Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

How Does Self Lender Credit Builder Loan Work To Help You (Boost Your Credit Score Fast) Review📞 Ready to get answers? - Schedule your call - https://houstonmcmiller.net/phone-consultation/ How Does Self Lender Credit Builder Loan Work To Help You (Boost Your Credit Score Fast) Review

Posted by Real Houston Mcmiller on Thursday, November 21, 2024

Building a solid credit history from scratch or repairing a damaged score can often feel like an uphill battle. The challenge is real, especially when you're confronted with the catch-22 of credit: it’s difficult to get approved for new credit without good credit history, yet you need active accounts to build that very history.

Having navigated the complex world of personal finance for years, I’ve seen firsthand how innovative tools like you will see in this Self Credit Builder review can empower individuals and small businesses by providing accessible pathways to better credit.

You might be intrigued by over 1 million people who have partnered with Self Financial on their journey toward financial wellness—and for good reason. This blog dives into the Self Credit Builder's nitty-gritty, peppering in user experiences and impartial comparisons to give you an all-encompassing view of its potential impact on your financial goals.

And if that's not enough to pique your curiosity—consider this: building your credit could unlock doors to opportunities previously beyond reach. Let’s discover how.

Self Credit Builder Review Key Takeaways

- Self Credit Builder is a program by Self Financial aimed at helping individuals build or rebuild their credit with products like credit builder loans, secured credit cards, and rent and utility reporting.

- To assist users in building credit, the program requires no initial credit check or hard pull on your report but includes fees such as a one-time $9 fee for the loan account and an annual fee of $25 for the secured card.

- Customers have access to a Visa secured card after satisfying specific criteria within the program. Positive payment history can lead to an improved credit profile over time.

- While many users successfully raise their scores using these services, some encounter issues with delayed payouts and unexpected account closures that negatively impact scores.

- Comparing Self to other programs like CreditStrong and Fizz reveals differences in product offerings, customer bases, additional features provided, costs involved, and ratings from external bodies like the Better Business Bureau.

What is Self Financial?

Formerly known as Self Lender, Self Financial is a financial company that offers credit builder programs to help individuals build or rebuild their credit. These programs include credit builder loans, secured credit cards, and rent and utilities reporting.

Formerly known as Self Lender

Under its previous name, Self Lender, the company made a mark by pioneering accessible credit-building tools for individuals and small businesses. Now operating as Self Financial, this change marks a step forward in their commitment to helping you grow your financial profile.

Their suite of products, including the popular Self Credit Builder Loan and the Self Visa® Credit Card, are designed with your credit goals in mind—no matter where you're starting from.

Joining over a million others who've boosted their credit scores through self-discipline and strategic financial behavior is now easier than ever with Self Financial. Without requiring an initial credit score or performing a hard pull on your report, they make it possible to start building or repairing your credit immediately.

The Secured Visa Credit Card starts with an attainable $100 minimum security deposit which could be increased up to $3,000 depending on your needs and circumstances.

Offers credit builder programs

Self Financial takes building credit seriously and provides tools to help you improve your score. Their Credit Builder Account acts like a savings plan with a twist: as you deposit money, Self reports these payments to the three major credit bureaus—TransUnion, Equifax, and Experian.

Each timely payment contributes positively to your credit history, which can be vital for individuals or small businesses looking to grow their financial opportunities.

The company also offers a Visa secured card that helps raise your credit limit as you manage it responsibly. This Secured Card requires an annual fee of $25 and charges an APR of around 28.24%, but if used wisely, it's another resource in your toolkit for strengthening your credit profile over time.

With flexible options such as rent and utilities reporting through LevelCredit, Self caters to those aiming for long-term financial health without overlooking day-to-day expenditures that could work in favor of your growing credit report.

Moving into how these programs operate; let's dive deeper into "How Does Self Financial Work?"

How Does Self Financial Work?

Self Financial offers credit builder programs through credit builder loans, secured credit cards, and reporting of rent and utilities. These options are designed to help individuals build or improve their credit scores.

Credit builder loans

Credit builder loans unlock the door to establishing or repairing your credit score. Essentially, these loans work by holding the amount you borrow in a bank account while you make payments.

You're not just paying off the loan; you're building credit as lenders report your payment history to the credit bureaus. After you've paid off the loan, you get access to the funds.

It's like creating a savings plan that spruces up your credit profile.

