Finding a way to build credit can be tough if you have bad credit. The Tomo Credit Builder Card for Bad Credit Review offers hope. This blog will show how the card works and its benefits.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Keep reading to learn more!

Overview of Tomo Credit Builder Card For Bad Credit

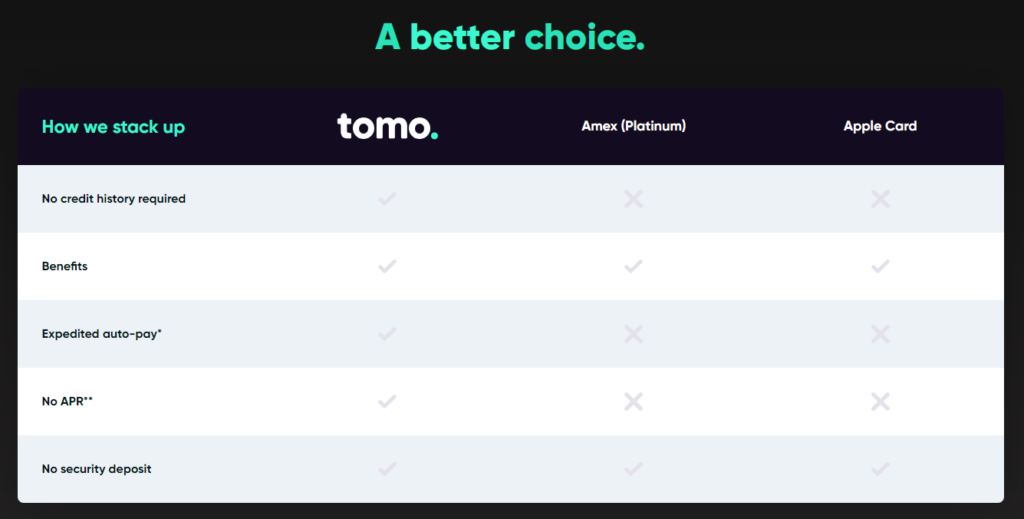

Looking for a credit card to build or rebuild your credit? Tomo Credit Builder Card might be the solution. This card offers unique features for those with bad credit, without requiring a credit check and no APR; however, the balance must be paid in full each month.

Key features

The Tomo Credit Builder Card is a unique tool for those with bad credit. It offers a way to build credit without common obstacles.

