Trying to build credit can be hard, especially with bad credit. The Chime Credit Builder For Bad Credit Review looks at a tool that might help. This review will show you how the Chime Secured Credit Card works and why it's a choice for many.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

|

Security deposit |

No minimum security deposit is required. The money you transfer from your Chime Checking Account to your Credit Builder secured account is how much you can spend with the card. |

APR |

0% |

Foreign transaction fee |

0 |

Recommended credit score: |

No credit check to apply (300-669 (Poor – Fair) |

Key Takeaways

- The Chime Secured Credit Builder Visa® Credit Card helps people with bad credit improve their score. It doesn't need a hard credit check, has no annual fees, or interest charges.

- Users can set their spending limit by the amount they deposit into their Chime account. This card reports to all three major credit bureaus to help raise your score.

- There are no rewards or cashback with this card. You must have a Chime Checking Account to use it.

- The card's impact on your credit score comes from reporting on-time payments and managing how much of your available credit you use.

- Compared to traditional secured cards, Chime's version stands out because it does not require a security deposit and offers easier access through its app without the usual fees.

What Is the Chime Secured Credit Builder Visa® Credit Card?

The Chime Secured Credit Builder Visa® Credit Card is designed to help people with bad credit build or rebuild their credit score. It does not require a hard credit check and has no annual fees or interest charges, offering an adjustable credit limit based on the deposits made.

Key features of the Chime Credit Builder Card

The Chime Credit Builder Card is a secured credit card to establish credit. It helps people with bad credit improve their scores. Here are its key features:

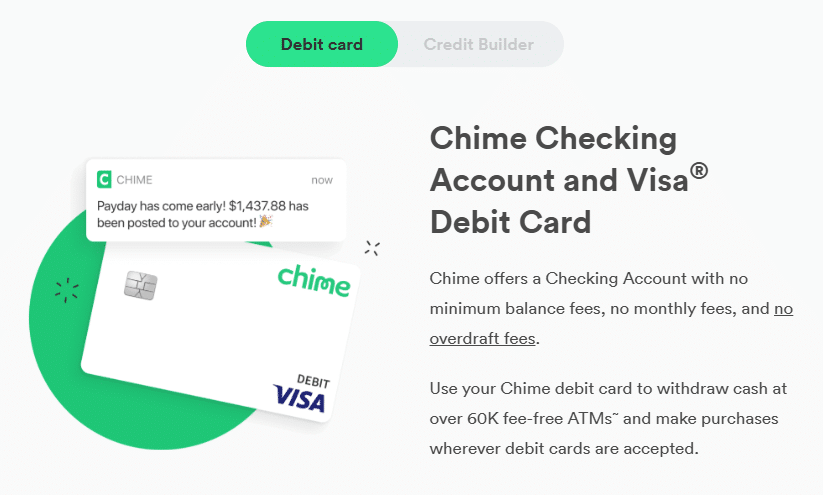

- Users get a Visa debit card that builds credit without annual, late, or interest fees.

- There's no credit check needed to apply, making it easier for those with low scores.

- This card allows setting spending limits based on the money in the Chime account.

- It reports to all three major credit bureaus, helping increase your credit score with proper use.

- The card includes an automatic payment feature to help avoid missed payments.

- You can only spend what you have, which means no debt accumulation.

- Every purchase updates your balance instantly, aiding in better budget management.

How it works for people with bad credit

For people with bad credit, getting a Chime Secured Credit Builder Visa® Credit Card helps a lot. You start by putting money into a Chime spending account. This amount sets your credit limit.

Since you can only spend what you've deposited, it lowers the chance of spending too much. Every time you buy something and pay on time, Chime tells the major credit bureaus. This process builds a good credit history over time.

Now let's look at the pros of using this card to build your credit.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Pros of the Chime Secured Credit Builder Card

The Chime Secured Credit Builder Card doesn't require a hard credit check and doesn't have annual fees or interest charges. It helps build credit through on-time payment reporting, offering an adjustable credit limit based on your deposits.

No hard credit check required

Getting the Chime Secured Credit Builder Card is easy for people with bad credit or those wanting to rebuild their scores. This card doesn't need a hard credit check. This means applying won’t hurt your credit score.

It's perfect for anyone looking to improve their financial standing without any risks.

This feature makes it stand out as a builders credit card. Since there’s no hard check, you can start building your credit right away. It offers a fresh start to build good habits and get on the path to better credit health with Chime Credit Builder Account options.

