Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

In the world of finance, a low credit score can feel like an anchor, dragging down your opportunities for borrowing and access to emergency funds. But it’s not all doom and gloom; companies like FundsJoy are stepping up to the plate, swinging big for those who’ve struck out with traditional banks due to their credit histories.

In this Fundsjoy review and with over two decades of experience demystifying financial solutions for individuals and small businesses alike, I’ve seen firsthand how alternative lending options have evolved to fill this vital need in the marketplace.

Here’s a beacon of hope: FundsJoy offers loans from $200 to $5,000 that could be your financial lifeline. This article peels back the layers of FundsJoy’s services so you can make an informed decision before you apply – because knowing is half the battle in guarding your wallet.

We’ll delve into what makes or breaks this option for your unique situation. Ready? Let’s uncover these key insights together.

Fundsjoy Review Key Takeaways

- FundsJoy caters to individuals with bad credit, offering loans from $200 to $5,000 through a quick online application process without traditional lending barriers.

- The company provides a secure platform for loan applications and connects borrowers with a network of active lenders ready to assist despite low credit scores or lack of credit history.

- Loans types available include emergency loans, personal loans, and payday loans with flexible solutions for different financial situations. Through AmOne partnership, they also offer personal loans starting at 5.99% APR.

- Some limitations exist; FundsJoy services are not available in all states and there is a monthly income requirement that could affect loan eligibility.

- Safety is prioritized by requiring detailed personal information during the application process and by being transparent about loan costs including interest rates and potential fees.

What is FundsJoy?

FundsJoy is a loan service provider specifically designed for individuals with bad credit. They offer a quick and easy online application process, as well as a variety of loans to suit different needs.

Additionally, FundsJoy ensures safety and security for all their customers.

A loan service provider for people with bad credit

If you’re dealing with bad credit, finding a loan can be frustrating. FundsJoy steps in to help by offering services for individuals who may not have the best credit scores but need quick cash.

They connect you directly with lenders who understand that financial hiccups happen and look beyond just credit history.

You don’t have to worry about being disqualified because of past struggles; FundsJoy makes it possible to secure emergency loans, personal loans, or other types of credit without the conventional barriers.

With their digital application process, they prioritize financial inclusion so money is more accessible when you most need it.

Quick and easy online application process

Even if your credit history isn’t perfect, FundsJoy provides a lifeline with their streamlined online application. You’ll find that applying for the financial help you need is faster than you may expect.

Gather your personal and financial details, including your social security number and bank account information, and you’re ready to start.

Filling out the application only takes a few minutes—no waiting in line or on hold. Just enter your employer’s phone number, how much money you need, and some basic info about yourself right there on their secure website.

Your request for an urgent loan could be just clicks away from reaching potential lenders eager to assist you through FundsJoy’s network. With loan amounts ranging from $200 to $5,000 available for borrowers like you, relief from financial stress is made more accessible than ever before thanks to this user-friendly platform.

Offers a variety of loans

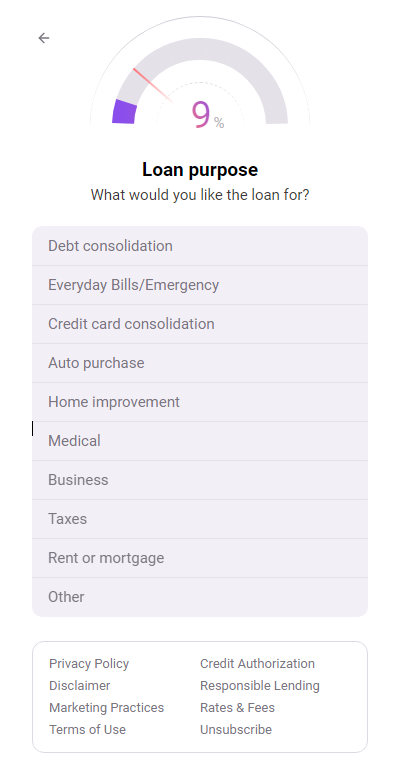

FundsJoy understands that every financial situation is unique, which is why they provide a range of loan types to meet different needs. Whether you’re facing an unexpected expense or need to consolidate debt, their personal and payday loans offer flexible solutions.

