Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

If you’ve ever felt the cold sweat of a financial pinch, you’re certainly not alone. Finding a quick infusion of cash can often seem like an impossible hurdle, especially when time is not on your side and traditional lenders are tightening their belts.

As someone who’s navigated the choppy waters of personal finance for over a decade, I understand the urgency that accompanies the need for a swift financial solution.

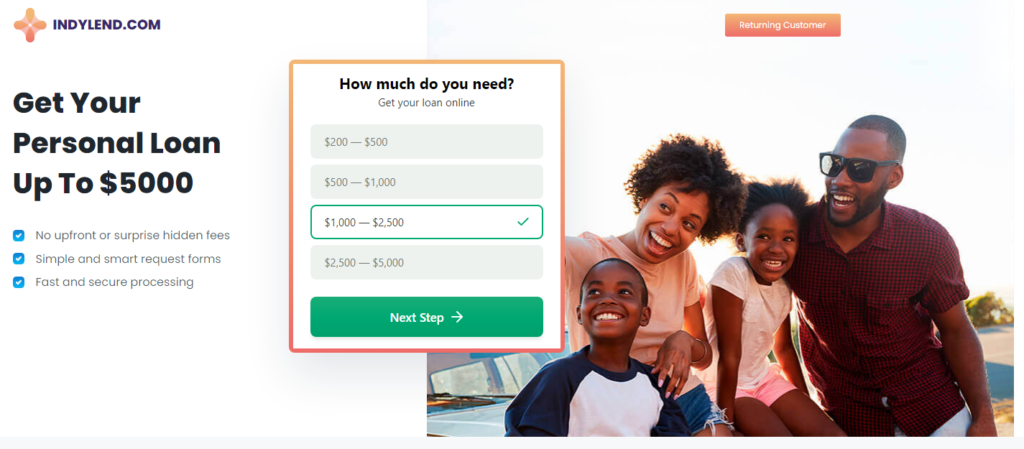

My Indylend Review: A platform designed to cut through red tape and fast-track your journey to securing funds up to $5000. This isn’t just about speed; it’s also about inclusivity, with loan offers crafted for all credit types.

For those wary of being ensnared by fine print or hidden fees—fear not. Indylend promotes transparency and simplicity as its hallmarks, ensuring you’re fully informed every step of the way.

Ready to discover how this service stands out in the bustling world of personal loans? Read on!

Indylend Review Key Takeaways

- Indylend connects borrowers to a wide network of lenders, offering personal loans up to $5000 for various credit types without hidden fees.

- The online application at Indylend takes less than 10 minutes and includes steps like providing basic info, choosing a loan amount, and submitting identity verification documents.

- Availability varies by state due to specific legislation; always check the latest availability on the Indylend website or with their customer support.

- Loan options are personalized with APRs ranging from 4.99% to 450%, tailored based on factors like credit history and income level.

- Customer feedback highlights the speed of the approval process and transparency in terms, while some have noted areas for improvement such as customer service response times.

Indylend: An Overview

Within the competitive landscape of financial services, Indylend.com emerges as a noteworthy entity, offering an expedited avenue for securing personal loans that can cater to your urgent monetary needs.

Discover how their digital platform streamlines the borrowing process, allowing you to navigate through their varied loan options with ease and precision.

Company information

Indylend stands as a guiding light for you, providing financial solutions when traditional lending doors close. They connect borrowers with an extensive network of lenders through their platform, indylend.com.

Focusing on accessibility and personalization, they break through the constraints of credit scores. This means whether your credit history shines bright or has some shadows, Indylend facilitates loan offers tailored to meet your unique circumstances.

Their commitment extends beyond just connecting you to potential lenders; there are no hidden costs lurking in the fine print—what you see is what you get. With transparent operations based out of Oakland, CA, Indylend operates with integrity and customer focus at its core.

And while they’re not directly lending money themselves, their role is crucial—they give customers like yourself a chance to find terms that align with both your current needs and repayment capacity.

