Facing financial troubles is hard, especially with bad credit. BadCreditLoans.com Short Term Loans Review shows a way out. This blog will guide you on how to get loans despite low scores.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Keep reading for insight!

Overview of BadCreditLoans. com

BadCreditLoans.com is a platform that helps people with poor credit get loans during emergencies. Since 1998, this service has been connecting borrowers with personal loans. They work all the time to offer support for those in financial need.

This site offers a way for individuals looking for terrible credit loans or bad debt loans to find help. With a rating of 4.2 out of 5.0 based on several factors like interest rates and lender reputation, it shows reliability.

Yet, the Better Business Bureau rates BadCreditLoans.com with an F score. To use their services, you must be at least 18 years old.

Operating Mechanism of BadCreditLoans. com

BadCreditLoans.com works by matching you with potential lenders. Once you apply for a loan, the platform connects you with lenders who specialize in bad credit loans.

Overview of the Loan Matching Platform

BadCreditLoans.com works like a bridge. It connects people who need loans with companies ready to help. People looking for online lenders for bad credit find it useful. Their goal is to help those with low credit scores get the money they need.

This platform does not give out loans itself. Instead, it finds the best match for borrowers by using their information.

Users do not pay to use BadCreditLoans.com. They can say no to any loan offer that doesn’t fit their needs. If the site can’t find a lender, it shows other ways to get financial help.

The next step after learning about this platform is understanding how to apply for a loan through it.

Procedure to Apply for a Loan

After learning how BadCreditLoans.com matches borrowers with lenders, let’s focus on how to apply for a loan. The process is online and quick, needing only minutes to complete.

- Visit the website. Start by going to BadCreditLoans.com.

- Fill out a form. You provide basic info like your name, age, and why you need the money.

- Mention how much you need. Pick the amount of money you want, up to what’s allowed.

- Share your details. Add info about your job and income to show you can pay back the loan.

- Wait for a response. Lenders look at your application and decide if they can help you.

- Review offers. If a lender says yes, you get their terms to look over.

- Sign electronically. Agree to the lender’s terms by signing online if everything looks good.

- Get your money. Approved funds land in your checking account within one business day.

This easy steps guide helps people with bad credit get loans quickly from online lenders like BadCreditLoans.com

Details on Loan Terms and Eligibility

Find out about the loan terms and who can apply for them. Also, understand the available loan amounts and repayment options.

Available Loan Amounts and Repayment Options

BadCreditLoans.com offers a range of loan amounts suitable for those in need. Users can apply for loans varying from $500 to $10,000. This flexibility supports various financial needs, whether minor emergencies or more significant expenses.

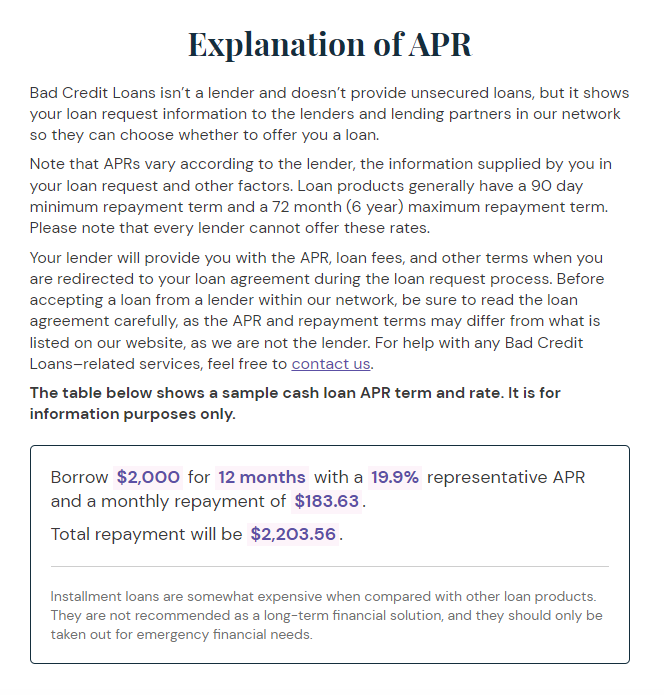

| Loan Amount | Repayment Options | APR Example | Monthly Payment Example | Total Repayment |

| $500 – $10,000 | Varies by lender | 19.9% for $2,000 loan | $183.63 over 12 months | $2,203.56 for $2,000 loan |

| $200 | 14 days | 391.07% | N/A | $230 |

These details showcase options for borrowers with bad credit seeking financial solutions. With installment loans, they offer monetary relief until the next paycheck arrives. Repayment terms and APRs differ, ensuring borrowers can select options that best fit their situation. The loan example of $2,000 at 19.9% APR demonstrates the straightforward approach of BadCreditLoans.com in presenting clear, concise loan information.