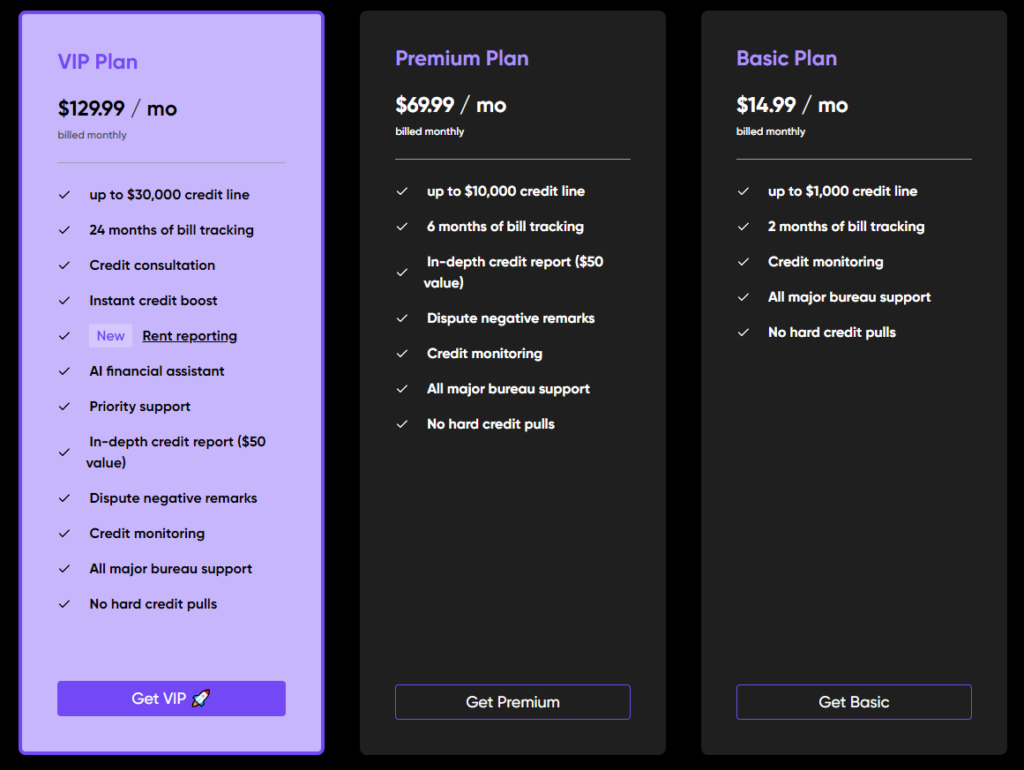

- Lines of Credit: Users can get a line of credit starting at $350 and may go up to $10,000. This depends on their payment history.

- No Interest Charges: The card does not charge any interest, making it easier to manage.

- Reports to Major Credit Bureaus: Tomo reports payments to Experian, TransUnion, and Equifax, helping users build their credit score.

- No Annual Percentage Rate (APR): Users don't have to worry about an APR since there's none.

- No Security Deposit Required: Unlike many other cards aimed at building or rebuilding credit, users do not need to put down a security deposit.

- Designed for Bad Credit: The Tomo Credit Card is made for people with bad credit, offering them a chance to improve their financial situation.

- Payments in Full: It requires that balances be paid in full, encouraging good financial habits and preventing debt accumulation.

Eligibility requirements

To apply for the Tomo Credit Card for bad credit, you need to meet some rules. These rules help Tomo decide if you can have the card.

- Link a bank account through Plaid, a tool that connects your bank to Tomo.

- Show how much money you make. Tomo looks at your income to see if you can pay back.

- Have enough money in your bank account. They check to make sure you're not spending all you have.

- You don't need a Social Security number or an Individual Taxpayer Identification Number to apply.

- Your financial history matters. They look at how you use money, not just your credit score.

- Be ready to share personal details like your name and address so they can know who you are.

- Make sure you're okay with them checking your financial behavior using data points.

These steps help Tomo offer a line of credit, even if your credit is not good or if traditional banks have said no before.

Unique Aspects of Tomo Credit Builder Card

The Tomo Credit Builder Card stands out for not requiring a credit check and having no APR, but the balance must be paid in full each month. These unique aspects make it an attractive option for those looking to improve their credit without traditional credit card charges.

No credit check required

Tomo Credit Card makes getting a credit line easy for those with bad credit. It does not require a credit check. This means you can apply without worrying about your past financial mistakes.

People often think that poor credit history will stop them from getting a good card. But with Tomo, that's not true.

Since there's no need for a credit check, applying is fast and simple. You can start rebuilding your financial life sooner. Many cards ask for detailed information about your finances, but Tomo skips this step.

This opens doors for more people to improve their credit scores without the usual barriers.

No APR; balance must be paid in full

The Tomo Credit Builder Card doesn't have an annual percentage rate and requires the balance to be paid in full. You can't carry a balance on this card, which means you won't accumulate debt from interest.

This can help users manage their spending more effectively and avoid getting into long-term debt.

Pros and Cons of Using Tomo Credit Builder Card

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

The Tomo Credit Builder Card offers unique perks such as no credit check required and the potential to build credit without traditional rewards. However, users should carefully consider associated costs and fees before signing up for the card.

Advantages of the card

The Tomo Credit Builder Card doesn't require a credit check. It also doesn't charge any interest, making it affordable to build credit. The card offers World Elite Mastercard benefits and having an on-time payment history can positively impact credit scores.

Potential drawbacks

The Tomo Credit Builder Card has a monthly "participation fee" of $2.99, summing up to $35.88 annually, which can be a downside for some users. It also requires a linked bank account and lacks a rewards program.

Furthermore, the card has received unfavorable reviews and complaints, resulting in an "F" rating from the Better Business Bureau.

These considerations should be taken into account when determining whether this card is suitable for you based on your individual financial situation and needs.

Card Costs and Fees

The Tomo Credit Builder Card has specific costs and fees associated with it, providing transparency for potential users. Understanding these financial aspects is vital before applying to make an informed decision.

