Having bad credit can feel like a big roadblock. Credit Strong Credit Builder for Bad Credit offers a way out. This article will show you how their service can help improve your score.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Keep reading to learn more.

Overview of Credit Strong's Services

Credit Strong offers Credit Builder Accounts and Business Credit Builder Options. It helps people with bad credit to build their credit by making regular monthly payments into a savings plan.

Credit Builder Accounts

Credit Strong offers credit builder accounts to help people build or improve their credit score. These accounts are cash-secured loans that act like savings plans. As you pay the loan off, Credit Strong reports your payments to major credit bureaus.

This can boost your score as long as you make payments on time. There is a one-time non-refundable fee to start and interest rates vary.

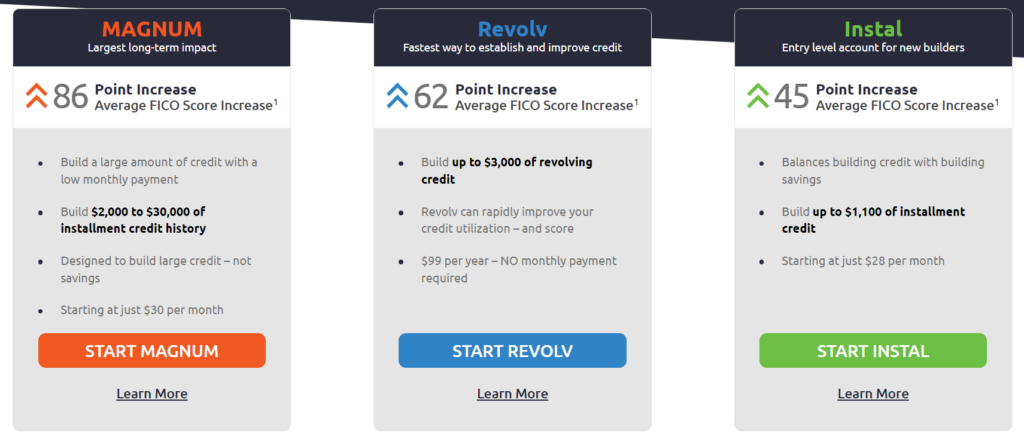

Magnum by Credit Strong uses revolv accounts for another way to build credit. With an annual fee of $99, these provide a secured line of credit. Making at least three consecutive monthly payments of $10 or more boosts the available credit by $250 each time, up to a max of $3,000.

All optional monthly payments go right into savings, making it easier to grow your money while strengthening your credit history.

Business Credit Builder Options

Moving from personal to business needs, Credit Strong also offers business credit builder options. They know that businesses need good credit too. Businesses can hold up to two accounts.

This helps them build their credit score quickly. With CreditStrong, there are three main products for businesses: Instal, Revolv, and CS Max. Each has different terms and interest rates.

For example, the CS Max option costs $49 a month for a $2,500 account. For bigger needs, it goes up to $99 a month for a $5,000 account or even $199 per month for a $10,000 account.

If your business is looking to really expand its credit capacity fast, there's also the option of paying $449 per month for a massive $25,000 account. The Instal plans have an initial fee of just $15 with an APR of 15.61%, while CS Max plans come with a higher setup fee of $25 but enjoy lower interest at 6.99% APR.

How Credit Strong Works

To open a Credit Strong account, simply follow the steps and set up monthly payments along with a savings plan. The account reports to major credit bureaus, helping you build credit without a credit check during application.

Steps to Open an Account

Opening a Credit Strong account is easy and fast. It helps people with bad credit or no credit start building their credit score.

- Check if you're eligible. You must be 18, live in the U.S., but not in Vermont or Wisconsin, and have a valid SSN/ITIN.

- Visit the Credit Strong website. Look for the application form online.

- Fill out your personal information. You will need your name, address, mobile phone number, and email address.

- Add your financial details. Include your checking account or debit card info.

- Agree to terms and conditions. Make sure you read them first.

- Submit your application. This won't take long, just minutes.

- Wait for approval. Credit Strong doesn't check your credit, so it's quick.

- Choose your plan. They have several options to fit different needs, like magnum credit builder or revolv.

With these steps, you can start building your credit while saving money at the same time with Credit Strong for bad credit.

Monthly Payments and Savings Plan

Credit Strong offers monthly payment plans that assist in building credit while saving money. For example, the 48-month plan involves a $28 monthly payment and leads to $1,010 in savings.

This can be advantageous for individuals seeking to enhance their credit scores gradually. Furthermore, the installment accounts necessitate the first payment one month after opening.

The availability of a Revolv account provides a secured line of credit at 0% utilization, which can increase total available credit and have a positive impact on credit score. The range of plan options makes it inclusive for individuals with diverse financial situations.

