#MarchMadness

For a limited time, the FIRST 100 business owners can get:

✅ FREE 30 MINUTE CONSULTATION

✅ 6 Months of FREE Payroll

✅ Free Credit Repair Consultation

✅ 6 Months of FREE Workers’ Comp Pay-by-Pay®

✅ 20% Lifetime Discount with ADP

✅ $0 Setup Fees

🔥 BONUS: Sign up through my link, and I’ll personally give you a FREE 30-minute 1-on-1 consultation to help you secure funding & grow your business!

🚀 Act FAST – This exclusive OFFER EXPIRES March 25, 2025! Once 100 spots are gone, they’re GONE!

Sign up NOW before you miss out!

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

For many small business owners, the quest for the perfect payroll system can feel like a never-ending battle. With employee satisfaction and legal compliance hanging in the balance, choosing a reliable service to manage your company's paystubs is no small decision.

Let's begin the ADP Paystubs Review. It's not just about issuing checks; it's about ensuring every detail is spot on, from taxes to overtime calculations.

Enter ADP Payroll Services—boasting an impressive 4.2-star rating from over two thousand users—who offer a comprehensive suite of tools aimed at tackling these very issues. In this evaluation, we're peeling back the layers to see if ADP really lives up to its reputation for accuracy and ease of use.

Whether you're baffled by benefits administration or seeking streamlined solutions for tax filings, this review promises clear insights and honest feedback.

So let’s dive right in and discover whether ADP can be the game-changer your business has been searching for!

ADP Paystubs Review Key Takeaways

- ADP Payroll Services help small businesses manage employee payments, taxes, and reports. They offer different plans that grow with your business.

- Users like the mobile app because it lets them handle payroll anywhere. The system also follows tax rules which helps you avoid mistakes.

- Some people have had problems with ADP's customer service and unexpected fees. It's important to know these issues before choosing a payroll service.

- ADP works well with other software like QuickBooks, making it easier for you to run your business from one place.

- Choosing between ADP and its competitors depends on your company’s size and needs. Look at all features, pricing, and support options before deciding.

ADP Payroll Services: An Overview

Delve into the world of ADP Payroll Services, a powerhouse offering tailored payroll solutions that cater to diverse business sizes and sectors. It's an ecosystem designed to streamline your payroll functions with precision and ease, setting a foundation for discussing its robust features and flexible pricing structures next.

