Personal Charge Cards: No Credit Check Needed For These Top 5 Picks

I know how frustrating it can be to get denied for a credit card due to bad credit or a lack of credit history.

But don’t lose hope just yet – there are personal charge cards available that don’t require a credit check.

In this article, I’ll be sharing the top five picks for personal charge cards that you can get approved for without a credit check.

Using a personal charge card can be a great way to build your credit history and make purchases without having to pay interest.

Plus, with no credit check required, you can have the freedom to apply for a card without worrying about your credit score.

So let’s dive into the benefits of using a personal charge card and explore the top picks that can help you achieve financial freedom.

Key Takeaways

- No credit check is required for these five personal credit charge cards, but they may do a soft pull or use a third-party bureau to check your credit history.

- Having an active checking account is a requirement for most of these credit cards.

- Debt to income ratio and current collections or charge-offs on your credit report may affect your chances of getting approved.

- Different credit cards have different requirements, such as no need for a Social Security number or looking at other factors like profession and bank account management.

How Personal Charge Cards Work

So, you’re interested in getting a personal charge card but not sure how they work? Let’s break it down for you.

Personal charge cards are similar to credit cards but with a few key differences.

First and foremost, they often come with preset spending limits, meaning you can only spend up to a certain amount on the card.

This can be helpful for those who struggle with overspending or want to keep a tight budget. Additionally, personal charge cards may offer reward points for spending, similar to credit cards.

One major benefit of personal charge cards is that they often come with no credit check required.

This can be a huge relief for those who have bad credit or no credit history at all. However, it’s important to note that some personal charge cards may still require an active checking account and have certain debt-to-income ratio requirements in order to be approved.

Additionally, while some personal charge cards may not have annual fees, others may come with high fees that can eat into your rewards points or spending limit.

When using a personal charge card, it’s important to keep an eye on your credit utilization. Just like with credit cards, you don’t want to max out your spending limit or carry a high balance, as this can negatively impact your credit score.

Instead, try to keep your spending to a reasonable amount and pay off your balance in full each month. This can help you build your credit history and improve your credit score over time.

Personal charge cards can be a great option for those looking to build their credit or stick to a budget. With no credit check required, they can be a good choice for those with bad credit or no credit history.

However, it’s important to understand the spending limits, rewards points, and fees associated with each card before applying.

Now, let’s take a look at some of the benefits of using charge cards.

Benefits of Using Charge Cards

You’re going to love how using these personal charge cards feels like flying on a cloud made of money. And the best part?

No credit checks are needed for these top 5 picks. That means you can enjoy all the benefits of having a charge card without worrying about your credit score.

One of the biggest benefits of using a personal charge card is the spending limit.

Unlike traditional credit cards, charge cards don’t have a set spending limit.

This means you can make bigger purchases without worrying about hitting your limit. Plus, most charge cards offer generous rewards rates, so you can earn points or cash back on your purchases.

Another perk of using personal charge cards is the lack of annual fees. Many credit cards come with annual fees, which can add up over time.

But with charge cards, you don’t have to worry about paying an annual fee. Plus, some charge cards offer membership rewards programs, such as the Platinum Card from American Express or the Gold Card from Capital One.

These programs offer exclusive benefits and perks to cardholders, such as access to airport lounges or concierge services.

Overall, using a personal charge card can be a great way to manage your finances and earn rewards without worrying about your credit score.

And with these top picks, you can enjoy all the benefits of a charge card without the hassle of a credit check or annual fees.

So why not give it a try and see how it can benefit your financial situation?

Now, let’s take a closer look at the Tomo Credit Card, one of the top picks for personal charge cards with no credit check required.

Tomo Credit Card

Let’s dive into the Tomo Credit Card, a fantastic option for those looking to build credit without the hassle of a credit check or annual fees.

With no credit history required for application, no foreign transaction fees, and 1% cash back on all purchases, Tomo is a great choice for those looking to earn rewards while managing their spending.