Key Features of Credit Strong

Credit Strong reports to major credit bureaus, enabling you to build your credit history with timely payments. No credit check is necessary when applying for their Credit Builder Accounts, making it accessible to those with bad credit.

Reporting to Major Credit Bureaus

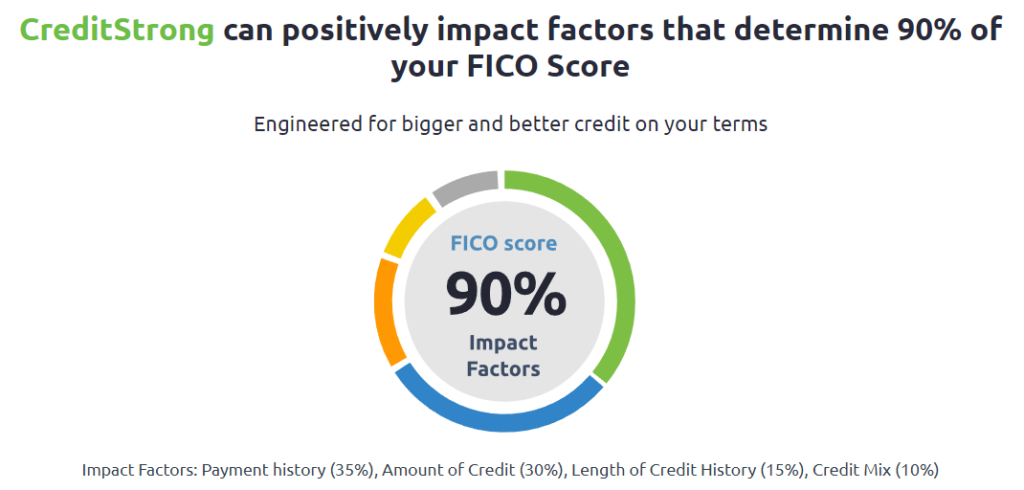

Credit Strong reports monthly payments to the three main credit bureaus, which affects 35% of a FICO score. The accounts are reported within 30-60 days for installment and 15 days for Revolv.

Credit Strong supplies a monthly FICO 8 score, reporting to Experian, Equifax, and TransUnion. Late payments carry a 4% fee after 15 days; anything over 30 days late is reported to credit bureaus.

Overall, Credit Strong's regular reporting helps users build their credit history by ensuring that their payment behaviors are accurately reflected in their credit reports with major bureaus.

No Credit Check for Application

Applying for Credit Strong takes only minutes and requires no credit check. It's available in almost all U.S. states, except Vermont and Wisconsin. There are no specific minimum score or income requirements.

To be eligible, you need to be at least 18 years old, have a permanent U.S. residency, a valid Social Security Number (SSN) or Individual Tax Identification Number (ITIN), a checking account or debit card, as well as a mobile phone number and email address.

Credit Strong doesn't perform any credit checks during the application process; hence it has no specific minimum score or income requirements. The eligibility criteria include being 18 years old with U.S. residency, possessing a valid SSN/ITIN, having a checking account or debit card, along with an active mobile phone number and email address.

Pros of Using Credit Strong

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Using Credit Strong builds credit while saving money, making it a smart financial move for anyone with bad credit. The flexible plan options cater to individual needs and goals, providing an effective way to improve credit scores.

Builds Credit While Saving Money

Credit Strong offers a unique way to build credit while also saving money. Monthly payments are reported to major credit bureaus, helping to improve credit scores. Notably, this accounts for 35% of FICO scores.

Plus, once the installment account is paid off, the savings account unlocks with options for interest or fund transfer. This provides an opportunity for individuals to establish a positive payment history and save money simultaneously.

Furthermore, CreditStrong's approach doesn't require large deposits like secured credit cards do—an advantage worth considering when aiming to boost one's credit profile without significant upfront costs.

Next point: "Flexible Plan Options

Flexible Plan Options

Credit Strong provides a variety of flexible plan options to meet different needs. The Instal Plans include a $15 fee and 15.61% APR, with monthly payments ranging from $28 to $48 for terms of 24 to 48 months, offering savings between $1,000 and $1,110.

On the other hand, the CS Max plans offer different fees from $49 to $449 per month, accommodating account sizes from $2,500 to $25,000 at an APR of 6.99%. These plans offer a range of choices customized to individual requirements.

The flexibility in plan options enables customers to choose a payment structure that suits their financial goals and capabilities while establishing credit through punctual payments.

This selection ensures that individuals can discover a plan that matches their specific needs and budget constraints as they strive to enhance their credit profile without being confined to fixed terms or amounts.

Cons of Using Credit Strong

Credit Strong may charge early cancellation fees, and it could entail potentially high interest rates.