No annual fees or interest charges

The Chime Secured Credit Builder Card is not burdened with annual fees, making it a cost-effective choice for users. What's more, the card is free from any interest charges, allowing you to concentrate on improving your credit without any extra expenses hindering your progress.

Helps build credit through on-time payment reporting

Transitioning from the absence of annual fees or interest charges, the Chime Secured Credit Builder Card proves advantageous in aiding credit building through on-time payment reporting.

This card reports timely payments to credit bureaus, contributing positively to improving one's credit score. By utilizing this feature, individuals with a poor credit history or lack thereof can effectively work toward rebuilding their credit.

Moreover, regular monitoring of one's progress in improving their credit score is made possible through the Chime app. Notably cost-effective, this card requires no annual fees and operates by establishing a security deposit as the user's credit limit while promoting responsible spending habits.

Adjustable credit limit based on your deposits

The Chime Secured Credit Builder Card sets your credit limit based on the amount you deposit into your Chime Spending Account. It's tailored for those with less than ideal credit or those working to build their credit history.

By making regular, on-time payments and keeping a low balance, you can improve your credit score. There are no interest charges; you can only spend what you've deposited.

This card comes with a user-friendly app to help track spending and manage payments. It is specifically designed to provide an accessible means of enhancing your creditworthiness through responsible usage.

Cons of the Chime Secured Credit Builder Card

The Chime Secured Credit Builder Card requires a Chime Checking Account, and it doesn't offer rewards or cashback benefits. To find out more, keep reading our blog.

Requires a Chime Checking Account

To get the Chime Secured Credit Builder Card, you must have a Chime Checking Account. Linking the card to this account is necessary for using its features and benefits. Without a Chime Checking Account, you won't be able to access the card or enjoy its perks.

This requirement aims to encourage responsible spending and effective management of deposits since what you can spend is tied to your Chime Checking Account balance.

No rewards or cashback benefits

The Chime Secured Credit Builder Card doesn't offer rewards or cashback benefits. Its focus is on helping individuals with bad credit to improve their credit scores. This card requires a refundable security deposit to set the credit limit, and users won't earn traditional credit card rewards while using it.

The primary goal of the Chime Secured Credit Builder Card is to help individuals build their credit instead of offering cash incentives, which may make it less appealing for those seeking traditional credit card benefits.

Limited functionality compared to traditional credit cards

The Chime Secured Credit Builder Card has restrictions compared to regular credit cards. It requires a deposit to secure the credit limit, which limits access. This card lacks rewards or cashback programs and does not offer cash advance options.

It may also have limited support for international transactions and generally has less widespread acceptance than traditional credit cards.

How the Card Impacts Your Credit Score

The Chime Secured Credit Builder Card impacts your credit score by reporting your on-time payments to major credit bureaus. Your credit utilization also affects your score, so using the card responsibly can help improve it over time.

Reporting to major credit bureaus

The Chime Secured Credit Card reports to all three major credit bureaus: Experian, Equifax, and TransUnion. Regular on-time payments with the card can help improve your credit score.

The card is designed for individuals with bad credit, offering a way to rebuild their credit history by utilizing it responsibly, which can lead to better credit opportunities in the future.

Effects of credit utilization on your score

When discussing credit scores, credit utilization plays a crucial role. Roughly 30% of your credit score is influenced by credit utilization. It is wise to keep a credit utilization ratio below 30% for a healthy score.

The Chime Secured Credit Card can effectively assist in managing credit utilization. Regular payments on this card can reduce the credit utilization rate, which is advantageous for individuals with poor credit aiming to enhance their scores over time.

Using the Chime Secured Credit Card responsibly can have a positive impact on an individual's overall credit health. It can help in establishing a positive payment history and reducing credit utilization rates, thereby enhancing overall credit scores.

Comparing Chime to Traditional Secured Credit Cards

Chime Secured Credit Builder Card stands out due to no annual fees or interest charges and adjustable credit limits, unlike traditional secured credit cards. It also allows for on-time payment reporting to help build credit but lacks rewards or cashback benefits often found with other secured credit cards.

Differences in fees and requirements

Chime’s Secured Credit Builder Visa® Card positively differs from traditional secured credit cards in relation to fees and requirements. Unlike many traditional secured cards, Chime does not charge annual fees.

It also does not require a credit check, making it more accessible for individuals with poor credit. Moreover, Chime does not require a refundable security deposit, in contrast to typical secured credit cards, where the deposit serves as collateral against potential default.

In addition, setting up the Chime Secured Credit Card is simplified through its app compared to the often complex application processes of traditional secured cards.

