Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Finding a loan with bad credit can be tough. That’s where “Upgrade Personal Loans Reviews” come in. This article will show you why Upgrade might be good for you if your credit isn’t great.

Keep reading to learn more.

Key Features of Upgrade Personal Loans

Upgrade Personal Loans offer a wide range of loan amounts to suit different financial needs. Their competitive interest rates and fees make them an attractive option for borrowers with bad credit.

Upgrade Loan Reviews! How To Get $50k Upgrade Personal Loans For Bad Credit No Credit Check (1080p)📞 Ready to get answers? – Schedule your call – https://houstonmcmiller.net/phone-consultation/ Upgrade Loan Reviews! How To Get $50k Upgrade Personal Loans For Bad Credit No Credit Check (1080p)

Posted by Real Houston Mcmiller on Thursday, November 21, 2024

Loan amount range

Upgrade loans offer a wide range of loan amounts. You can borrow anywhere from $1,000 to $50,000. This makes Upgrade personal loans flexible for many needs, whether you’re looking to cover a small expense or finance a large project.

Interest rates and fees play a big role in deciding on a loan.

Interest rates and fees

After talking about the range of loan amounts you can get with Upgrade, it’s key to look at interest rates and fees. Interest rates play a big part in how much you pay back. Upgrade personal loans have rates that can go as high as 35.99%.

This means if you borrow money, the cost could increase significantly over time due to interest. Apart from this, there’s an origination fee for setting up the loan. This fee ranges from 1.85% to 9.99%.

So, when you take out a loan with Upgrade, part of your loan amount covers this fee right off the bat.

These costs are important to think about because they add to the total amount you need to repay. It’s not just what you borrow but also these extra charges that affect your payments.

Knowing these details helps manage expectations and plan for repayment more effectively.

Pros of Choosing Upgrade for Bad Credit Loans

Upgrade offers flexible loan terms tailored for borrowers with less-than-ideal credit. They also provide competitive interest rates, allowing for more manageable repayment options.

Flexible loan terms

Upgrade offers loan terms up to 7 years. This long period makes it easier for borrowers to manage their payments. If your budget is tight, spreading payments over several years can lower monthly costs.

Also, Upgrade lets people add a co-borrower. Doing this might get you better terms on your loan. For many, having flexible options helps fit a loan into their life without stress.

Competitive interest rates for bad credit

Upgrade Personal Loans offers competitive interest rates for individuals with bad credit. With a minimum credit score requirement of 580, the company aims to cater to a broader range of borrowers.

They provide lower starting APRs compared to Prosper, making their loans more accessible and affordable for those with less-than-ideal credit histories. This focus on competitive rates enables Upgrade to stand out as a viable option in the lending market for individuals seeking financial assistance despite their credit challenges.

Cons of Upgrade Personal Loans

Upgrade personal loans can come with origination fees and higher rates compared to good credit loans. However, it is important to note that these cons might impact the overall cost of borrowing for individuals with bad credit.

Origination fees

Upgrade Personal Loans charge origination fees ranging from 1.85% to 9.99% of the total loan amount. Moreover, late payment and returned payment fees are set at $10 each, so borrowers should be mindful of potential additional costs when applying for a loan.

These fees can significantly impact the overall cost of borrowing from Upgrade, especially for those who might face financial challenges meeting repayment deadlines or encounter returned payments.

Therefore, it’s crucial for prospective borrowers to factor in these expenses when assessing whether Upgrade Personal Loans align with their financial needs.

Higher rates compared to good credit loans

Upgrade personal loans for bad credit come with higher interest rates than those offered to borrowers with good credit. The maximum APR is 35.99%, and interest rates range from 9.99% to 35.99%.

This means that individuals with bad credit may encounter higher costs when compared to those with better credit scores, making it essential for them to carefully consider their financial options before choosing a loan.

Moving on to the eligibility requirements for Upgrade Personal Loans…

Eligibility Requirements for Upgrade Personal Loans

To qualify for Upgrade personal loans, you need to meet a minimum credit score and income requirements. Understanding these criteria is essential for successfully applying for a loan with bad credit.

Minimum credit score

Upgrade Personal Loans requires a minimum credit score of 580 to qualify. This means that if your credit score is at least 580, you may be eligible to apply for their loans. In fact, around 59% of borrowers who obtained loans from Upgrade had fair credit.

