Highest Approvals in these states and income $25k or more: Alaska (AK), Alabama (AL), Arkansas (AR), Arizona (AZ), California (CA), Delaware (DE), Florida (FL), Idaho (ID), Indiana (IN), Kansas (KS), Kentucky (KY), Louisiana (LA), Michigan (MI), Minnesota (MN), Missouri (MO), Mississippi (MS), Montana (MT), Nebraska (NE), Ohio (OH), Oklahoma (OK), South Carolina (SC), Tennessee (TN), Texas (TX), Utah (UT), Wisconsin (WI), Wyoming (WY).

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

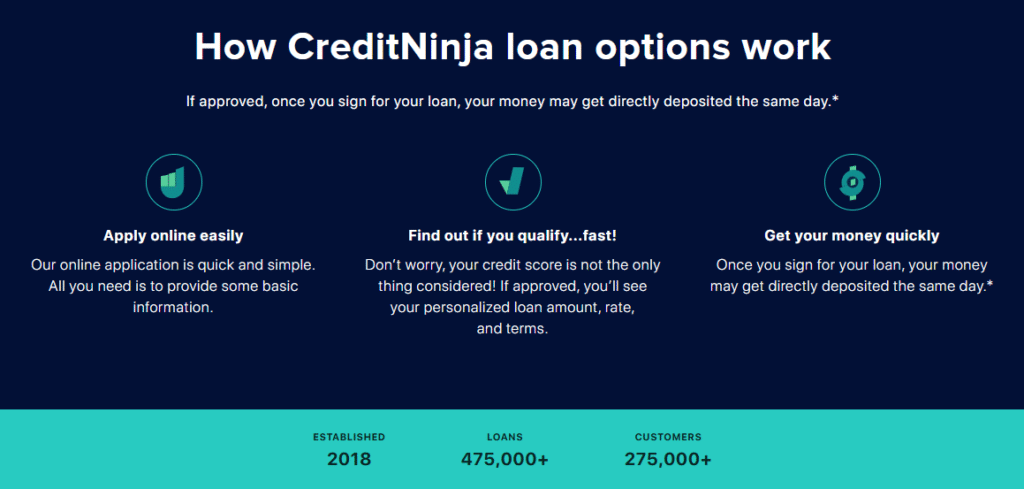

Having bad credit can make getting a loan tough. CreditNinja steps in to help with their personal loans for those with less-than-perfect scores. This "CreditNinja Personal Loan Review" will show you how they offer quick and easy solutions.

Key Features of CreditNinja Personal Loans

CreditNinja offers various loan amounts and terms. The application process is quick, and approval goes at a fast pace.

Loan amounts and terms

CreditNinja personal loans offer amounts between $1,000 and $10,000. This range makes them a flexible option for many borrowers. People can choose these ninja loans based on their needs and eligibility.

The terms for repaying the loan can be from 6 to 18 months. With fixed interest rates, monthly payments stay the same. This setup helps people plan their finances better. Plus, there are no fees for paying off the loan early.

Speed of application and funding

Applying for online loans can be quick and easy with CreditNinja. People can fill out their applications from home. The approval process is fast, often taking only minutes. Once approved, you might get your money as soon as the next business day.

This makes it a good choice for fast simple loans or if you need cash ninja-fast.

CreditNinja uses an online platform that makes everything smooth. You won't need much paperwork to apply. This helps make the loan application speedy. For those looking online loans same day or easy online loans, this could be helpful.

Availability by state

CreditNinja personal loans are not available in every state. Where you live can affect if you can get a loan and on what terms. States have different rules about loans. This means the interest rates and how long you have to pay back a loan can change based on where you live.

Before moving on to the pros and cons of CreditNinja personal loans, check if these loans are an option where you live.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Pros and Cons of CreditNinja Personal Loans

CreditNinja Personal Loans offer fast funding and are available for people with bad credit, making them accessible in times of need. However, the interest rates might be higher compared to traditional bank loans, so it's important to compare options before making a decision.

Pros

CreditNinja personal loans offer several benefits for individuals with less-than-perfect credit scores. These advantages make CreditNinja a competitive option for those in need of financial assistance. The following table outlines the pros of opting for a CreditNinja personal loan.

| Pros |

|---|

| Accommodates individuals with bad credit |

| Application process is quick and easy |

| Funds can arrive as soon as the next business day after approval |

| Offers flexible repayment terms to match borrowers' budgets |

| No penalties for paying off the loan early |

| Helps improve credit score by reporting timely payments to credit bureaus |

| Provides a mobile-friendly platform for managing loans online |

| Accessible customer service for assistance |

These features demonstrate CreditNinja's commitment to providing accessible financial solutions for those who might find it challenging to secure loans through traditional banks, especially with a history of bad credit.

Cons

Transitioning from the benefits CreditNinja offers, it's crucial to also consider the drawbacks of their personal loans. Here's a concise outline of the negatives:

| Con | Description |

|---|---|

| High Interest Rates | Borrowers with bad credit face high interest rates. |

| Time-consuming Application | Applying requires detailed documentation, slowing down the process. |

| Potential Fees | Some loans come with fees that can increase the total loan cost. |

| Limited Loan Amounts | Options for larger borrowing amounts are restricted. |

| Late Payment Penalties | Late payments can lead to additional financial strain. |

| Inconsistent Credit Reporting | Reporting to credit bureaus may be inconsistent, affecting credit-building. |

| Shorter Loan Terms | Shorter terms can result in higher monthly payments. |

| Variable Customer Service | Some users report difficulty in reaching customer support. |

Who Can Benefit From CreditNinja?

CreditNinja personal loans are valuable for individuals with less-than-ideal credit seeking swift access to funds and adaptable repayment choices. It serves those encountering emergencies, requiring funds, and having restricted access to traditional banking services.

This offers a substitute for payday loans for customers managing financial challenges.

How to Apply for a CreditNinja Loan

To apply for a CreditNinja loan, follow these simple steps:

- Go to the CreditNinja website and fill out the online application form.

- Provide your personal information, income details, and banking information as required.

- Wait for the loan eligibility assessment, which is based on income rather than just credit score.

- Choose a suitable loan amount ranging from $1,000 to $10,000 based on your financial situation.

- Select a repayment term that works best for you.

- Once approved, expect to receive funds quickly, often within one business day.

This process provides an easy way for individuals with bad credit to access personal loans when needed.

Conclusion

Looking for personal loans with flexible repayment options and quick funding? Creditninja might be a good solution for those with less than ideal credit. Their simple online application process and competitive interest rates make it worth considering.

With positive customer ratings and a user-friendly interface, Creditninja seems to shine in the world of online lending.

Ready to start your financial journey? Creditninja's personalized support and educational resources could make it a smooth experience despite your credit situation.