ADP Payroll Features

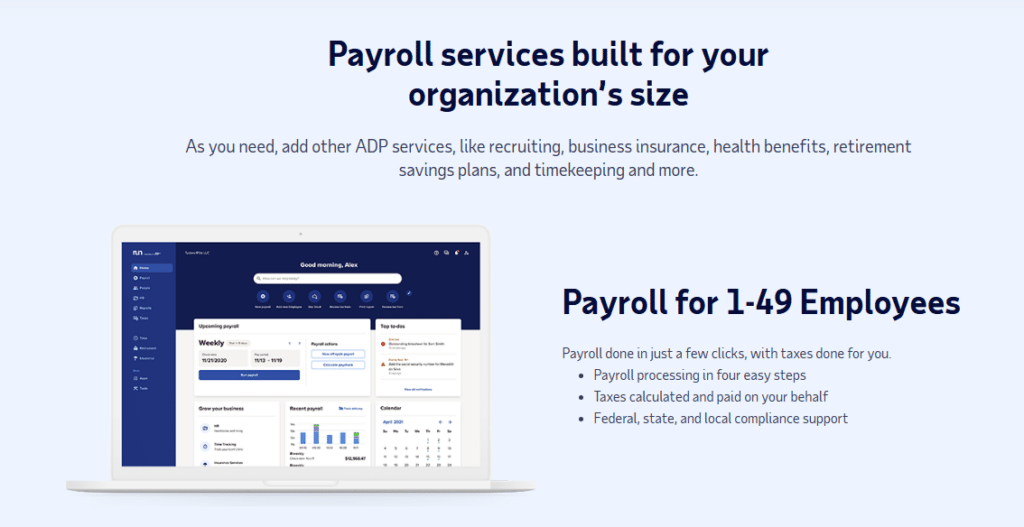

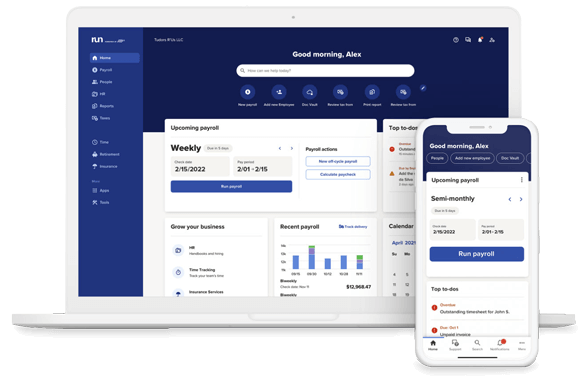

ADP payroll software helps small businesses manage their payrolls effectively. You can choose between RUN POWERED BY ADP for smaller teams or WORKFORCE NOW for larger groups.

- Customized Payroll Solutions: ADP tailors its services to meet your business's unique needs, whether you have a few employees or hundreds.

- Easy Mobile Access: Use the ADP mobile app to handle payroll from anywhere, making it simple to keep business moving while on the go.

- Direct Deposit and Payroll Cards: Offer your employees convenient payment options including direct deposit to their bank accounts or using ADP payroll cards.

- Tax Compliance Assistance: Stay on top of payroll taxes with ADP's help in handling federal, state, and local tax regulations.

- Integration with Other Software: Easily connect ADP with accounting software, time tracking apps, and other business tools you use every day.

- Employee Self-Service: Your team can view pay stubs and W-2 forms anytime through an easy-to-use portal which reduces questions for managers.

- Time and Attendance Tracking: Keep track of hours worked, overtime, and paid-time-off all within the same system that processes your payroll.

- Human Resources Helpdesk: Get support from HR professionals when you need guidance on labor laws or have HR questions.

- Automatic Updates: As laws change, ADP updates its systems so your payroll stays compliant without any extra work from you.

- Comprehensive Reports: Generate detailed reports about payroll data to make informed decisions about your business finances.

- Onboarding Services: Streamline bringing new hires onto your team with efficient processes for paperwork and setting up payment information.

Pricing and Available Plans

Understanding the cost and available plans for ADP Payroll Services is crucial for small businesses in search of a reliable payroll solution. ADP caters to every stage of business growth with its diverse offerings.

| Service Plan | Features | Suitable For | Pricing |

|---|---|---|---|

| Essential Payroll | Basic payroll processing, tax filing, direct deposit | Small businesses looking for fundamental payroll services | Varies based on company size and services required |

| Enhanced Payroll | All Essential features plus state unemployment insurance and labor law poster compliance | Businesses needing additional payroll support and compliance | Dependent on the number of employees and additional services |

| Complete Payroll | Includes Enhanced features, plus HR support, background checks | Growing businesses that require HR services in addition to payroll | Customized based on services utilized and business size |

| HR Pro Payroll | Comprehensive solution including Complete features, enhanced HR support, and training | Established businesses seeking a full suite of HR and payroll services | Tailored pricing to fit the scope of HR and payroll needs |

Each plan is designed to offer scalability, allowing businesses to upgrade as their needs evolve. Special promotions may apply, particularly for smaller companies seeking to get the most value out of their investment. Pricing generally reflects the payroll frequency, the number of states in which employees work, and the services chosen. Overall, ADP's tiered structure aims to support businesses as they grow and their payroll complexities increase.

Advantages of ADP Paystubs

ADP Paystubs give small businesses a big boost. They make payroll smooth and keep tax worries low. Here are the top benefits:

- Flexibility: ADP fits all business sizes. You can pick services that grow with your company.