Income requirements

To qualify for Upgrade personal loans, income verification is mandatory. Specific income thresholds are not provided on the company’s website, but borrowers must have a verifiable bank account and a valid email address.

Co-borrowers are allowed, which can potentially improve loan terms for individuals with lower incomes.

Upgrade personal loans require income verification. Specific income requirements aren’t disclosed on the website, but eligible borrowers need a verifiable bank account and valid email.

Co-borrowers can help improve loan terms for those with lower income situations.

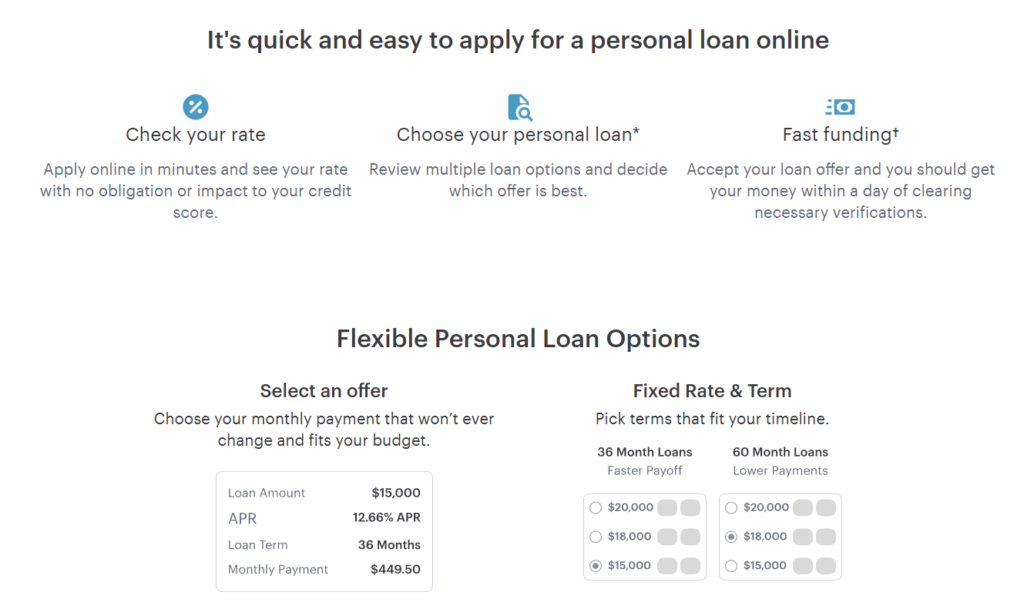

Application Process for Upgrade Personal Loans

Applying for Upgrade personal loans is simple. You can complete the application online and receive the funds quickly once approved.

Steps to apply

To apply for an Upgrade personal loan, follow these straightforward steps:

- Visit the Upgrade website or mobile app.

- Fill out the online application with personal and financial information.

- Personalize your loan offer by selecting the desired loan amount and term.

- Review and agree to the loan terms and conditions.

- Submit any extra requested documentation.

- Once approved, electronically sign the loan agreement.

- Receive funds directly into your bank account as soon as the next business day.

Keep in mind that you can also manage your account through the convenient mobile app for easy access to your loan details and payments.

Time to funding

The time to funding for Upgrade Personal Loans is quick, with same-day approval and next-day funding. This means that once your loan application is approved, you can expect the funds to be deposited into your account the following day.

This fast funding speed provides a convenient solution for those in need of prompt financial assistance.

Upgrade loans have consistently shown fast funding data from 08/22/24 to 10/21/24, ensuring that customers can access the funds they require within a short timeframe. Whether it’s for unexpected expenses or planned purchases, this rapid access to funds sets Upgrade apart as an efficient option for individuals seeking timely financial support.

Customer Reviews and Feedback

Check out what customers are saying about their experiences with Upgrade Personal Loans. Discover the positive highlights and common complaints to help you make an informed decision.

Positive highlights

Upgrade Personal Loans has garnered a Trustpilot Rating of 4.4 out of 5 from over 40,000 reviews, underscoring the high level of customer satisfaction with their services. In a Bankrate Survey involving 1,300 loan borrowers, Upgrade’s funding time received a commendable score of 4 out of 5.

This indicates that customers experience relatively fast processing and disbursement when applying for loans through Upgrade. Such positive ratings and feedback position Upgrade as a reputable and efficient choice for personal loans despite bad credit.

