Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Choosing the right corporate credit card can be a challenge. The Bill.com Spend & Expense card, formerly known as Divvy, stands out for its innovative solutions. This article will compare it to five other business cards to help you make an informed decision.

Get ready for some eye-opening insights with this Bill Divvy Credit Card Review!

Bill Divvy Credit Card Review Key Takeaways

- Bill.com Ex - Divvy Corporate Card combines a credit card with expense management tools, making it easy for businesses to control spending and manage finances.

- The card is great for small businesses and frequent flyers because of its flexible spending controls, rewards on purchases, and travel perks like access to airport lounges.

- Compared to other business cards like Capital One Spark Cash Plus, Brex 30 Card, U.S. Bank Business Platinum Card, and Ink Business Cash Credit Card, Divvy stands out with its integrated budgeting software and real-time tracking features.

- Users can earn rewards on every purchase with Bill.com Ex-Divvy Corporate Card, including more points in bonus categories such as travel and office supplies which can be redeemed for cash back or travel expenses.

- Bill.com reports payments to major credit bureaus helping small business owners build or improve their credit score while providing wide acceptance at numerous locations worldwide due to operating on major networks like Visa or Mastercard.

Overview of Bill. com Ex-Divvy Corporate Card

The Bill.com Ex-Divvy Corporate Card stands out with its impressive blend of features designed for modern businesses. It combines financial control with rewarding benefits, making expense management easier and more efficient.

Features & Benefits

| Feature | Benefit |

|---|---|

| Spend Controls | Allows for precise management of expenses, reducing the risk of overspending. |

| Expense Management Services | Streamlines expense reporting, saving time and making financial management easier. |

| All-in-One Solution | Combines a corporate card with powerful expense tracking and management tools. |

| CPA Acclaimed | Recognized as top-notch by accounting professionals for small business needs. |

| Rebranding as BILL Spend & Expense | Ensures a seamless user experience with continued spend controls and enhanced features. |

| Innovative Product | Regarded for pioneering an integrated approach to business spending and expense management. |

Pros & Cons

| Pros | Cons | |

|---|---|---|

| Features & Benefits | - Integrated expense management - Flexible spending controls - Rewards for business expenses | - Limited to businesses; not for personal use - Rewards system may be complex for some users |

| Interest Rates & Fees | - No annual fee - Competitive APR for businesses | - Potential for high APR based on creditworthiness - Fees for late payments |

| Unique Features | - Real-time expense tracking - Customizable spending limits per employee | - Setup may require time for customization - Might be overwhelming for very small businesses |

| Market Position | - Acknowledged for excellence in expense management | - Strong competitors in the market - Constant updates may be required to stay innovative |

| Usability | - User-friendly interface - Comprehensive mobile app for on-the-go management | - Learning curve for new users - Dependence on internet connection for real-time features |

Detailed Review of Bill. com Ex-Divvy Corporate Card

Our deep dive into the Bill.com Ex-Divvy Corporate Card reveals its standout features and quirks. You'll see how rewards work, understand fees, and discover unique controls that manage your spending efficiently.

Rewards and how they work

Bill.com Ex-Divvy offers a rewards structure that lets you earn points on every purchase. You get more points per dollar spent in bonus categories like travel, office supplies, and recurring software subscriptions.

These points can then be redeemed for cash back, gift cards, or to cover travel expenses through the online portal. The system is designed to support businesses by turning everyday expenses into rewards.

You control how and when to use your reward points without facing restrictions such as blackout dates for travel or minimum redemption amounts. This flexibility ensures you can optimize your spending and rewards according to your business needs.

Whether it's reducing costs with cashback or investing in future trips with travel points, Bill.com Ex-Divvy puts the power back in your hands.

Interest rates and fees

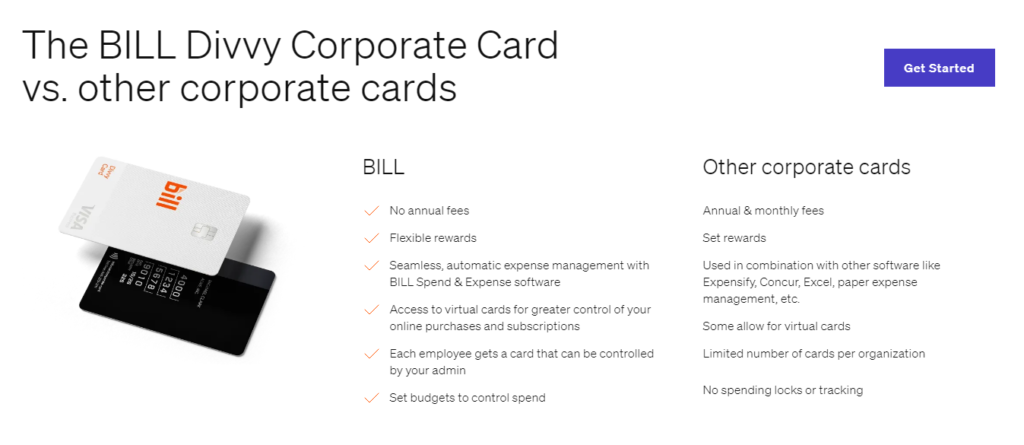

Moving from how rewards work, let's talk about the interest rates and fees. These factors are crucial for any credit or charge card decision. The BILL Spend & Expense Card charges no annual fee, making it an attractive option for small businesses looking to save money.