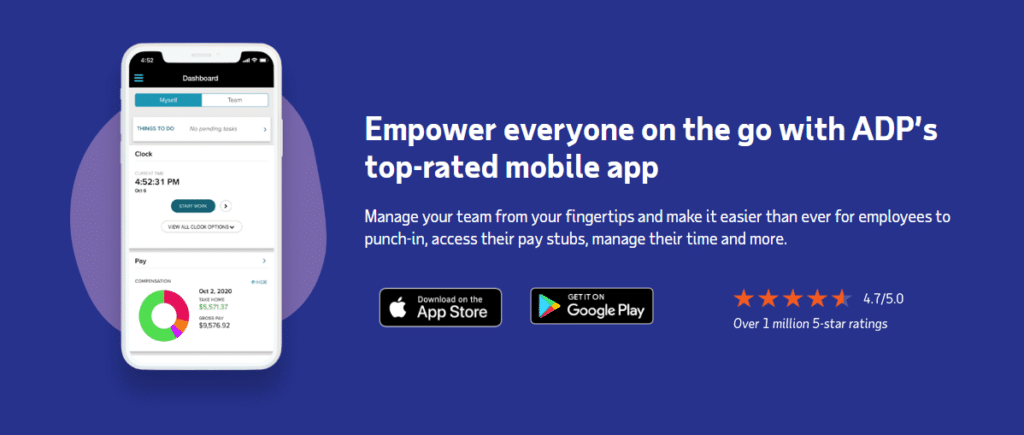

- Mobile Access: Run payroll anytime, anywhere with ADP's mobile apps for Android and Apple iOS.

- Automated Services: ADP automates your payroll and taxes. This cuts mistakes and saves you time.

- Scalability: As your business gets bigger, ADP can handle more workers easily.

- Compliance Help: Keep up with laws. ADP knows tax rules everywhere you do business.

- Time-saving Features: Spend less time on payroll. Use that extra time to build your business.

- Employee Access: Workers can see their paystubs online. They can also manage their own info.

- Onboarding Support: Get new staff started right. ADP guides you through setup steps.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Assessing ADP Paystubs Accuracy

Delving into the accuracy of ADP paystubs is a crucial pit stop on this payroll journey—after all, precision here means peace of mind for both employers and employees alike. Let's examine how ADP stands up to the meticulous scrutiny of payroll perfectionists, ensuring every digit and decimal is in its rightful place.

Payroll Processing

ADP takes the stress out of payroll processing for small businesses. With just a few clicks, your company's payroll gets calculated accurately, taxes filed, and employees paid. This service isn't just about saving time—it ensures that each pay stub reflects the right numbers and every tax penny is accounted for.

Small business owners can relax knowing ADP's automated systems handle the nuts and bolts of payroll tasks. From direct deposits to year-end reporting, you're covered. The platform is designed to grow with your business, making it easy to add new employees or adjust salary changes without headaches.

Plus, with compliance baked into the process, you'll never miss a beat on federal or state regulations.

Payroll Taxes and Compliance

Handling payroll taxes can be tough for small businesses. ADP makes it easier by managing payroll tax services. They keep track of the rules and fill out the right forms for you. This means you can focus on growing your business without stressing over tax laws.

ADP's software, RUN, is designed for companies that are getting bigger and need to stay on top of tax compliance. With this tool, you get help with all those tricky taxes and make sure everything is done right.

No more headaches from trying to understand complex tax codes!

Payment Options

ADP gives you choices on how to pay your team. You can use direct deposit, which sends the money straight into employees' bank accounts. Prepaid debit cards are another choice, great for workers without a bank.

And if needed, paper checks work too.

You set up payments in ADP's software called RUN. It makes paying everyone easy and handles payroll taxes as well. With these options, you find what best fits your business and helps your team.

Direct deposits save time because there's no need to deal with cash or checks at the bank. Paying with prepaid debit cards means instant access to wages for employees once payday hits.

If an employee prefers a traditional approach, paper checks still get the job done reliably.

Payroll Reports

ADP makes handling payroll reports simple and efficient. Customizable options let you tailor reports to fit your unique business needs. Just like a one-stop shop, ADP offers both basic analytics for everyday tracking and advanced tools for deeper insights into your finances.