The positive highlights are further exemplified by Upgrade’s commitment to offering competitive interest rates for bad credit borrowers, making them stand out in the lending market as an accessible and reliable option for those seeking financial assistance while dealing with less-than-perfect credit scores.

With these strengths in mind, individuals looking for personalized loan options can confidently turn to Upgrade for their diverse financial needs without compromising on quality or customer service.

Common complaints

Common complaints about Upgrade Personal Loans include higher rates than good credit loans and upfront origination fees. According to a Bankrate survey, the customer service rating is 3.7 out of 5, indicating room for improvement in this area.

It’s important to note that some customers have expressed dissatisfaction with these aspects when reviewing their experience with Upgrade loans.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Comparing Upgrade with Other Lenders

How does Upgrade stack up against other lenders? What sets Upgrade apart from competitors like Upstart and Best Egg?

Upgrade vs. Upstart

Comparing Upgrade and Upstart sheds light on how different lenders cater to borrowers with varying credit profiles and needs. Upgrade stands out by offering more flexible terms, which is a significant advantage for many borrowers.

| Feature | Upgrade | Upstart |

|---|---|---|

| Flexibility | More flexible terms | Less flexible terms |

| Co-borrower Option | Allows co-borrowers | May not offer this option |

| Target Borrower | Focuses on bad credit | Targets broad credit spectrum |

| Loan Purpose | Various, including debt consolidation | Primarily personal, educational, and debt consolidation |

| Funding Time | Quick, often within a few days | Varies, usually within a week |

Upgrade’s approach to lending provides more opportunities for those with less-than-perfect credit by allowing for a co-borrower, which can result in better loan terms. This feature is particularly beneficial for applicants striving to secure loans at competitive rates despite their credit challenges.

Upgrade vs. Best Egg

Here we take a close look at how Upgrade personal loans for bad credit stack up against Best Egg loans. Both lenders offer competitive options, but there are key differences to consider.

| Aspect | Upgrade | Best Egg |

|---|---|---|

| Loan Amount Range | $1,000 to $50,000 | $2,000 to $50,000 |

| Interest Rates | Competitive rates for bad credit; lower starting APR compared to Prosper | Competitive rates; tends to favor applicants with better credit |

| Origination Fees | Yes, varies by loan | Yes, ranges from 0.99% to 5.99% |

| Application Process | Online, straightforward | Online, user-friendly |

| Direct Payment to Creditors | Available for debt consolidation loans | Not specified |

| Minimum Credit Score | Lower requirement, more accommodating for bad credit | Requires higher credit scores for best rates |

| Time to Funding | As soon as one business day | 1 – 3 business days |

Upgrade stands out for individuals with bad credit, offering lower starting APRs and a direct payment feature which can be particularly beneficial for debt consolidation. Best Egg, on the other hand, might cater more to those with better credit scores. Both lenders provide a range of loan amounts and competitive interest rates, but it’s the specifics such as fees, application process, and the minimum credit score requirements where they diverge, potentially making Upgrade a more suitable choice for those with less-than-perfect credit.

Conclusion

In summary, Upgrade Personal Loans provides a viable option for individuals with bad credit seeking flexible loan terms and competitive rates. The comprehensive review covers key features, customer feedback, and a comparison with other lenders, offering valuable insights for those considering personal loans.

Summary of Upgrade personal loans for bad credit

Upgrade offers personal loans for bad credit with a minimum score of 580. Loan amounts range from $1,000 to $50,000 and can be approved the same day with next-day funding available.

The maximum APR is 35.99%, and origination fees are between 1.85% and 9.99%. Upgrade has a Trustpilot rating of 4.4 out of 5 and an overall Bankrate score of 4.7.The company operates in all 50 states including Washington, D.C., providing various customer support options.

Final recommendation

Considering Upgrade’s accessible minimum credit score requirement of 580, positive customer feedback and a Bankrate rating of 4.7, it’s advisable to consider Upgrade for individuals seeking personal loans with bad credit.

The streamlined application process with same-day approval makes it a suitable option for quick funding, alongside its strong customer experience and affordability ratings from reputable sources.

With the company being recommended for individuals with bad credit seeking personal loans due to these factors, Upgrade proves to be a competitive choice in the lending market.