Products and services

If you’re in need of quick funding, look no further. Indylend stands out with its array of personal loans that can reach up to $5000, tailored to meet your financial demands without burdening you with upfront or hidden fees.

The annual percentage rate on these loans varies widely, from as low as 4.99% to as high as 450%, which means there’s likely a fit for different credit profiles and budget needs.

You get the privilege of browsing through personalized loan options after filling out a simple online application form. This seamless process connects you swiftly with reputable lenders who understand your urgency for funds, whether it’s for covering an unexpected expense or giving your small business the boost it needs.

Next, let’s explore how easily available Indylend’s services are across various states.

Availability by state

Keep in mind that while Indylend aims to serve a broad audience, they aren’t available in every state due to legislation and company policy. Below is a handy table that sums up where Indylend’s services can be accessed. This table will give you a quick glance at your state’s status for obtaining a personal loan through Indylend.

| State | Availability |

|---|---|

| Alabama | Available |

| Alaska | Available |

| Arizona | Not Available* |

| Wyoming | Available |

*Residents of certain states like Arizona may not be eligible for loan products offered by Indylend due to state legislation.

Always check the most current information on Indylend’s website or contact their customer service to confirm the availability of their services in your specific state. Remember, submitting a loan request through Indylend does not guarantee a loan offer, and not all lenders from their network operate in all states. Your location can impact your eligibility for loan products, so be sure to consider this before proceeding with your application.