Also, while some traditional secured credit cards may not report to all three major credit bureaus or have restrictions on how much you can spend based on your deposits, Chime reports to all three major bureaus and allows users to spend only what they have available in their Chime account – promoting responsible use and potentially impacting users’ overall financial health.

Advantages and disadvantages over competitors

The Chime Secured Credit Card sets itself apart from competitors by not conducting hard credit checks, making it more accessible for those with less than ideal credit. It also doesn't impose annual fees or interest, ultimately reducing overall costs for users.

Moreover, it distinguishes itself by reporting to major credit bureaus, thereby aiding in building credit just like other secured cards. The customizable initial deposit and lower interest rates compared to some competitors further contribute to its appeal.

Unlike conventional secured credit card providers, Chime provides a user-friendly mobile app for real-time tracking and management, enhancing the customer experience. This is a notable differentiator from certain competitors who might lack such robust technological capabilities.

Additionally, adjustable credit limits based on deposits offer added flexibility compared to other similar options in the market. These features give the Chime Secured Credit Card an edge over its competitors, making it a strong choice for individuals aiming to enhance their credit standings.

Next - How the Card Affects Your Credit Score

Frequently Asked Questions

Wondering if you can use the Chime Credit Builder Card with no money or if Chime charges fees for the Credit Builder Card? Find out more about how the Chime card helps build credit.

Can you use the Chime Credit Builder Card with no money?

The Chime Credit Builder Card needs funds in your Chime account to work. It is a secured credit card, so you need money upfront as your credit limit. You can't use the card if there's no money in your Chime account.

The card aims to help people with bad credit enhance their credit scores by reporting payments to credit bureaus. Users can add money from their Chime Spending Account to the Credit Builder Card anytime they want.

Does Chime charge fees for the Credit Builder Card?

Chime offers the Credit Builder Card without any fees. There are no annual fees, foreign transaction fees, or late payment fees. Moreover, purchases made with this secured credit card do not incur interest.

Users are required to fund the card with their own money, which aids in enhancing credit scores without incurring additional costs.

How does the Chime card help build credit?

The Chime Credit Builder Card helps build credit by reporting your card activity to major credit bureaus. It promotes responsible spending habits and timely payments to enhance your credit score.

With no annual fees or interest charges, it's a cost-effective option for individuals with bad credit or no credit history. You can increase your credit limit by adding funds, which improves your credit utilization ratio and positively impacts your credit score.

This secured card encourages good financial habits such as budgeting and timely payments, allowing you to build a positive credit history.

Is the Chime Secured Credit Builder Card Right for You?

The Chime Secured Credit Builder Card could be the right fit if you have a lower credit score and are looking to enhance it. It's specifically designed for individuals with less favorable credit histories.

The card offers a secured credit limit ranging from $200 to $2,500 without requiring a hard credit check. Additionally, it reports to all three major credit bureaus, providing an opportunity to build a positive credit history with no annual fees.

If you're seeking a cost-effective option that allows account management via the Chime mobile app while enhancing your credit rating, this could be a suitable choice for you. Keep in mind it's important to deposit between $200 and $2,500 as collateral.

Are you ready to explore whether this card meets your needs? Let's discuss further.

Conclusion

Looking at the Chime Secured Credit Card, it seems like a good option for people with bad credit looking to build their score. With no annual fees or interest charges, and the opportunity to round up purchases into a savings account, it offers some unique benefits.

Its lenient approval process without requiring a credit check makes it more accessible. Overall, if you're looking for an uncomplicated way to work on rebuilding your credit, this could be worth considering.

FAQs

1. What is a Chime secured credit card?

A Chime secured credit card, also known as the Chime Credit Builder, is a type of card designed to help individuals establish or build their credit.

2. How does the Chime Credit Builder work?

The Chime Credit Builder works by allowing you to make purchases with your own money while reporting the payments to major credit bureaus, helping build your credit score.

3. Can I use my Chime Credit Builder Card at an ATM?

Yes, you can use your Chime Credit Builder Card at ATMs just like any other Visa cards.

4. Does having a chime account help me in building my credit?

Yes, using the chime account and its features such as the "Credit builder" can assist you in establishing and building your credit over time.

5. How do I apply for a chime secured credit card?

To apply for a chine secured card or what's called "Charm Credit Card", visit their website or app and follow their step-by-step application process which includes creating an account if you don't have one already.

6. Is there any monthly payment required for using the Charm Secured Account?

No, there are no monthly payments required for using Charm's Secure Account; however, it's essential to keep track of your spending habits to avoid debt accumulation.