Having bad credit can make life hard. RentReporters offers a way to help. They report your rent to credit bureaus, which might boost your score fast. Keep reading for more on RentReporters to build credit reviews.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

|

Reports to |

Equifax, TransUnion |

Pros |

Roommates and spouses get a $50 discount on signup fee |

Guaranteed full refund within 7 days of updated credit score |

Reports up to 24 months of rent payments |

Offers a free service called RentCheck that links with your bank account |

Cons |

Requires landlord involvement |

Doesn’t report to Experian |

Expensive signup fee |

Need your landlord’s help to verify your payment history |

Cost and fees |

$94.95 setup fee |

$9.95 per month after that (or pay an annual fee at one time, which equates to $7.95 per month) |

Key Takeaways

- RentReporters helps people with bad credit by reporting rent payments to credit bureaus. This can improve credit scores.

- There is a one-time setup fee and a monthly charge for the service. They offer a 30-day money-back guarantee if you are not satisfied.

- The service verifies rent history with landlords before reporting to Experian, TransUnion, and Equifax. This can quickly boost your credit score.

- Customers have seen improvements in their credit scores, leading to better loan approvals. Some complaints include high fees and slow responses.

- Comparing RentReporters to competitors like Boom and Self Rent Reporting shows it provides effective services for building or repairing credit through rental payment history.

What is RentReporters?

Moving on from the introduction, RentReporters is a service that can change how people with bad credit are seen by lenders. It takes rent payments and sends them to credit bureaus.

This can help people build a good credit profile by showing they pay on time. For those who sign up, there's both a one-time setup fee and a monthly charge.

The company gives users access to their rent payment history through a secure platform. Many have found this service useful for improving their credit scores over time. With RentReporters, customers get their on-time rent payments reported, making it easier for individuals with poor or no credit to prove their financial responsibility.

How RentReporters Works For Bad Credit

RentReporters helps improve bad credit by verifying rental history, reporting it to credit bureaus, and assisting individuals in building their credit scores. The sign-up process is straightforward, your rental payments are verified, and then RentReporters reports them to major credit bureaus for you.

Sign-up process

To start using RentReporters, you need to provide your personal info. This includes details about your lease and how you've paid rent in the past. You must also let RentReporters talk to your landlord.

They do this to check if you have paid your rent on time. There's a one-time setup fee and a monthly cost for using their service. RentReporters works for people renting both apartments and houses.

If you're not happy with their service, they offer a 30-day money-back guarantee.

After signing up, the next step is making sure all your rental payments get reported correctly.

Rental history verification

RentReporters liaises directly with landlords and property management to verify your rent history, ensuring the accuracy of their collected details. They assess your previous rent payments to aid in the improvement of your credit score.

Additionally, they factor in previous rent payments to your credit history, providing an opportunity for individuals to demonstrate timely bill payments, even if they weren't recorded previously.

RentReporters carries out this service for a recurring monthly fee and occasionally an initial additional charge.

Reporting to credit bureaus

Moving from rental history verification to reporting to credit bureaus, RentReporters works by sending your verified on-time rent payments to major credit bureaus, including Experian, TransUnion, and Equifax.

This process helps individuals with bad credit improve their credit profiles. Generally, the service requires a one-time setup fee and a monthly subscription fee.

RentReporters effectively validates your rent payments with landlords before reporting them to the designated credit bureaus. After incorporating this reported data into your credit file, users may likely see an increase in their credit scores.

Key Features of RentReporters

RentReporters reports past rental payments, integrates with major credit bureaus, and offers customer support services. Find out more about RentReporters by reading the full blog!

Reporting past rental payments

RentReporters allows renters to add their past rental payments to credit bureaus, potentially boosting their credit scores. This service caters specifically to individuals with bad credit and gives them the opportunity to incorporate positive rental history into their credit reports.

Rent payments are reported to major credit bureaus such as Experian and TransUnion. Users may witness an increase in their credit score after reporting rental payments, depending on their individual credit history.

Consistent and timely rent payments are emphasized as they can significantly influence credit scores over time.

Moving on to "Integration with major credit bureaus", this feature discusses how RentReporters interacts with leading names in the financial industry.

Integration with major credit bureaus

RentReporters integrates with major credit bureaus such as Experian, TransUnion, and Equifax. This integration allows for comprehensive reporting of rental payment history to these significant credit bureaus.

As a result, users can see a positive impact on their credit scores over time through the inclusion of their rental payments in credit reports. By including rental payment history in these reports, RentReporters aids individuals in establishing their credit histories and building better financial futures.