Early Cancellation Fees

Credit Strong does not charge early cancellation fees, so users can close their accounts at any time without penalties. However, while early repayment is allowed with no fines, it may limit the benefits of payment history.

Loan proceeds are provided by Austin Capital Bank and held in a locked savings account as collateral. Payments include both principal and interest; at the end of the term, any unpaid interest or fees are deducted from the returned principal amount.

Potential for High Interest Rates

Transitioning from the discussion on early cancellation fees to potential interest rates, it's important to note that Credit Strong has two plans. For the "Instal" plan, the interest rate goes as high as 15.61% APR with a $15 fee.

On the other hand, for their "CS Max" plan, there is a higher monthly fee but significantly lower at just 6.99% APR and a $25 fee. These varying rates and fees can impact how much you end up paying in total over time.

The Instal plans come with options like a 48-Month plan where you pay $28 per month and save about $1,010 or a 24-Month option of $48 per month with approximately $1,000 in savings.

As for the CS Max plan options: it includes payments such as $49/month for a $2,500 account or even up to $449/month for a larger credit line of up to $25,000.

Customer Reviews and Feedback

Customer reviews and feedback showcase the positive impacts on credit scores, along with complaints about refunds and service. It's important to gauge both perspectives before making an informed decision.

Positive Impacts on Credit Scores

Credit Strong has a positive impact on credit scores by reporting monthly payments to the major credit bureaus, which is crucial for establishing a good payment history. As payment history accounts for 35% of a FICO score, this can significantly enhance one's credit profile.

In addition, CreditStrong provides monthly FICO 8 scores and reports to Experian, Equifax, and TransUnion. While there might be a temporary dip in the credit score after opening an account due to inquiries and new credit lines, timely payments reported subsequently contribute to an upward trend in the credit score.

Moreover, late payments incur a 4% fee after 15 days; over 30 days late are reported to credit bureaus. This underscores the significance of timely payments embedded within Credit Strong's services as it directly impacts customers' overall financial well-being.

Moving forward from these impacts on credit scores, let's explore customer reviews and feedback.

Complaints About Refunds and Service

Credit Strong has received negative reviews for its refund process and customer service. The company holds a 2.6 out of 5 rating on Trustpilot and a 1.27 out of 5 rating from the Better Business Bureau.

Customers have reported issues with refunds and encountered problems with customer service, affecting their overall experience with Credit Strong's services.

Conclusion

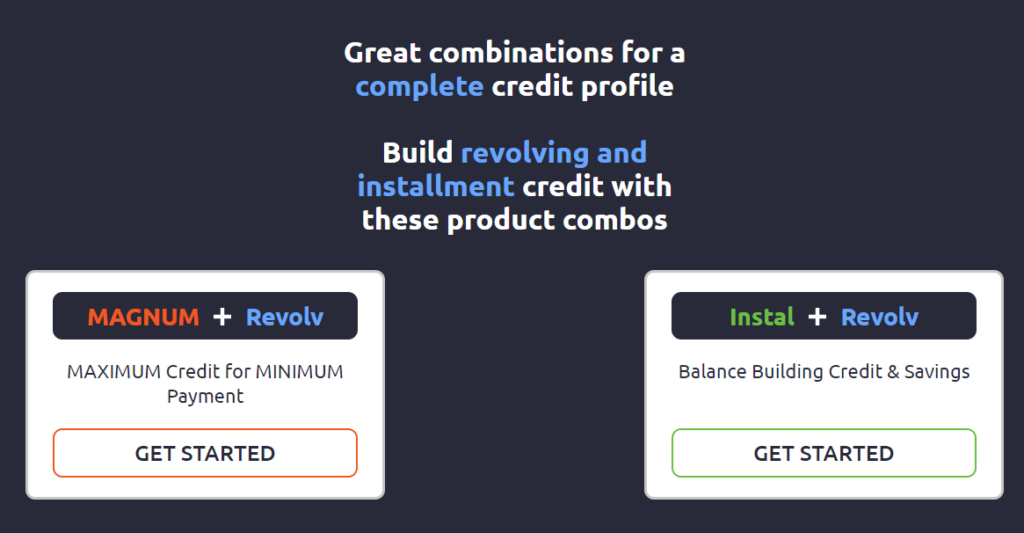

In conclusion, Credit Strong offers effective solutions for individuals with bad credit. It provides options for building credit while saving money through its installment and revolving accounts.

The company's commitment to reporting to major credit bureaus helps in establishing a positive credit history. Despite some drawbacks such as early cancellation fees and potential high-interest rates, the overall impact of Credit Strong on improving credit scores is noteworthy.

With simple steps to open an account and a focus on flexibility, it's an option worth considering for those looking to rebuild their credit.