Annual or monthly fees

The Tomo Credit Builder Card imposes a $2.99 monthly fee, totaling an annual cost of $35.88 for cardholders.

This means you'll be paying approximately $36 each year to use the card, broken down into manageable monthly payments of just under $3 per month.

Other associated costs

There are no annual or monthly fees connected with the Tomo Credit Builder Card. However, there may be some associated costs like a one-time card issuance fee. Also, for users who miss payments after their seven-day automatic payment schedule expires, late fees will apply.

It's important to stay vigilant about these potential charges so that you can benefit fully from the otherwise advantageous features of this credit-building tool.

Perks of the Tomo Credit Builder Card

The Tomo Credit Builder Card offers exclusive perks without traditional rewards, making it unique compared to other cards. It allows you to qualify for benefits that go beyond regular credit card incentives.

Qualification for perks without traditional rewards

Tomo Credit Builder Card offers perks from companies like Lyft and DoorDash through Mastercard. Even though it doesn't have a rewards program as of 2023 (previously offered 1% cash back), you can still qualify for perks without the usual benefits, which may make it an appealing option for some users.

Application Process for Tomo Credit Builder Card

Applying for the Tomo Credit Builder Card is simple. You can follow a few easy steps to apply online. To learn more about this process and what to expect, continue reading.

Steps to apply

To apply for the Tomo Credit Builder Card, follow these steps:

- Visit the Tomo website to begin the application process.

- Provide necessary personal information, including your name, address, and social security number.

- Link a bank account using Plaid to assess your eligibility based on income and account balances.

- Complete the application and wait for a decision from Tomo.

- If approved, fund your Tomo account to activate the line of credit.

These simple steps will guide you through the process of applying for the Tomo Credit Builder Card.

What to expect during application

When applying for the Tomo Credit Builder Card, expect a straightforward process with no credit check required. You can apply without needing a Social Security number or Individual Taxpayer Identification Number, making it accessible to many individuals looking to build or repair their credit.

The application process entails basic steps and allows you to qualify for perks without traditional rewards, presenting an opportunity for those in need of a credit building option.

After submitting your application, there may be waiting time as approvals are not guaranteed for everyone. In contrast to other traditional cards that require extensive background checks and documentation, the Tomo Credit Builder Card aims to simplify the application experience by offering accessibility and flexibility even for those with bad credit.

Comparison with Other Credit Builder Cards

When comparing with other credit builder cards, Tomo Credit Builder Card stands out for its unique features and eligibility requirements. To find out how it stacks up against competitors, continue reading the full review.

Tomo Credit Card vs. Secured Chime Credit Builder Visa® Credit Card

The Tomo Credit Card has an annual fee of $35.88, while the Chime Card has no fees. Comparatively, Chime Card does not require credit checks, but it does mandate a qualifying direct deposit of $200 or more.

Focused on bad credit management and building credit, Tomo Credit Builder card requires no traditional APR; balances must be paid in full monthly to avoid interest charges. On the other hand, Secured Chime Credit Builder Visa® Credit Card is secured by a cash deposit which acts as collateral for the line of credit.

These differences make both cards suitable for different financial situations and goals.

In considering these options, it's essential to assess individual financial needs and habits before making a decision on which card suits best to improve personal financial health.

Moving onto "Tomo Credit Card vs Discover It® Secured Credit Card"...

Tomo Credit Card vs. Discover it® Secured Credit Card

The Discover it® Secured Credit Card has no annual fee, while the Tomo Credit Card charges $35.88 annually. Discover it® offers rewards with 1% cash back on eligible purchases, but Tomo doesn't have traditional rewards or perks associated with its card.

Overall, if you're looking for a secured credit card with no annual fees and a reward program, the Discover it® Secured Credit Card may be a better option for you. However, if you're focused on building credit and are willing to pay an annual fee without seeking traditional rewards, then the Tomo Credit Card might suit your needs better.

Next up is "User Feedback and Reviews".

User Feedback and Reviews

See what users have to say and discover more by reading the reviews.