Additionally, there are no late fees or penalty APR, and credit limits range from $100 to $10,000. One unique feature of the Tomo Credit Card is the seven-day payment window after the statement is issued.

This allows cardholders to make payments and manage their finances on their own schedule, without the pressure of a strict due date.

Tomo also reports to all three major credit bureaus, allowing individuals to build their credit history and improve their credit scores over time.

It’s important to note that while Tomo doesn’t charge annual fees or foreign transaction fees, there is still interest charged on balances carried over month to month.

Therefore, it’s essential for cardholders to use their credit card responsibly and pay their balances in full each month to avoid accruing interest charges.

With these considerations in mind, the Tomo Credit Card is an excellent option for those looking to build credit without the burden of extra fees or a credit check.

Moving onto the next option, let’s explore the Deserve EDU Mastercard.

Deserve EDU Mastercard

If you’re a student looking for a credit card that doesn’t require a Social Security number or a credit check, the Deserve EDU Mastercard might be the perfect choice for you.

Not only does it offer 1% cash back on all purchases, but it also provides perks like cell phone insurance.

And with no annual fee or foreign transaction fees, it’s a great option for students who want to start building credit without incurring unnecessary costs.

To emphasize the benefits of the Deserve EDU Mastercard, here is a 3-column and 5-row table:

| Benefit | Description |

|---|---|

| No annual fee | No need to worry about incurring additional costs |

| 1% cash back | Earn rewards for every purchase you make |

| Cell phone insurance | Protect your phone from damage or theft |

| No foreign transaction fees | Use your card abroad without worrying about extra fees |

| Reports to all 3 credit bureaus | Build your credit by making on-time payments |

One unique aspect of the Deserve EDU Mastercard is that it targets students specifically. This means that the card is designed to help students manage their finances and build their credit history.

Whether you’re paying for tuition, textbooks, or other school-related expenses, this card can help you earn rewards while also improving your credit score.

In addition to its benefits for students, the Deserve EDU Mastercard can also be a useful tool for business owners who are just starting out.

By using the card to make purchases and pay bills related to your business, you can build credit for your company while also earning rewards.

And with features like travel insurance and no foreign transaction fees, it’s a great card to have on hand when you’re traveling for work.

If you’re looking for a personal charge card with no credit check and no annual fee, the Deserve EDU Mastercard is definitely worth considering.

With its rewards program and student-friendly features, it’s a great option for anyone who wants to start building credit. Next, let’s take a look at the Surge Mastercard.

Surge Mastercard

Looking to build your credit but worried about bad credit or a high debt to income ratio?

The Surge Mastercard may be a good option for you, as they target individuals seeking to build credit and only do a soft pull on your credit.

Here are four things you need to know about the Surge Mastercard:

- Annual fees: The annual fee ranges from $75 to $125 for the first year, and $99 to $125 thereafter. While this may seem steep, it’s important to note that building credit often requires some investment in the beginning.

- Credit limit: Your initial credit limit will range from $300 to $1,000. This is lower than some other credit cards, but it can be helpful in preventing you from overspending and getting into further debt.

- Purchase APR: The purchase APR for the Surge Mastercard is 29.99%, which is higher than some other credit cards. However, it’s important to pay off your balance in full each month to avoid accruing interest.

- Late fees: Late fees for the Surge Mastercard can be up to $41, which can add up quickly if you’re not making payments on time. It’s important to stay on top of your payments and set up automatic payments if possible.

Now that you know more about the Surge Mastercard, let’s move on to the next personal charge card on our list: the Jasper Mastercard.

Jasper Mastercard

You can easily soar to new heights of financial success with the Jasper Mastercard, as it’s specifically designed to cater to professionals who are new to the US and lack credit history.

This personal charge card is perfect for those who are looking to build their credit score while enjoying the benefits of a credit card.