Application process

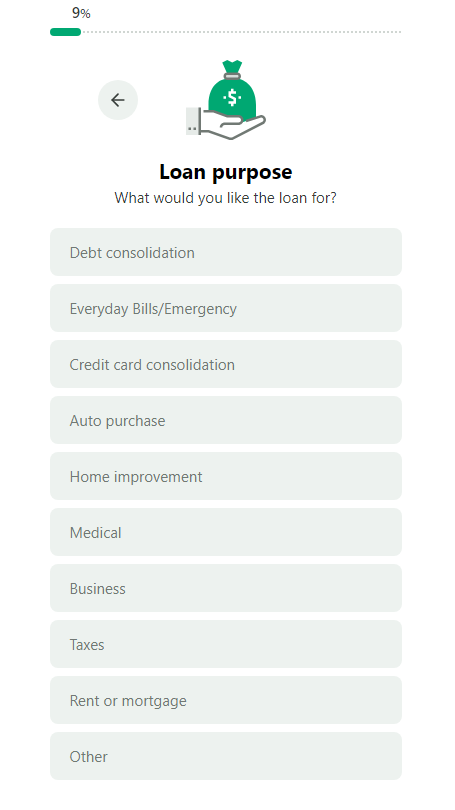

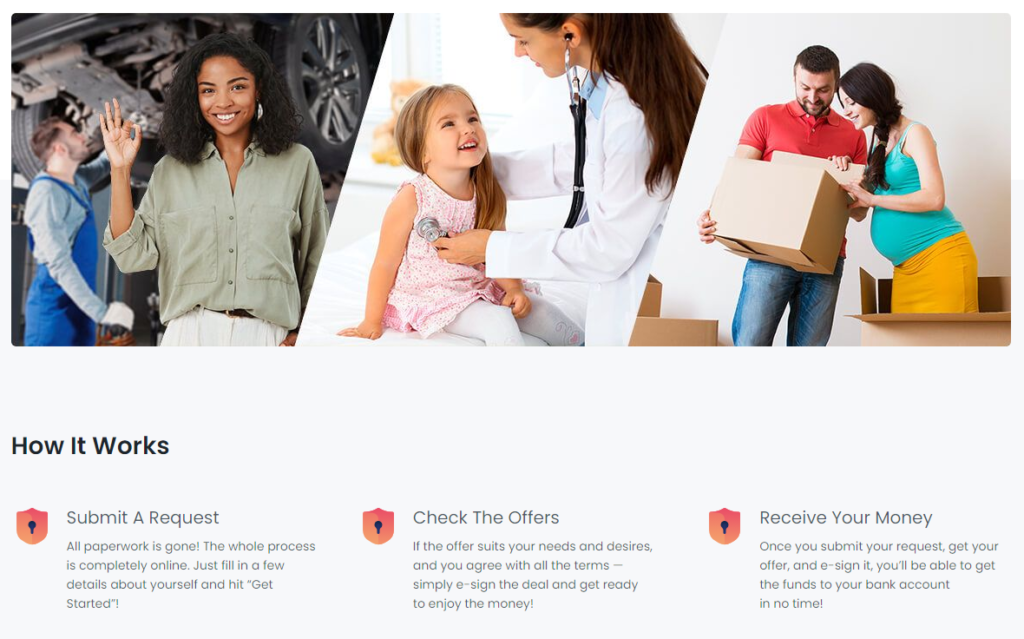

Getting your personal loan through Indylend is quick and straightforward. Complete the secure online application in just a few steps, and you could receive loan offers tailored to your financial needs.

- Begin by visiting Indylend’s website where you’ll find the application form. Make sure your device has an SSL certificate for a secure connection.

- Provide basic information such as your name, address, email address, and employment details to start your loan request.

- Decide on the amount you wish to borrow, up to $5000, taking into account your repayment capacity and financial situation.

- Fill in your checking account details; lenders will use this for both depositing funds and setting up a repayment plan if approved.

- Verify your identity by providing necessary documents like proof of income, bank statements, or identification verifying you’re a permanent resident or citizen.

- Review their privacy policy and cookie preferences to understand how Indylend protects and uses your data during the online experience.

- Accept or adjust functional cookies settings to ensure the website performance matches your user experience expectations.

- Submit the application after thoroughly checking all entered information for accuracy. This helps avoid any delays in processing.

- Wait for feedback; many users report receiving personalized loan options shortly after applying due to Indylend’s fast process.

- If an offer meets your needs, go over the terms carefully—consider interest rates, loan duration, and any potential fees involved.

- Sign off on the agreement electronically if everything looks good. This means signing with e – signature tools which are typically part of Indylend’s streamlined online process.

- Monitor your email inbox for confirmation messages from Indylend or any further instructions regarding your loan terms or additional verification.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Benefits of Using Indylend

3. Benefits of Using Indylend: Discover how Indylend revolutionizes your access to personal loans, making the journey from application to approval both seamless and swift—read on for a deep dive into the perks that set it apart in the lending landscape.

Fast process

You need a personal loan fast, and Indylend delivers exactly that. Their application process stands out because you can complete it in less than 10 minutes. Time is precious, especially for busy individuals and small businesses juggling multiple tasks while seeking funding options.

With Indylend, the wait time that usually accompanies loan applications is cut down significantly. You’ll be impressed by the swift response as their automated system quickly assesses your information to connect you with potential lenders.

This efficiency means you won’t be left hanging, wondering about your financial future; instead, you get to take action almost immediately after submitting your application.

Convenient online application

Applying for a loan with Indylend couldn’t be more hassle-free, thanks to their streamlined online application. Imagine filling out all your details from the comfort of your home or office and having it done in under 10 minutes.

No piles of paperwork, no waiting in lines – just a simple digital process that respects your time.

Your information is secure at every step, giving you peace of mind as you apply for up to $5000 in funding. With encryption technology safeguarding your data, you can focus on what matters: getting the funds you need quickly and efficiently.

Forget about traditional lending hurdles; Indylend’s online convenience puts personal loans within easy reach with just a few clicks.

Personalized loan options

After experiencing the ease of a convenient online application with Indylend, you’ll find their personalized loan options truly stand out. These tailor-made solutions take into account your unique financial situation to provide you with loans that suit your specific needs.

Whether you’re an individual facing unexpected expenses or a small business planning to expand, Indylend’s approach ensures that everyone gets access to funds that align with their objectives and repayment ability.

You’ll appreciate how Indylend matches you with offers based on your information. There’s no one-size-fits-all here; instead, loan terms and interest rates ranging from 4.99% to 450% are determined by factors such as credit history and income level.

This customization is key in setting up a successful borrowing experience because it means payments are more manageable for your budget, helping avoid any unwelcome financial strain down the road.