Criteria for Eligibility

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

To qualify for a loan with BadCreditLoans.com, you must meet certain criteria:

- Be at least 18 years old.

- Provide proof of citizenship (such as a Social Security number or legal residency).

- Have a regular income source, which can be employment, self-employment, disability benefits, or Social Security.

- Maintain a checking account in your name.

- Furnish work and home telephone numbers.

- Provide a valid email address.

These are the essential eligibility requirements to apply for a loan through BadCreditLoans.com.

Benefits of Using BadCreditLoans. com

Using BadCreditLoans.com provides help when you have poor credit and face emergencies. The online application process is quick, taking only minutes to complete. Upon approval, funds are deposited into your checking account within one business day.

The service doesn’t charge for assistance and doesn’t obligate you to accept any loan offers.

Drawbacks of Using BadCreditLoans. com

BadCreditLoans.com often charges high-interest rates on loans, making it more expensive for borrowers. The Better Business Bureau has given the platform an F rating due to numerous customer complaints.

People with poor credit may get less favorable loan terms compared to other lending options. Not being available on Finder.com limits its reach among potential borrowers seeking bad credit loans online.

Client Feedback and Ratings on BadCreditLoans. com

Client Feedback and Ratings on BadCreditLoans.com present a blend of favorable reviews and common feedback, offering insights into user experience and satisfaction levels. This section provides firsthand experiences with the platform, delivering valuable perspectives for those looking for more information prior to applying for a loan.

Positive Reviews

Users have given BadCreditLoans.com a rating of 4.2 out of 5.0, taking into account interest rates, fees, approval rates, credit bureau reporting, and lender reputation. Additionally, Senior Editor Ashley Fricker awarded it a rating of 4.8 out of 5 stars in reviews for its exceptional services.

The feedback from clients highlights the platform’s ease of use and efficiency in finding suitable loan options despite having less-than-ideal credit. The approval process and customer support are notably quick and helpful as well.

Furthermore, many users appreciate the transparent terms and conditions that make borrowing straightforward and manageable compared to other lending platforms for less-than-ideal credit loans.

It is recommendable to explore BadCreditLoans.com as an effective solution for securing short-term loans with unfavorable credit scores while benefiting from competitive interest rates and accommodating repayment plans.

Frequent Criticisms

BadCreditLoans.com has encountered frequent critique for its high-interest rates on loans. Despite advertising low credit score loans, the Better Business Bureau has given BadCreditLoans.com an F rating.

Users have reported feeling misled by the company’s promises and dissatisfied with the overall borrowing experience. In addition, unfavorable reviews highlight issues with transparency and customer service, indicating a lack of confidence in the legitimacy of the services offered by BadCreditLoans.com.

Customers seeking online lenders for bad credit loans often express frustration at the hidden costs and unclear terms associated with loans from BadCreditLoans.com. Many individuals looking for assistance during financial hardship end up facing even more significant challenges due to what they perceive as predatory lending practices.

Overall, frequent critiques center around high interest rates, poor communication, deceptive advertising, and dissatisfaction with customer support when dealing with BadCreditLoans.com.

Verification of BadCreditLoans. com’s Legitimacy

BadCreditLoans.com has been in operation since 1998 and offers its services round the clock. The platform has received a notable 4.8 out of 5-star rating from Ashley Fricker, Senior Editor, and is overseen by finance expert Adam West and veteran journalist Lillian Guevara-Castro.

Aliyyah Camp’s recent review was updated on December 8, 2021, affirming their continued presence in the market.

To concrete our understanding of BadCreditLoans.com’s legitimacy, it’s crucial to highlight these key points as we move forward with evaluating alternative options to BadCreditLoans.com.

9. Alternative Options to BadCreditLoans.com.

Alternative Options to BadCreditLoans. com

If you’re looking for other options, consider MoneyMutual with loans up to $5,000 and funds available within 24 hours. Avant also offers loan amounts ranging from $2,000 to $35,000 with interest rates between 9.95% and 35.99%.

Another alternative is the 24/7 Lending Group which provides loan amounts from $500 to $35,000 at interest rates starting at 5.99%. All these alternatives have high ratings based on Trustpilot reviews.

Once you’ve considered these alternatives, it’s important to evaluate the best fit for your specific needs and financial situation before moving forward.

10. Conclusion.

Conclusion

In summary, BadCreditLoans.com provides a lifeline for those with bad credit facing unexpected financial challenges. The platform connects borrowers with lenders willing to offer short-term loans despite less than perfect credit scores.

Although the terms may not be as favorable for those with poor credit, BadCreditLoans.com’s streamlined process and quick funding can provide much-needed relief in times of urgency.

This service offers a practical solution for individuals experiencing financial difficulties due to unforeseen expenses, making it a valuable option for many in need.