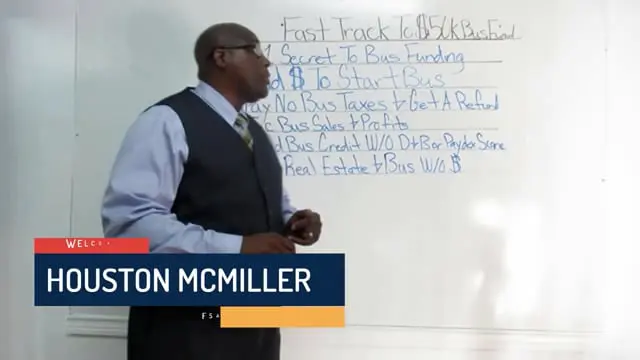

Get Your Business on Track with Houston McMiller

Through personalized consultations, Houston provides the tools and strategies you need to get your business on track.

Click To Schedule a Call with Houston!Do You Need Money To Start Or Grow Your Business, But Don't Know Where To Get It?

You're not alone. The world of business funding is tricky. It's full of red tape, and making a mistake can cost you a lot.

Houston McMiller has the answer. His Fast Track to $50,000 in Business Funding is a free video series. He shares top secrets that only 10% of small businesses know.

You'll learn how to get funds fast, avoid mistakes, and cut through the red tape.

testimonials

As usual, I followed your advice. And seeing as I was already a member and had direct deposit I applied for the Platinum card and was approved in 5 minutes for $15,000. Even though my credit score has been taking hits due to all new credit I incurred. I will sing you praises from high.

– Dewayne McCoy

Saw video this morning (Independence Day)… After watching 2-3 times and getting a good understanding of your methodology; I prequalified during third viewing of video and just applied for cash rewards (3:30 am following morning). Approved for 25k @12,99%. Thank you so much for your video!!! Not sure how or why your video came across my feed but I'm glad it did!

– Anthony Jones

You know your stuff brother… I applied for the NFCU Amex at around 12.30 and was approved early that morning… Thanks for your help!!!

– Gary Venzant

So everyone that just happened to apply got approved.

– Maria M.

Latest Blog Posts

-

10 Critical Navy Federal Mistakes I Urge You to Avoid (My Insider Guide)

Making common Navy Federal mistakes can seriously derail your financial plans and sour your relationship with one of the best credit unions out there. From my experience, ... Read More

-

Social Security Recipients Loans No Credit Check

Social security recipients loans no credit check are available for seniors and disabled individuals needing quick financial assistance. Hey, it's Houston here. Let's cut right ... Read More

-

How Can You Clean Up Your Credit in 24/48 Hours

Hey, it's Houston here. Let me cut through the noise and show you what really works with credit repair. I know you're frustrated. Everyone's telling ... Read More

-

Rentreporters Review For Bad Credit

Having bad credit can make life hard. RentReporters offers a way to help. They report your rent to credit bureaus, which might boost your score ... Read More

-

Chime Secured Credit Card For Bad Credit Review

Trying to build credit can be hard, especially with bad credit. The Chime Credit Builder For Bad Credit Review looks at a tool that might ... Read More

Resources

I've put together a Resources page just for you.

It's a one-stop place for everything you need to start and grow your business. Here you'll find programs I recommend:

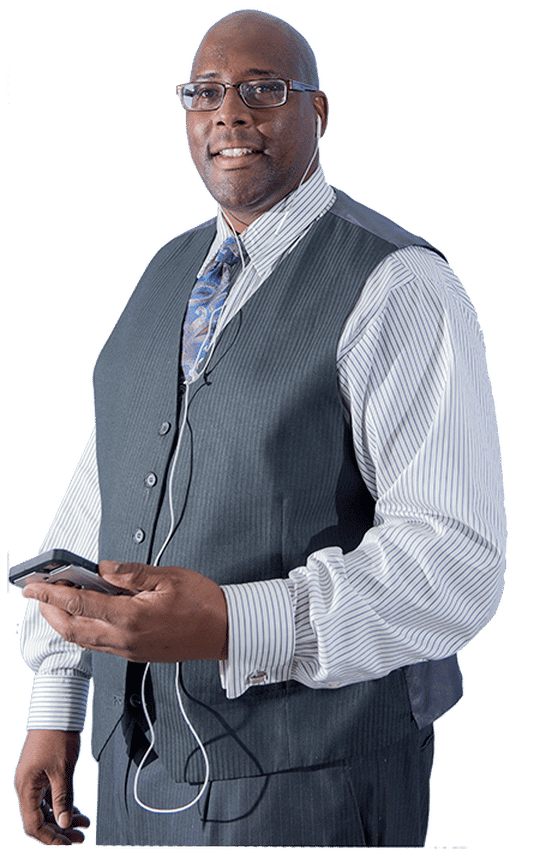

about me

I'm Houston McMiller, your dedicated Business and Credit Specialist.

I have 2 decades in this space and am renowned for having crafted personalized credit solutions for thousands of entrepreneurs, I offer unique one-on-one attention to address your specific needs.

My experience extends from aiding pro athletes and celebrities to empowering small businesses and startups across diverse industries.

I've successfully leveraged credit to foster both Fortune 500 companies and budding ventures.

Now, it's your turn.

Know More About Me!Why choose me?

Social media