Positive reviews

Users have praised the Tomo Credit Builder Card for not requesting a credit check, making it accessible to individuals with poor credit. They appreciate that there are no interest charges, helping them avoid extra debt accumulation.

Furthermore, users value the benefits of the World Elite Mastercard that come with the card, enhancing their overall experience and providing added value.

Criticisms and complaints

Transitioning from positive reviews to criticisms and complaints, it's important to note that the Tomo Credit Builder Card has a history of negative feedback. With an "F" rating from the Better Business Bureau and spending temporarily disabled for some existing cardholders in early 2024, there have been concerns about its credibility.

Many users have expressed dissatisfaction with the customer service and the overall experience with Tomo Credit. This is something potential users should consider before applying for the card.

The Tomo Credit Builder Card has attracted notable criticisms and complaints, evident in its "F" rating from the Better Business Bureau and temporary spending freeze for certain existing cardholders at the beginning of 2024.

Dissatisfaction regarding customer service and user experience further brings into question the reliability of this credit builder option.

Final Recommendation

Is the Tomo Credit Builder Card right for you? Head over to our blog for an in-depth review.

Is the Tomo Credit Builder Card right for you?

If you have bad credit and need to build it up, the Tomo Credit Builder Card may be a good fit. The card doesn't charge interest and does not require a credit check. However, it also has its downsides: there are no rewards or perks, and the fees can add up.

Taking those into account will help you decide if it's the right choice for you.

Conclusion

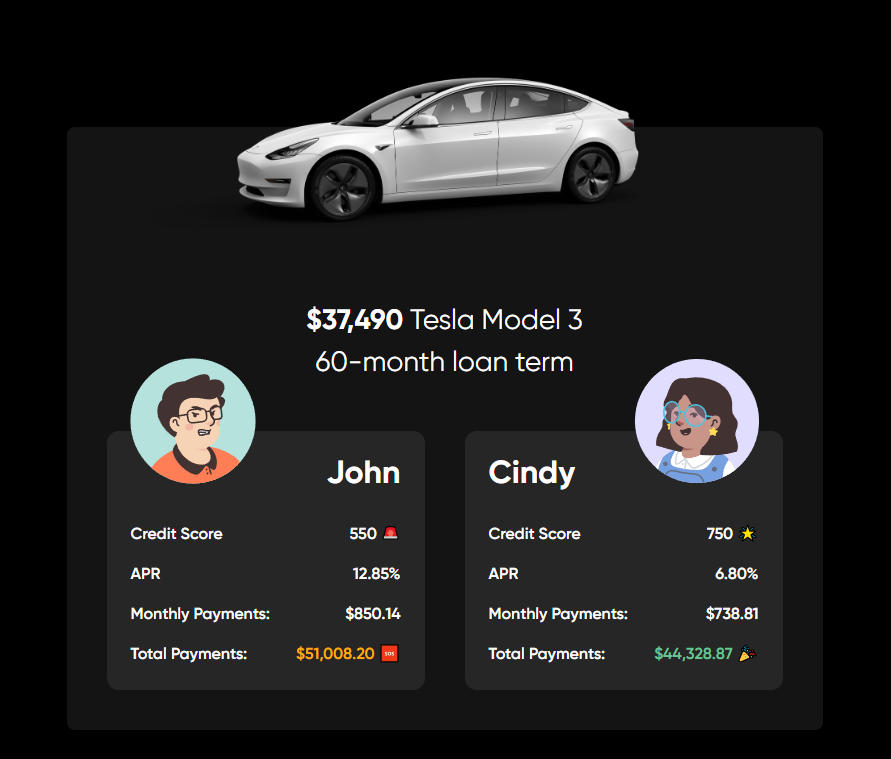

In conclusion, the Tomo Credit Builder Card offers an appealing option for individuals with less-than-ideal credit or no credit history. With its unique features like no interest charges and potential for a credit limit up to $10,000 based on payment history, it stands out in the world of credit-building tools.

The card's goal to report on-time payments to major credit bureaus could assist in improving users' credit scores over time.

Moreover, the simple application process and availability through a mobile app provide convenience for customers seeking to start their journey towards improved financial health. While there are associated costs with the card, such as a monthly participation fee, it still presents itself as a customized and user-friendly solution for those looking to improve their credit profile.