With no annual fee and at least 1% cash back on every eligible purchase, the Jasper Mastercard is a top pick for those who want to keep more money in their pockets.

Unlike other credit cards, the Jasper Mastercard does not require a Social Security number for the application. Instead, it looks at what type of profession you’re in and how you manage your bank account.

This makes it ideal for those who are just starting out in their careers or who are self-employed.

With an APR range of 15.49% to 24.99% and no foreign transaction fees, the Jasper Mastercard is a great financial tool for those who want to stay on top of their business expenses.

The Jasper Mastercard requires a traditional hard credit inquiry for application, but it does not look at your personal credit score.

Instead, it takes into account your debt-to-income ratio, making it an excellent choice for those who may have bad credit but are still looking to build their credit score.

With an active bank account and a low debt-to-income ratio, you can easily qualify for the Jasper Mastercard and start enjoying the benefits of a credit card. The Jasper Mastercard is a top pick for personal charge cards that require no credit check.

With its focus on professionals who are new to the US and lack a credit history, this credit card is an excellent tool for building your credit score and keeping more money in your pocket.

However, if the Jasper Mastercard is not the right fit for you, consider the First Premier Bank Gold Credit Card for individuals with poor credit.

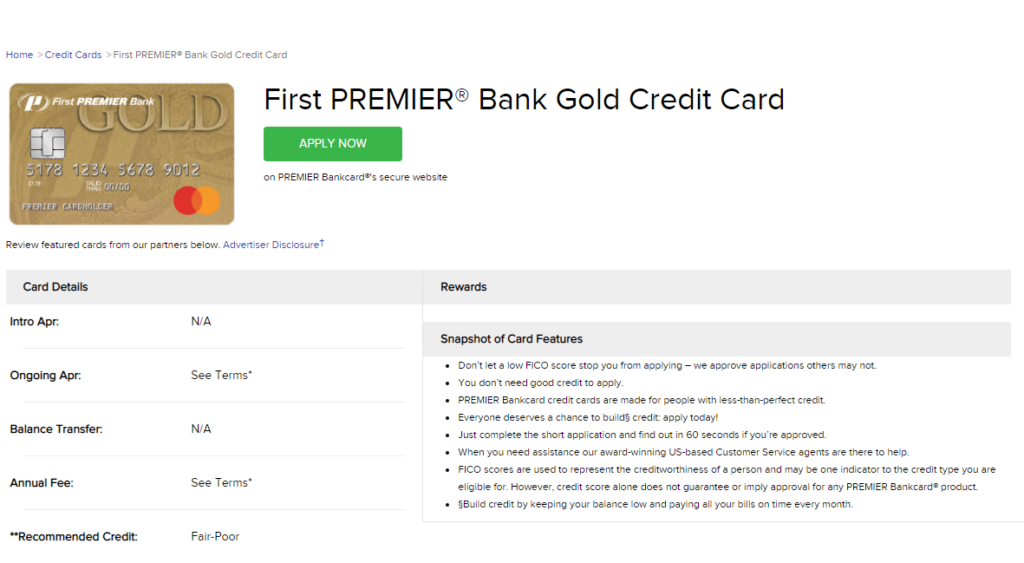

First PREMIER Bank Gold Credit Card

The First PREMIER Bank Gold Credit Card is a financial tool that targets individuals with poor credit, offering a way to build credit while enjoying the benefits of a credit card.

Here are some important details to consider before applying for this card:

- The initial credit limit is $300, which can increase over time with responsible use.

- There is a one-time processing fee of $95 and an annual fee of $75 for the first year. After that, the annual fee drops to $45 with a monthly fee of $6.

- The APR ranges from 17.99% to 24.99%, depending on creditworthiness.

While the card does not offer rewards, it does report to the major credit bureaus and can help individuals establish or rebuild their credit.

It’s important to note that the First PREMIER Bank Gold Credit Card does come with some fees, including a balance transfer fee and a cash advance fee.