With amounts ranging from $200 to $5,000, these loans are designed to bridge the gap in your finances without long waits or cumbersome paperwork.

They cater to individuals and small businesses alike, ensuring access to funds regardless of credit history. You can secure the money needed for urgent repairs, medical bills, or even starting up a new venture without the hassle typically associated with conventional lending institutions.

Next up: how FundsJoy ensures your safety and security while handling your loan application.

Ensures safety and security

FundsJoy provides a secure and streamlined digital platform for loan applications, ensuring the safety of your personal and financial information. The company’s stringent approval criteria, including age verification, citizenship status, bank account validation, and income assessment, ensures that only eligible applicants can access their services.

With FundsJoy’s commitment to safeguarding your data throughout the application process, you can confidently pursue your credit needs without compromising your privacy or security.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

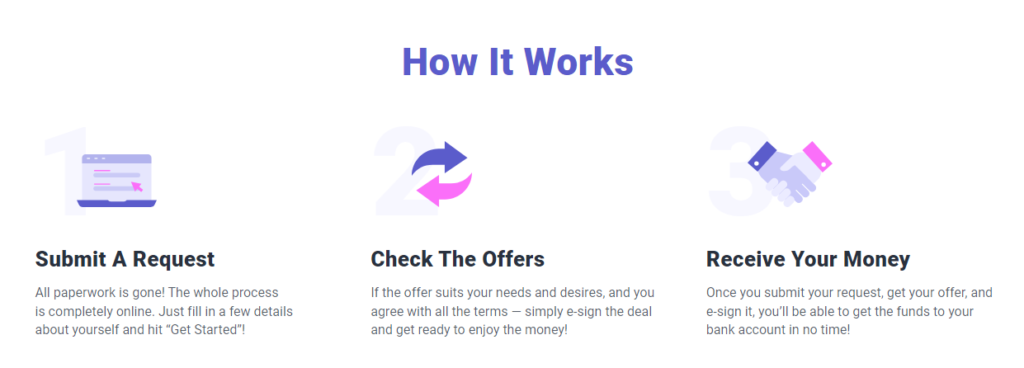

How Does FundsJoy Work?

FundsJoy operates by connecting borrowers with a network of active lenders, offering a simple application process and various loan options to choose from. To learn more about the specifics and how it can benefit you, continue reading.

A network of active lenders

FundsJoy connects borrowers to a network of active lenders who are ready to provide loans ranging from $200 to $5,000. This enables quick access to cash for individuals and small businesses in need, especially those with bad credit or no credit history.

The digital process ensures a simple application and efficient loan approval, making it an accessible option for those looking for fast and reliable financial support.

Borrowers can take advantage of the variety of loans available through FundsJoy’s network of active lenders, ensuring that different financial needs are met. From installment loans to cash advances, the service caters to a wide range of funding requirements while prioritizing safety and security throughout the lending process.

Simple application process

To apply for a loan with FundsJoy, you simply answer a few questions online. The process is quick and flexible, allowing borrowers in urgent need of cash to access funds without unnecessary delays or complications.

You may find this straightforward approach particularly helpful if you require swift financial assistance.

As we delve into the application process further, let’s explore how FundsJoy streamlines lending services for individuals and small businesses seeking credit and funding quickly.

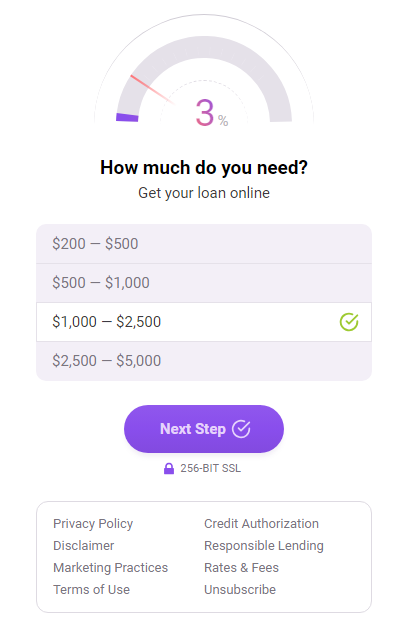

Loan limits

FundsJoy provides loan amounts ranging from $200 to $5,000. Borrowers have access to quick cash for various needs within these specified limits. However, this service may not be suitable for those requiring larger business loans or seeking substantial funding beyond the established range.