Imagine making monthly contributions to your future financial wellbeing that simultaneously improve your approval odds for personal loans, mortgages, and auto insurance. Self offers this kind of program—your timely payments demonstrate responsibility to future creditors without having upfront cash or an existing strong credit history.

With disciplined budgeting and on-time payments through such programs, achieving solid financial foundations becomes straightforward for individuals and small businesses alike.

Secured credit card

The Self Financial program offers a secured credit card to help you build your credit. With a starting limit of $100 to $3,000, the Self Visa® Credit Card requires a security deposit.

You have the option to increase your credit limit by adding more funds to your Credit Builder Account or incorporating an unsecured portion to it.

If you need to replace your Self Visa® Credit Card, you can do so through your online account or by calling customer service at (877) 883-0999. There is no fee for this replacement service.

Rent and utilities reporting

Reporting your rent and utilities payments through the Self Financial program can help you build a positive credit history. It's available at no additional charge, and you also have the option to add utilities for a small monthly fee of $6.95.

By including rent and utilities in your credit-building options alongside the Credit Builder Loan and secured Visa® Credit Card, Self Financial provides flexibility and an opportunity to establish a positive payment history.

This feature is available nationwide across all 50 states, making it accessible for individuals looking to improve their credit.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Evaluating Self Credit Builder Programs: Pros and Cons

As individuals and small businesses strive to build and maintain strong credit, understanding the advantages and disadvantages of any credit-building option becomes crucial. Self Financial provides an array of services intended to enhance credit profiles, but like any financial tool, it presents its unique set of benefits and challenges. Here's a detailed analysis of the pros and cons associated with Self Credit Builder programs, using an HTML table for clear and concise comparison.

| Pros of Self Credit Builder | Cons of Self Credit Builder |

|---|---|

| Builds credit history quickly | Charges fees and may include penalties |

| A secured credit card requires a deposit, which may not be feasible for all | Limits on loan amounts could be restrictive for some users |

| Eligible for a secured credit card after certain criteria are met | Secured credit card requires a deposit, which may not be feasible for all |

| Rent and utilities reporting can boost credit score | Utilities reporting adds a monthly fee of $6.95 |

| Secured credit card offers an initial limit of $100 to $3,000 | Customer service concerns and high fees reported by users |

| No hard credit pull, keeping your score intact | Received a B rating from the Better Business Bureau |

| Monthly expenses contribute to credit building with LevelCredit | Trustpilot rating of 1.5 stars from 90 reviews reflects customer dissatisfaction |

The table above synthesizes the key points to ponder when evaluating Self Credit Builder Programs. Weighing these pros and cons can guide you in making an informed decision that aligns with your financial goals and circumstances. Remember, while positive aspects can quicken the journey to better credit, potential costs and limitations warrant careful consideration.

Pros:

Self Credit Builder programs have a track record of helping individuals quickly build their credit without requiring a credit check. Additionally, users can access secured credit cards through the program.

This is valuable for individuals and small businesses seeking to strengthen their financial standing.

The program's fast credit-building capabilities and accessibility make it an ideal choice for those looking to enhance their financial profile efficiently. It's particularly beneficial for individuals and small business owners aiming to establish or improve their credit scores in order to secure funding for various purposes.

Builds credit quickly

Build credit quickly with Self Credit Builder programs, allowing you to establish a positive credit history promptly. By making on-time payments on the credit builder loan, you can demonstrate responsible financial behavior to potential lenders.

As your payment history is reported to major credit bureaus, you can see an improvement in your credit score over time.

Moreover, utilizing the secured credit card provided by Self Financial allows for additional opportunities to boost your credit rating efficiently. With these options at your disposal, achieving a better financial standing becomes attainable in a shorter timeframe than traditional methods.

No credit check required

Building credit quickly is advantageous, but the process often involves a credit check, which can be a barrier for individuals with poor or no credit history. Self Financial eliminates this hurdle by offering their credit builder programs without requiring a credit check.

This accessibility makes it easier for individuals and small businesses to start on the path to building or rebuilding their credit without the obstacle of a traditional credit inquiry.

Additionally, by not performing a hard pull on your credit, Self ensures that you can proactively work towards better financial stability without facing potential setbacks due to inquiries negatively impacting your current standing.

Can receive a secured credit card

To qualify for a secured credit card through Self Financial, you need to make at least three on-time payments and deposit a minimum of $100 into your credit-builder account. Once you meet these eligibility criteria, Self Financial provides you with a Visa secured credit card, offering an opportunity to demonstrate responsible use of credit while building or rebuilding your credit score.