Yet, it's vital to pay attention to other potential costs like late payment fees and foreign transaction fees if you're doing business internationally.

For funding your small business needs without stress, understanding these expenses is key. Interest rates vary based on several factors including credit score and the market rate. For most users, staying informed of these charges helps in managing finances better and avoiding surprises on your statement.

Always read the fine print related to fees before applying for a new card.

Unique features like spending controls and business rewards

The BILL Spend & Expense card, formerly known as Divvy, offers powerful spending controls. Users can set limits on employee cards to ensure business expenses stay within budget. This feature helps manage finances better and prevents overspending.

Moreover, virtual cards add an extra layer of security for online transactions.

Business rewards with the BILL Spend & Expense card are designed to benefit small businesses and frequent flyers alike. From cash back on purchases to points for travel, users enjoy rewards that directly support their business needs.

These perks make it a top choice among corporate credit cards for those seeking value through their everyday spending and financial activities.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Comparing Bill. com Ex-Divvy to Other Business Cards

Check out how Bill.com Ex-Divvy stacks up against other top business cards. You'll see where it shines and where others might have the edge.

Divvy vs. Capital One Spark Cash Plus Card

- Divvy and Capital One Spark Cash Plus Card both offer great options for businesses looking to manage expenses and earn rewards. Divvy stands out with its innovative expense management tools that allow you to control employee spending limits easily.

- It combines a business credit card with budgeting software, making it seamless for teams to track their purchases in real-time. On the other hand, the Capital One Spark Cash Plus Card is known for its simple cash-back rewards program.

- Businesses earn 2% cash back on every purchase, which can be a straightforward way to save money on regular expenses.

- The choice between these two cards largely depends on what your business values more: the flexibility of managing budgets and controlling employee spending or earning uncomplicated cash back on all purchases.

- With Divvy, there's no annual fee and access to detailed reports for better financial insights—ideal for small businesses keen on tracking every dollar spent. Meanwhile, the Capital One Spark Cash Plus requires an annual fee but offers unlimited 2% cash back and doesn't require a personal guarantee, appealing to established businesses prioritizing straightforward rewards over detailed expense management.

Divvy vs. Brex 30 Card

- The Brex 30 Card and the BILL Spend & Expense, formerly known as Divvy, serve small businesses who need flexible funding. The Brex 30 Card does not require a personal guarantee and provides rewards for spending in categories like software subscriptions and travel.

- It adjusts credit limits based on cash flow or sales performance. This feature aims at high-growth startups with significant investment or revenue.

- BILL Spend & Expense focuses on detailed expense tracking and management features along with its spend controls that remain from its Divvy days. You get real-time visibility into company spending, which helps in budget management.

- Both cards integrate well with accounting software like QuickBooks Online, but they cater to different needs: one leans towards rapid growth companies; the other supports businesses aiming for tight control over expenses.

Divvy vs. U.S. Bank Business Platinum Card

- Divvy offers a unique blend of expense management and credit facilities, making it stand out. You get spending controls and business rewards right at your fingertips. Unlike the U.S. Bank Business Platinum Card, which primarily focuses on providing users with an extended introductory APR period for both purchases and balance transfers, Divvy goes beyond just being a payment tool by integrating real-time budgeting solutions into its platform.

- On the other side, the U.S. Bank Business Platinum Card appeals to business owners looking for simple credit solutions without annual fees or complicated reward structures. It's best for those who value straightforward financing over additional features like automatic expense reporting or spend controls provided by Divvy.

- Each card serves different needs depending on what you seek – innovative financial management tools or uncomplicated credit access with minimal costs.

Divvy vs. Ink Business Cash Credit Card

- The Ink Business Cash Credit Card shines with its cash back rewards, especially on office supplies and telecom services. You get 5% cash back in these categories. This card is a great fit if your spending aligns with its bonus categories.

- On the other hand, the Bill.com Ex-Divvy Corporate Card offers flexible spend controls and business expense management tools. It's particularly useful for businesses looking to streamline their spending and expense reporting processes.

- Choosing between them depends on what your business needs most. If maximizing rewards on everyday office expenses is top priority, the Ink Business Cash may be your winner. But for those needing advanced spend management features and tools to simplify expense tracking, Bill.com’s Ex-Divvy Corporate Card stands out as a strong option.

- Both cards have unique advantages that cater to different types of business financial strategies.

Ideal Users for Bill. com Ex-Divvy Corporate Card

The Bill.com Ex-Divvy Corporate Card shines for frequent flyers and budding small businesses. Those who manage weekly payments find this card a match made in heaven.

Frequent flyers

Frequent flyers find great value in the Bill.com Ex-Divvy Corporate Card's travel perks. It offers access to airport lounges and excellent rewards programs. These features make business trips more comfortable and rewarding, turning expenses into future travel opportunities.