You can quickly generate state-mandated new-hire reports with ease, making sure you're always in compliance with the law. These features save time so you can focus more on growing your business rather than getting bogged down by paperwork.

Accessing quarterly tax reports and forms is a breeze through ADP’s platform. The system supports your growth every step of the way, offering the payroll documents necessary to understand where your money's going.

With this level of detail at your fingertips, managing budgets becomes less stressful and more strategic.

Navigating ADP Paystubs: User Experience

Discovering the ins and outs of ADP Paystubs is a breeze, whether you're at your desk or on-the-go; dive deeper to see how its user-friendly design simplifies payroll management for both employers and employees.

Ease of Use

ADP paystubs make life simple for small business owners. You can run payroll whether you're at your desk or on the go with just a few taps in the mobile app or clicks on your computer.

It's designed to save time, letting you focus on growing your business instead of getting stuck in paperwork. The platform is user-friendly, which means even those who aren't tech-savvy can navigate it without trouble.

You can choose how to pay employees—direct deposit, paper checks, or payroll cards. Each option plugs right into ADP's system. This flexibility means you meet every team member's needs without extra hassle.

Plus, integrating with other software tools like ERP systems is smooth and straightforward. With these choices at your fingertips, managing finances becomes a lot less daunting.

Mobile App Accessibility

The mobile payroll app makes checking paystubs easy for small business owners on the go. You can access it from your phone, tablet, or computer. The design is sleek and user-friendly.

This ensures that you can manage payroll tasks quickly without a hassle.

Employees love the app too because they can view their pay information anytime. They don't have to wait until they're at a computer or ask you for details. With just a few taps, workers check their hours, see deductions, and track payday.

Using this app helps cut down on paper waste and saves time too. You won't need to print out stubs or reports unless you want to. Everything you need for managing payrolls fits right in your pocket with ADP's mobile app solutions.

Integration Capabilities of ADP Payroll

ADP Payroll makes life easier by working with apps you already use. Let's say you keep your books in QuickBooks or track sales in Xero. With ADP, connecting these services is a breeze, helping you see the big picture without jumping between systems.

You can even send data straight to your accountants with a simple click.

Think about how much time this saves. Imagine one central hub where payroll meets project management and accounting connects with customer relationship management (CRM) tools. ADP has that covered too! It links up with popular software like Wave and enterprise resource planning (ERP) systems for smooth workflow across all aspects of your business—the kind of flexibility small businesses dream of!

Evaluating ADP's Customer Support

ADP's customer support gets mixed reviews from small business owners. Many appreciate the 4.2 rating for its helpfulness in resolving issues swiftly. However, there are also stories of frustration with technical errors and confusing setup processes that put a damper on their experience.

ADP promises to tackle complaints by looking into them and following up with customers who have had less than stellar interactions.

The company offers both automated support through a toll-free number and online help for administrators and users facing challenges. Despite these services, some clients find it hard to navigate problems when they arise.

The commitment to improve is clear, but ADP faces tough competition from other service leaders who prioritize client experience above all else.

ADP Paystubs Review FAQs

1. What makes ADP stand out as a payroll provider?

ADP is known for its accuracy and accessibility, offering automated payroll services that are easy to use. Plus, it supports multijurisdictional payroll needs, making it great for businesses all over.

2. Can ADP help with more than just paystubs?

Absolutely! ADP offers a range of services like talent management, retirement services, and HR helpdesk in addition to its reliable online payroll service.

3. Is it easy for employees to access their pay information with ADP?

Yes indeed – employees can easily check their paychecks and tax returns using self-service kiosks or even their smartphones through biometric login features.

4. How secure is the personal information within ADP's system?

Security's top-notch with ADP; your social security number and other sensitive details are well-protected thanks to automation and proprietary tech measures.

5. Can I integrate other business software with ADP's services?

For sure – you can link things like QuickBooks Online, time clocks, or staffing applications via the handy ADP Marketplace feature!

6. Do small businesses find value in using ADP?

Small business owners often turn to companies like Sage and Zenefits but many still choose APD because of its cloud-based software versatility that includes everything from applicant tracking systems to workers' compensation support—all under one roof.