By making timely payments and managing your secured card responsibly, you can establish a positive payment history and improve your overall credit profile. This can be particularly beneficial for individuals and small businesses seeking to expand their access to financial resources in the future.

Cons:

Fees and penalties can be a drawback for some users of the Self Credit Builder program. In addition, the limited loan amount may not meet the needs of those seeking substantial credit building opportunities.

Fees and penalties

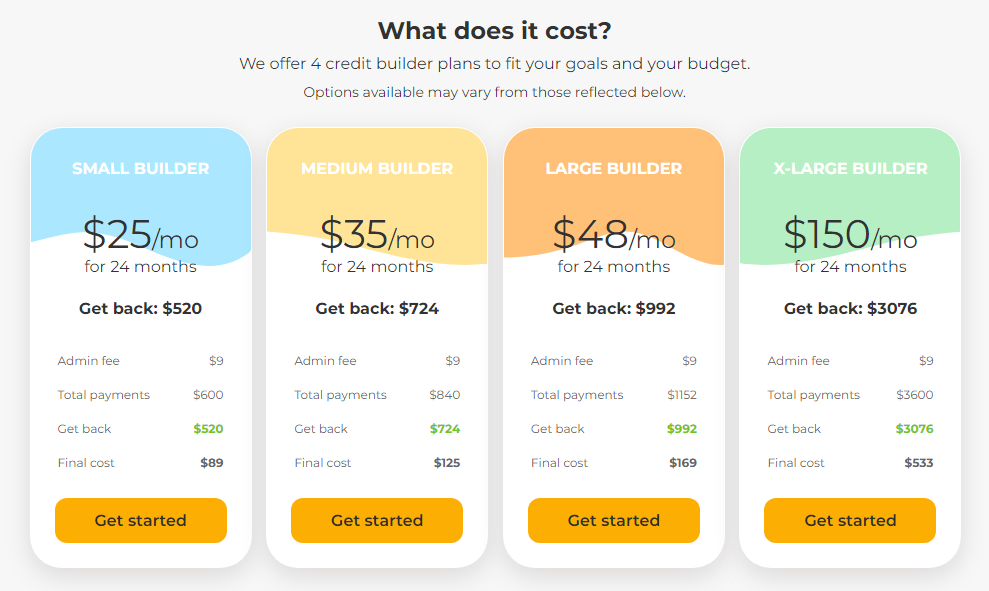

Self Credit Builder programs come with certain fees and penalties that you should be aware of. For instance, there is a one-time, non-refundable $9 administrative fee to activate the credit builder loan account.

Additionally, the Self Visa® Credit Card requires a security deposit, although there is no charge for requesting a replacement card.

It's important to consider these fees and penalties when evaluating whether the Self Credit Builder program is suitable for your credit-building needs. Taking into account these costs will help you make an informed decision about whether the benefits outweigh the potential expenses.

Limited loan amount

The Self Credit Builder program offers a limited loan amount, with starting credit limits for the Self Visa® Credit Card ranging from $100 to $3,000. This may be a drawback for individuals and small businesses looking for higher credit-building opportunities.

However, despite this limitation, utilizing the credit builder loan alongside other credit-building options such as secured cards and rent reporting can still be beneficial in improving your credit score over time.

While the initial loan amount may be restrictive, it is important to consider that gradually building a positive payment history through responsible use of the available credit can lead to increased borrowing capacity in the future.

Real User Experiences and Reviews

What are the real user experiences and reviews of Self Credit Builder programs? Let's take a closer look at what people have to say about their experiences with Self Financial.

Positive highlights

Self Credit Builder has garnered rave reviews for its efficient credit-building solutions, with over 1 million users benefiting from the service. A key positive highlight is the speed at which Self can significantly elevate credit scores.

Moreover, the absence of a mandatory credit check and hard inquiry makes it accessible to those with limited or poor credit histories. Positive customer experiences also emphasize the ease and convenience of using the Self app, as evidenced by high ratings on both Apple's App Store and Google Play.

Furthermore, Self's flexible payment options for their Credit Builder Loan allow users to manage their finances effectively while reporting progress to all three major credit bureaus.

Negative highlights

While there are positive aspects to consider, it's equally important to address the negative highlights of Self Financial's credit builder programs. Numerous customers have reported delayed payouts and account closures without adequate explanations.

Moreover, some users experienced a significant decrease in their credit scores after engaging with Self Financial, with one instance citing a 49-point drop. This has led many individuals to question the legitimacy of the services provided by Self Financial, especially as some have labeled it as a potential scam.