Customer support services

RentReporters provides customer support via both email and phone, catering to inquiries and issues. The support team is trained to assist users with account setup and reporting processes, emphasizing timely responses for enhanced user experience.

Moreover, the website offers a user-friendly FAQ section covering common questions related to RentReporters' services. Support staff are well-equipped to handle concerns specifically related to bad credit reporting.

User feedback plays a critical role in the continuous improvement of support services.

Moving on to "Advantages of RentReporters for Bad Credit"...

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Benefits of RentReporters for Bad Credit

RentReporters helps unscorable individuals build credit by reporting their past rental payments to major credit bureaus. Over time, it can improve credit scores and offers affordable pricing options for those looking to rebuild their credit.

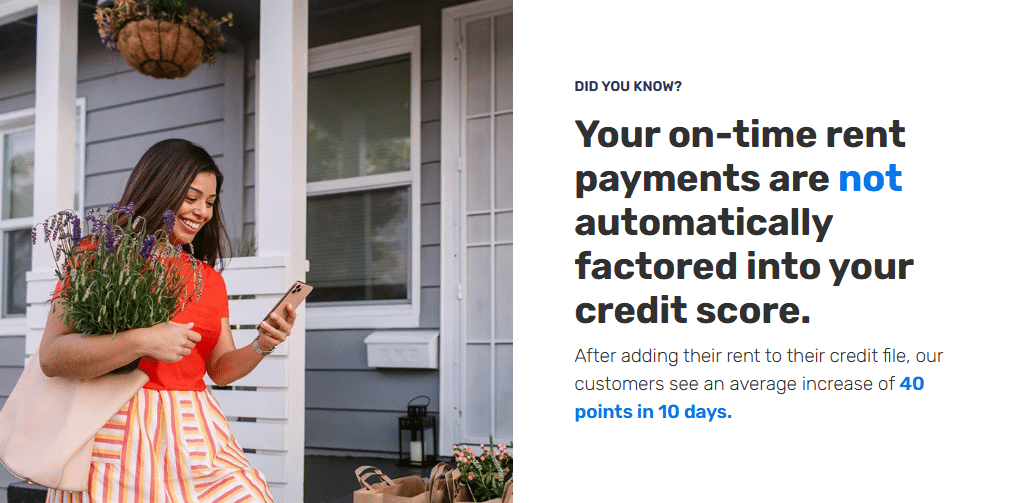

Helps build credit for unscorable individuals

RentReporters is a service that helps unscorable individuals build their credit history. By reporting rent payments to credit bureaus, RentReporters enables those without a credit score to establish a credit profile over time.

This can positively impact users' credit scores and benefit renters lacking traditional forms of credit like loans or credit cards. The process for tenants to report their rent payments is simple and can enhance their creditworthiness, potentially qualifying them for better loan rates and financial products as their credit improves.

In essence, RentReporters assists those who have struggled with establishing traditional lines of credit in building a positive payment history by reporting rent payments to the major U.S.-based Credit Bureaus, thereby influencing an incremental increase in the user's FICO® Score within just 15 days on average upon verification period completion.

Improves credit score over time

RentReporters leads to an improved credit score over time by reporting on-time rental payments to major credit bureaus. Renters with limited or no credit history can use the service to showcase their reliable payment habits, thereby building their credit scores.

This can result in better loan terms and lower interest rates, ultimately offsetting the cost of RentReporters' one-time setup fee and monthly subscription. Furthermore, a higher credit score opens up opportunities for financial stability and access to more favorable housing options.

Moving on from this, let's explore the key features of RentReporters that make it beneficial for individuals with limited credit history.

Affordable pricing options

Improving credit score over time is great, and RentReporters makes it affordable too. The service has a competitive pricing structure with low monthly fees and a reasonable one-time setup fee.

This makes it accessible for those with bad credit. Compared to other credit-building services, RentReporters offers an affordable option for renters looking to improve their credit.

RentReporters provides clear information on its pricing, enhancing consumer understanding of the service's value. With this accessible pricing structure, RentReporters stands out as an advantageous choice for individuals seeking to build or rebuild their credit history at an affordable cost.

RentReporters Pricing and Plans

RentReporters offers a standard monthly subscription plan for reporting rental payments. There's an initial setup fee for new users to start reporting, and the service is intended to help those with unfavorable credit enhance their credit scores.

For new customers, there's also a free trial period offered so they can evaluate the service before committing. Customers also have the option to report rent payments from up to two years back, with focus placed on consistent and timely rent payments to improve credit profiles.

