZIP code or city.

- The tool will provide a list of ACE Cash Express stores near you, along with their addresses, contact information, and operating hours.

- You can also find additional details such as services offered and in-store features.

Stop writing.

Advantages of Using ACE Cash Express for Financial Needs

You can receive funds quickly, even within a day after approval. Applying for a loan with ACE does not affect your credit score negatively. There are no application fees and returning loan funds within 72 hours doesn't incur any penalties.

ACE offers financial services such as loans, check cashing, and other financial assistance. They also have options available for those with poor credit using standard underwriting criteria.

ACE Cash Express provides quick access to funds, without negative effects on your credit score while offering loans without application fees and the flexibility to return funds without penalties within 72 hours.

All this is available alongside their range of financial services like loans and check-cashing options, making it possible to obtain financial assistance even if you have poor credit by following standard underwriting criteria.

Conclusion

In conclusion, ACE Cash Express offers services designed for individuals with less-than-perfect credit. You can find their locations nearby and explore installment loans, payday loans, and prepaid debit cards to address your financial needs.

Despite the high costs, there are advantages such as quick fund access and longer repayment terms compared to payday loans. Keep in mind that applying for a loan at ACE Cash Express won't impact your FICO® score negatively.

Overall, if you need quick funds despite having less-than-perfect credit, ACE Cash Express may be worth considering.