However, these fees are fairly standard for credit cards targeting individuals with poor credit.

Overall, the First PREMIER Bank Gold Credit Card can be a good option for those looking to build or rebuild their credit.

While the fees may seem high, they are comparable to other credit cards in this category.

As with any credit card, it’s important to use it responsibly by making payments on time and keeping balances low.

In comparison to the other personal charge cards on the list, the First PREMIER Bank Gold Credit Card offers a higher initial credit limit and reports to all major credit bureaus.

However, it does come with higher fees than some of the other options. It’s important to weigh the benefits and drawbacks of each card before making a decision.

Comparison of Top 5 Picks

Alright folks, let’s compare the top 5 picks for personal charge cards that don’t require a credit check and see which one might be the best fit for you.

First up is the Tomo Credit Card. This card offers 1% cash back on all purchases, has no annual or foreign transaction fees, and provides a 7-day payment window after the statement is issued.

With credit limits ranging from $100 to $10,000, the Tomo Credit Card reports to all three major credit bureaus, making it a great option for those looking to build credit.

Next is the Deserve EDU Mastercard, primarily targeted at students. This card offers 1% cash back on all purchases, perks like cell phone insurance, and does not charge an annual or foreign transaction fee.

While it requires a Social Security number for the application, it does not offer a path to a higher-tier card. With these features in mind, the Deserve EDU Mastercard could be a valuable tool for students looking to build credit.

Moving on to the Surge Mastercard, this card targets individuals seeking to build credit.

While it has an annual fee ranging from $75 to $125 for the first year and $99 to $125 thereafter, it offers an initial credit limit of $300 to $1,000 and reports to all three major credit bureaus.

The Surge Mastercard does have a high purchase APR of 29.99% and a late fee of up to $41, so it’s important to make payments on time to avoid these charges.

Lastly, the Jasper Mastercard is an option for working professionals new to the U.S. and lacking a credit history.

This card offers at least 1% cash back on every eligible purchase, has an APR ranging from 15.49% to 24.99%, and doesn’t charge a foreign transaction fee.

While it requires a Social Security number and a traditional hard credit inquiry for application, it doesn’t charge an annual fee.

Overall, these top picks for personal charge cards offer a variety of features and rates that cater to different needs and financial situations.

It’s important to consider factors such as annual fees, credit limits, and payment terms before choosing a card that fits your specific needs.

By doing so, you can take advantage of these credit-building tools and work towards achieving financial freedom.

Frequently Asked Questions

What is the application process like for these personal charge cards?

Getting approved for these personal charge cards is easy.

All you need is an active checking account and a low debt-to-income ratio. Some cards don’t even require a Social Security number. No credit check is needed.

What are the consequences of having a high debt-to-income ratio when applying for these cards?

Having a high debt-to-income ratio can result in being denied for personal credit charge cards. Lenders want to see that you can manage your finances responsibly and not be overburdened with debt.

It’s important to keep your debt-to-income ratio below 50% to increase your chances of approval.

How do these cards report to credit bureaus and affect credit scores?

These personal credit cards report to all three major credit bureaus, which can positively impact your credit score if used responsibly.

However, late payments or high credit utilization can have a negative effect. It’s important to maintain a low debt-to-income ratio and make payments on time to see the benefits.

What kind of perks or rewards do these cards offer?

I’m excited to share that these personal credit charge cards offer perks like 1% cash back on all purchases, cell phone insurance, and no annual or foreign transaction fees.

They also range in credit limits and report to all three major credit bureaus.

Are there any fees associated with using these cards, and if so, what are they?

Yes, there are fees associated with some of these cards.

The Surge Mastercard has an annual fee ranging from $75 to $125 for the first year, and $99 to $125 thereafter, plus a monthly maintenance fee of up to $10.

The First PREMIER Bank Gold Credit Card has a one-time processing fee of $95 and an annual fee of $45, with a monthly fee of $6 after the first year.