Overall, RentReporters provides an accessible way for individuals dealing with unfavorable credit to take proactive steps toward improving their financial standing by including their rental payment history into their credit reports.

RentReporters vs. Competitors

RentReporters stands out from its competitors in providing seamless rental history verification and prompt reporting to credit bureaus. To know more about how RentReporters can help with bad credit, keep reading.

RentReporters vs. Boom

RentReporters and Boom are both services that report rental payments to credit bureaus. They aid individuals with bad credit by allowing retroactive reporting of rent payments for improved credit history.

RentReporters is especially useful for those with limited or rebuilding credit. Positive reviews have noted RentReporters' customer service and effectiveness. Both services enable landlords to sign up, facilitating credit score benefits for tenants.

RentReporters and Boom differ in features or pricing but ultimately aim to assist individuals with bad credit in building a better financial future through their rental payment reporting services.

Moving on to "RentReporters Pricing and Plans"...

RentReporters vs. Self Rent Reporting

When contrasting RentReporters with Self Rent Reporting, it's crucial to acknowledge that RentReporters reports rent payments to major credit bureaus, aiding tenants in establishing credit history.

Conversely, although Self Rent Reporting enables individuals to report payments, it might not offer the same comprehensive service as RentReporters. Moreover, RentReporters imposes a monthly fee for its services, while Self Rent Reporting may have an alternative pricing model.

Customer reviews lean towards RentReporters for significantly enhancing credit scores compared to Self Rent Reporting alternatives. Ultimately, both services can assist users with poor credit in enhancing their scores through consistent reporting.

User Reviews and Feedback

Read what users have to say about RentReporters and gain insights from direct experiences.

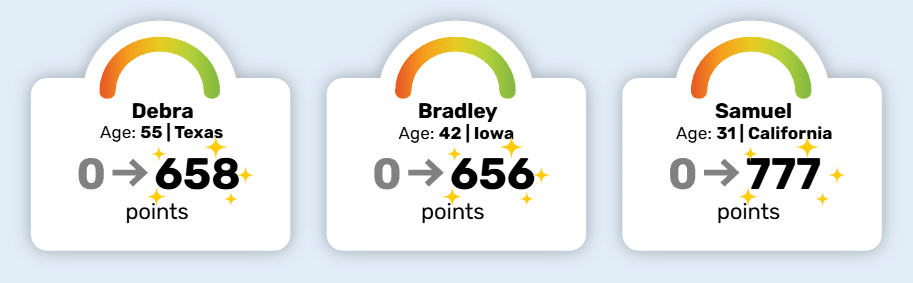

Positive testimonials

Rentreporters has garnered positive testimonials from users who have seen significant improvements in their credit scores after utilizing the service. Customers appreciate the straightforward signup process and effective communication offered by Rentreporters.

Many individuals have experienced increased loan approval rates due to having their rental history reported, proving beneficial for those with bad credit or limited credit history.

Furthermore, Rentreporters receives positive feedback for its customer support and responsiveness, reinforcing its value for individuals seeking to improve their credit standing.

Common complaints

RentReporters has been associated with high fees, dissatisfactory customer service, and slow response times. Users have expressed frustration over limited improvement in credit scores from the reporting services provided by RentReporters.

They have also reported unclear billing practices causing confusion, including dissatisfaction with feedback reports due to limited information and difficult navigation on a non-user-friendly website interface.

Is RentReporters Worth It for Bad Credit?

RentReporters can be a valuable tool for individuals with bad credit looking to build their credit score. By reporting rent payments to major credit bureaus, RentReporters may help improve credit scores over time.

However, some users might find the monthly fee concerning if they have limited budgets. It's important to note that RentReporters offers a 30-day money-back guarantee, allowing users to try the service risk-free.

Overall, it could be worth considering for those seeking to establish or enhance their credit score through positive rental payment history.

Conclusion

Ready to improve your credit score? Rentreporters might just be the solution for you. With its simple sign-up process and affordable pricing, it's a valuable option. Plus, their Money-Back Guarantee adds an extra layer of trust.

Take control of your credit score with Rentreporters today!

FAQs

1. How can I use the RentReporters login?

You can use the RentReporters login to access your account, view your credit status, and get customer service help.

2. What is the phone number for RentReporters?

The phone number for RentReporters can be found on their website or through a quick internet search.

3. Can you explain how does Rent Reporters work?

Rent Reporters works by reporting your paid rent to credit bureaus. This helps improve bad credit scores over time.

4. Is there any feedback about RentReporters on Reddit?

Yes, you can find various reviews and user experiences about RentReporters on Reddit.