Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Having bad credit can make getting a loan tough. Big Buck Loans offers options for those with less-than-perfect credit scores. This blog post will show you how to get funding, even if your credit isn’t great.

Keep reading to learn more about Big Buck Loans reviews.

Key Features of Big Buck Loans

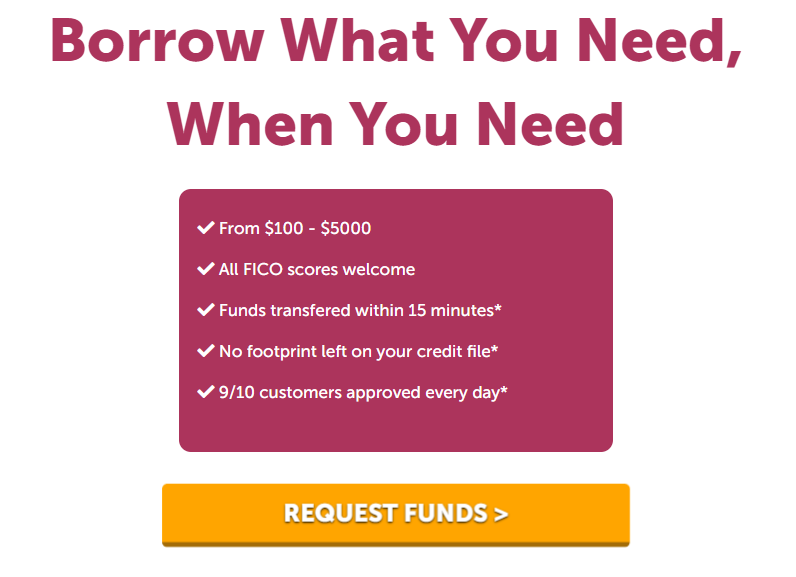

Big Buck Loans offer instant approvals and do not require a credit check, providing quick access to funds for those with bad credit. The online application process is simple, and document verification is swift, ensuring a hassle-free experience for potential borrowers.

Instant loan approvals

Getting a loan fast is crucial for many people. Big Buck Loans makes this easy with instant loan approvals. Once you apply, they decide quickly if you get the money. If they say yes, funds can be in your account in as little as 15 minutes.

This fast service helps those who need emergency cash loans or have a credit score of 500 and still need help immediately. With Big Buck Loans, waiting days to know if you’ve been approved isn’t part of the process.

This speed supports anyone looking for no credit check loans or bad credit loans guaranteed by approval lenders seeking quick financial solutions.

No credit check requirements

Big Buck Loans offers options for people with bad credit, but they don’t skip the credit check due to rules they must follow. They make sure loans fit within laws that keep things fair.

This means while you might worry about your low score, Big Buck Loans still considers your application.

They offer several loan types without demanding perfect credit scores. This opens doors for many who need money fast but have faced financial troubles before. Even if you’ve had trouble, there’s a chance Big Buck Loans can help with emergency cash loans in one hour or bad credit loans guaranteed approval lenders.

Application Process

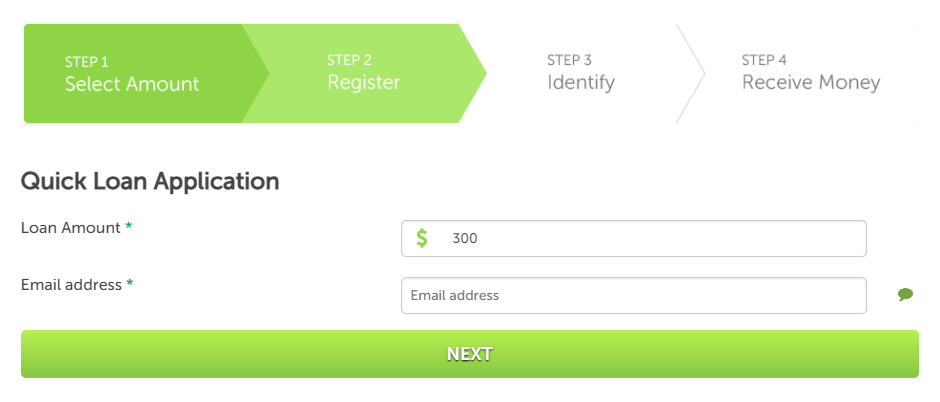

The application for big buck loans is straightforward. It involves a simple online process and quick document verification, making it easy to apply for the loan.

Online application simplicity

Filling out the online form for a big buck loan is easy. You just choose how much money you need, from $100 to $5,000. Then pick how long you want to take to pay it back, between 3 and 24 months.

This process means anyone can apply quickly without having to worry about their credit score. Plus, you don’t have to wait long to find out if you get the loan or not.

Quick document verification

After smoothly filling out the online application, gather and submit all necessary documents. Make sure to show proof of income by earning at least $1,000 per month. This process is crucial to ensure you can afford the loan and get quick approval for big buck loans with no credit check.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Advantages and Disadvantages

Big Buck Loans offer quick access to funds without the hassle of a credit check. Potential borrowers should be aware that these loans may come with high-interest rates.

Accessibility of funds

Once approved, the funds can be transferred within just 15 minutes. Approved loans are usually paid out within an hour, ensuring quick access to the much-needed money for individuals with bad credit.

The process ensures prompt payouts, typically ranging from 15 to 60 minutes or at most within 24 hours.

Moving on to the next section – “Potential high-interest rates”.

Potential high-interest rates

Big Buck Loans can come with high-interest rates, ranging from 5.99% to 35.99%. This means that if you borrow money through Big Buck Loans, you could end up paying a significant amount in interest on top of the principal loan amount.

It’s important to carefully consider whether the benefits of getting the cash quickly outweigh the potential cost of paying higher interest rates.

When seeking big buck loans with no credit checks, be mindful that convenience and accessibility may come at a higher financial expense due to these high-interest rates.

Conclusion

Looking for a loan when your credit score is not great? Big Buck Loans can help. You can borrow from $200 to $5,000 with quick approval. The online process is fast and funds are accessible within an hour of approval.

Keep in mind, interest rates may be high so consider this before borrowing.