It's essential for individuals and small businesses seeking credit solutions to carefully weigh these negative experiences when considering whether Self Financial is the right fit for their needs.

Use case scenarios

With Self Credit Builder, customers have reported an increase in their credit score showing diverse use case scenarios. Some users have faced issues with withdrawals and account closures, affecting their financial planning.

Additionally, Self Financial's option to increase the security deposit for a higher credit limit provides varied use case scenarios for customers needing funding options.

Self Financial allows individuals and small businesses in need of credit to improve their financial standing through tailored solutions. Embracing the flexibility provided by Self Credit Builder can bring about transformative changes in your financial journey while addressing specific needs and goals.

How Does Self Compare to Other Credit Builder Programs?

How does Self's credit builder program stack up against other options in the market? We'll compare it to CreditStrong and Fizz to give you a better understanding of what Self has to offer compared to its competitors.

Comparison to CreditStrong

Self and CreditStrong both offer credit-building programs, but they have different focuses. Self offers a broader range of products for credit building, including credit builder loans, secured credit cards, and rent and utilities reporting.

On the other hand, CreditStrong primarily focuses on credit-building through their credit builder account. Both companies do not require a credit score and do not perform hard pulls on your credit.

However, Self reports over 1 million customers while CreditStrong's customer base information is not available.

In terms of additional features, Self provides a Visa secured credit card to facilitate building credit - similar to CreditStrong’s options for building positive credit history. It's also worth noting that Self received a B rating from the Better Business Bureau while there is no BBB rating provided for CreditStrong.

Comparison to Fizz

When comparing Self Credit Builder to Fizz, it's essential to consider the cost and benefits of credit building. Self Credit Builder offers credit builder loans, a secured credit card, and rent and utilities reporting as part of its program.

On the other hand, Fizz may have different features or costs associated with their credit-building options. It's important to weigh these factors carefully to determine which platform aligns best with your financial goals and needs.

Understanding how each platform operates and what they offer can help you make an informed decision about which one is most suitable for your specific situation. By comparing the details of both Self Credit Builder and Fizz, you can confidently choose the option that will effectively assist in improving your credit profile while meeting your budgetary requirements.

Who is Self Credit Builder For?

Self Credit Builder is tailored for individuals who are seeking to rebuild, establish, or enhance their credit scores. It is best suited for those with no credit history or a poor credit standing, provided they have a flexible budget and the capability to make on-time payments.

This program can empower individuals who are determined to improve their financial health by taking proactive steps towards securing better credit opportunities in the future.

Self Credit Builder Review Conclusion: Is Self Credit Builder Worth It?

Is Self Credit Builder the right choice for you? The review has provided a detailed analysis of the credit-building options available. You now have practical and efficient strategies to consider.

How can these approaches improve your financial journey? Are you ready to take action and start building your credit with confidence? Empower yourself by exploring additional resources for further guidance.

FAQs

1. What is a credit-builder loan and how does it work?

A credit-builder loan helps people with bad credit or no credit history save money while building their credit score; you borrow a set amount, but instead of getting the funds upfront, the bank holds onto them in a savings account as you repay the loan.

2. Can Self's Credit Builder Loan improve my FICO score?

Yes, if managed responsibly by making timely payments, Self's Credit Builder Loan can contribute positively to your FICO score by diversifying your credit mix and establishing a good payment history.

3. Is my financial information secure when using Self's website?

Absolutely, Self uses 256-bit encryption to protect your personal data like social security numbers and email addresses from being hacked ensuring privacy on every part of their website.

4. Will applying for a loan through Self impact my current interest rates on other debts?

Applying for any new line of credit could affect your interest rates due to changes in your financial profile evaluated by lenders; however, since Self mainly deals with small loans reported to consumer credit bureaus it might have minimal effect compared to larger debts like mortgages or auto loans.

5. How do I know if I'm eligible for a Credit Builder Account with Self?

Eligibility depends on factors such as annual income, employment status, and existing debt - use tools like their loan calculator along with advice from financial advisors before you log in to apply and commit to terms that suit your budget effectively.

6. Do I get access to traditional banking features like checking accounts or debit cards with Self?

While its primary focus is building or improving credit scores through products like certificate deposits (CDs) tied up in loans rather than free-flowing cash accounts so typically there isn't immediate availability of such tools but after successfully completing payment terms access additional services may become available.