Different types of loans are available

Run a quick scan of the loan options available at FundsJoy, and you’ll discover an array of financial solutions to meet your needs. Whether it’s personal loans for diverse purposes, short-term payday loans to bridge any gaps, or installment loans tailored for student expenses, auto financing, or even mortgages – you can find a suitable match.

Plus, through their partner AmOne, access personal loans with impressively low APR rates starting at 5.99%, ensuring that there’s something for everyone’s financial requirements.

Safety and security measures

FundsJoy prioritizes safety and security, requiring borrowers to provide personal and financial information, including their social security number, employer’s phone number, bank account details, and identification.

Additionally, the platform emphasizes the importance of carefully considering the costs associated with taking out a loan through FundsJoy. This includes interest rates, origination fees, late fees, and prepayment penalties to ensure transparency in all financial transactions.

The platform further addresses uncertainties around lenders when applying through FundsJoy by maintaining a network of active lenders who meet certain standards for reliability. By implementing these stringent safety measures and transparent practices, FundsJoy aims to provide a secure environment for individuals and small businesses seeking credit options.

Pros and Cons of FundsJoy

FundsJoy offers fast and reliable loan services, but operates in limited states and has a monthly income limit. For more detailed information on the pros and cons of FundsJoy, keep reading to make an informed decision before applying.

Pros: fast, reliable, transparent

You can rely on FundsJoy for fast, reliable, and transparent access to small loans that cater to your urgent financial needs. With a simple and straightforward application process, FundsJoy ensures a speedy approval, allowing you quick access to the funds you require with minimal hassle.

Additionally, the transparency of their services means you can expect clear terms and conditions without hidden surprises.

The reliability of FundsJoy lies in its ability to offer accessible financing solutions for individuals and small businesses despite low credit scores. This makes them an attractive option for those struggling with poor credit history who need prompt financial assistance.

Cons: operation in limited states, monthly income limit

FundsJoy operates only in certain states, which may limit your access to their services depending on where you live. Additionally, there is a monthly income limit associated with using FundsJoy.

This could affect your eligibility for obtaining a loan, making it important to consider whether you meet the income requirements before applying.

To improve your financial literacy and make informed decisions about credit and funding, let’s delve into the various types of loans offered by FundsJoy.

Conclusion and Final Thoughts

In conclusion, making an informed decision when applying for credit is essential. Understanding the key aspects of a loan service provider like FundsJoy arms you with practical knowledge to navigate the process efficiently.

By considering the pros and cons, as well as the specific requirements and limitations, you can make a well-rounded decision that aligns with your financial needs. Emphasizing safety measures and transparency reinforces its importance in responsible lending practices.

Remember, seeking personalized advice from qualified professionals regarding specific investment issues remains crucial for informed decisions.

FAQ

1. What does FundsJoy do?

FundsJoy connects you with loan providers who can offer credit loans like personal loans, debt consolidation, and auto loans even if your credit check shows bad credit.

2. Will applying for a loan through FundsJoy affect my credit score?

Yes, when you apply for a loan, FundsJoy may perform a soft or hard credit check that could impact your credit score depending on the lender’s process.

3. Are the loan terms offered by FundsJoy flexible?

FundsJoy itself doesn’t set the loan terms; it finds lenders who can provide varied APR ranges and repayment options based on your specific needs and creditworthiness.

4. Can I trust customer reviews of FundsJoy?

While customer reviews can be helpful, always cross-check them with trusted sources like bbb.org to ensure they are legitimate and not influenced by spammers or targeted advertising.

5. Does FundsJoy guarantee approval for bad-credit-loans?

No company including FundsJoy is able to promise guaranteed approval for all applicants because each money lender has different criteria related to annual percentage rates (APRs), income checks, and more.

6. How secure is it to apply for a loan through FundsJoy online services?

Fundsjoy uses security measures such as SSL certificates to protect your information during online transactions but always verify any emails or requests using the official contact details listed on their website before sharing sensitive data.