With the card, earning points on flights and hotels quickly adds up, allowing for even more savings on business-related travel.

Small businesses just starting out also benefit from the flexible spending controls and streamlined expense management services provided by this card.

Small businesses just starting

Small businesses just kicking off need all the help they can get. The Bill.com Ex-Divvy corporate card offers an all-in-one solution that blends credit access with expense management, making it a perfect fit for new entrepreneurs.

Its spend controls allow these businesses to manage budgets effectively without needing extensive financial knowledge or resources.

Newer ventures also benefit from features like sign-up bonuses and spending rewards which can maximize their early cash flow. Moreover, the simplicity of integrating Bill.com's services means less time on accounts payable and more focus on growing the business.

For small companies aiming to scale quickly but wisely, this card could be a game-changer in handling finances efficiently and securely.

Business owners with a weekly payment schedule

Business owners with a weekly payment schedule find the BILL Divvy corporate card especially useful. It offers flexible spending controls that adjust to their unique financial cycles.

This feature helps in managing cash flow efficiently, ensuring they have the funds needed for operations and growth without worry about timing mismatches between income and expenses.

The card also supports expense management services, simplifying tracking and reporting. Owners can see where every dollar goes each week, making it easier to spot trends and adjust budgets on the fly.

This level of control and visibility is crucial for businesses operating on tighter schedules, allowing them to stay agile and responsive.

Common Questions About Bill. com Ex-Divvy Corporate Card

Got questions about the Bill.com Ex-Divvy Corporate Card? You're not alone. Many users wonder about where they can use this card and how it affects their credit score.

Card acceptance locations

You can use your Bill.com Ex-Divvy Corporate Card almost anywhere. This card enjoys wide acceptance since it operates on major networks like Visa or Mastercard. Whether you're booking flights, managing online subscriptions, or making in-store purchases, this card has you covered.

For small businesses and individuals alike, having a card that's accepted at countless locations worldwide means one less thing to worry about. From restaurants to retail stores and even online marketplaces – if they accept credit cards, chances are they'll take your Bill.com Ex-Divvy Corporate Card without any hassle.

Credit reporting details

BILL Divvy sends updates to credit bureaus. This means your use of the card can impact your FICO score and credit history. It's vital for small business owners who are building or improving their credit.

The company reports to major credit rating agencies like Dun & Bradstreet and the Small Business Financial Exchange (SBFE). Good payment habits with this card can help raise your score.

On time payments get reported, but so do late ones. Ensure you pay on time to avoid negative impacts on your credit scores. This feature makes BILL Spend & Expense a tool not just for managing expenses but also for demonstrating financial responsibility.

Keep in mind, using too much of your line might hurt your debt-to-income ratio, which lenders look at when you apply for loans or other lines of credit.

Difference between Divvy and a line of credit

Divvy is a corporate credit card that offers built-in expense management tools. It allows businesses to control spending in real time and provides rewards for purchases. On the other hand, a line of credit is more like a loan from a bank or financial institution.

You get access to funds up to a certain limit and pay interest on the amount you borrow. Unlike Divvy, lines of credit don't typically come with tools for managing expenses or rewards for spending.

With Divvy, your business can set budgets for specific categories or teams, ensuring money is spent wisely. This feature isn't usually available with traditional lines of credit, where the focus is more on financing rather than budgeting or expense tracking.

Plus, Divvy reports payments directly to help build your business's credit history—a key difference from some lines of credit that may not report to credit bureaus unless there's missed payments.

Bill Divvy Credit Card Review Conclusion: Is Still Worth It?

Bill.com Ex-Divvy keeps its spot at the top with innovative features and comprehensive expense management services, proving its worth in a competitive market. The challengers bring their strengths to the table, yet none match Divvy's all-in-one approach.

With its rebranding as BILL Spend & Expense, it simplifies customer experience while maintaining strong controls on spending. Small businesses and frequent flyers will find it especially beneficial.

Considering these points, Bill.com Ex-Divvy stands strong among contenders for those in need of credit and funding solutions.

FAQs

1. What makes Bill.com stand out for managing accounts payable and receivable?

Bill.com excels with its automation features for accounts payable and receivable, streamlining payments directly from your checking account or charge card.

2. Can I use Bill.com without a US bank account or EIN?

No, you need a US bank account and an EIN (Employer Identification Number) to fully utilize Bill.com's services.

3. Does Bill.com offer credit lines or cash advances?

Yes, alongside its primary functions, Bill.com provides options like credit lines and cash advances to support your business financial needs.

4. How does the integration with accounting software work?

Bill.com seamlessly integrates with major accounting platforms like NetSuite and Sage Intacct, making data sync effortless for users.

5. Are there mobile apps available for on-the-go management?

Absolutely! For both iOS and Android devices, Bill.com offers mobile apps available on the Google Play Store and Apple App Store, complete with Face ID for secure access.

6. What are some alternatives to consider against Bill.com?

Competitors worth considering include American Express — known for its travel portal benefits; Ink Business Preferred® Credit Card — famous for statement credits; plus others offering unique perks in accounts payable automation, customer service excellence, and robust expense report features.