Customer Reviews and Complaints

Discover what others are saying about their experiences with Indylend by delving into the myriad of customer reviews and reported complaints; these insights can help you gauge the credibility of this service and inform your decision-making process.

Trustpilot ratings

When evaluating the trustworthiness and efficiency of a personal loan provider like Indylend, customer feedback on platforms such as Trustpilot can offer invaluable insights. Indylend has garnered a Trustpilot rating that reflects its commitment to customer satisfaction and the ease of its loan process. You deserve a straightforward understanding of what current users think about their services. Here’s a concise summary represented in an HTML table format:

| Trustpilot Rating | Number of Reviews | Positive Highlights | Areas for Improvement |

|---|---|---|---|

| 4.3 out of 5 stars | Varies (as of last update) |

|

|

This table captures the essence of Indylend’s performance through the lens of actual users. Ratings reflect satisfaction, while reviews illuminate both the strengths and areas where Indylend can enhance their offerings. Trust your instincts and use this data as a guide in your decision-making process for personal loans.

Consumer reviews and experiences

People seeking loans are talking about Indylend, and their voices echo throughout online forums and review platforms. Customers frequently highlight the speed and efficiency of Indylend’s application process, noting how quick it is to receive loan approval.

They appreciate completing applications within minutes instead of hours and emphasize the lack of hidden charges as a significant plus.

Reviews often mention customer service experiences, with many borrowers expressing satisfaction regarding the clarity of information provided by Indylend representatives. This transparency helps you understand exactly what you’re signing up for without any unwelcome surprises in the fine print.

As we turn our attention to dealing with complaints and resolutions, let’s examine how effectively Indylend addresses issues raised by users.

Complaints and resolution

Indylend’s user experiences aren’t all perfect, and some customers do run into issues. However, the company actively works to resolve any complaints that surface.

- The Better Business Bureau (BBB) profile for Indylend helps track customer satisfaction and address grievances.

- Customer reviews on third – party sites provide real insights into how Indylend handles problems.

- Resolution steps often include direct communication between the customer and Indylend’s service representatives.

- Some customers have reported quick resolution times after complaining directly with Indylend.

- Complaints related to additional charges due to non – payment are taken seriously, as they can impact a borrower’s credit score.

- Indylend often advises consulting financial specialists if the loan does not seem to alleviate major budget difficulties.

- Regular audits of feedback mechanisms ensure that false allegations or fake reviews do not mislead potential clients.

- Indylend collaborates with advertising partners to avoid targeted advertising that may lead to misunderstandings about products and services offered.

Conclusion: Is Indylend a Reliable Option for Personal Loans?

You’ve just explored how Indylend can turbocharge your journey to financial flexibility, with loan options crafted for a variety of credit scores. Imagine the relief of securing up to $5000 without hidden charges or delays.

Have you evaluated how such a speedy loan could transform your financial situation? Remember, it’s all about finding an option tailored to your needs while managing responsibilities wisely.

Let this be the nudge you need: Empower yourself by making informed and strategic financial choices today!

FAQs

1. Is Indylend a BBB accredited service for personal loans?

No, Indylend has not earned BBB accreditation, which means it does not meets the standards for trust and customer service set by the Better Business Bureau.

2. Can I apply for an Indylend loan without worrying about scams?

Indylend takes security seriously with SSL certificates to protect your data, but always stay vigilant against phishing or other online scams by verifying information on their official website.

3. What is the maximum loan amount I can request from Indylend?

You can request a personal loan of up to $5000 through Indylend’s quick and straightforward application process.

4. What payment methods does Indylend accept for repaying my loan?

Indylend allows various repayment options like bank transfer, debit card, wire transfer, and even e-mail reminders so you won’t miss a payment.

5. How fast can I get approved for an Indylend personal loan?

With lightning-speed approval processes at Indylend, you could get your loan in no time; however, remember that actual times may vary based on several factors.

6. Do I need to log in somewhere to check my application status on Indylend?

For updates on your loan application with Indylend, simply log into their secure portal using your unique credentials.