Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Getting a loan can be hard if you have bad credit. Upstart is rated 4.4 by U.S. News for helping people in this spot. This blog will show how "Upstart Loans Reviews" shine light on a new way to borrow money.

Keep reading to learn more!

Overview of Upstart Personal Loans

Upstart personal loans cater to individuals with varying credit scores. The loan terms and conditions are flexible, making it accessible for a wide range of borrowers.

Eligibility Requirements

To get an Upstart personal loan, you need to meet some requirements. These rules make sure you can pay back the loan.

- Make at least $12,000 a year. This is the lowest amount of money you can earn to apply.

- No bankruptcies in the last 12 months. If you had one, wait until a year has passed.

- Live in a place where Upstart works. They don't give loans in Iowa or West Virginia.

- The AI looks at lots of things about you. It uses information from 4.4 million loans to decide if you qualify.

Loan Terms and Conditions

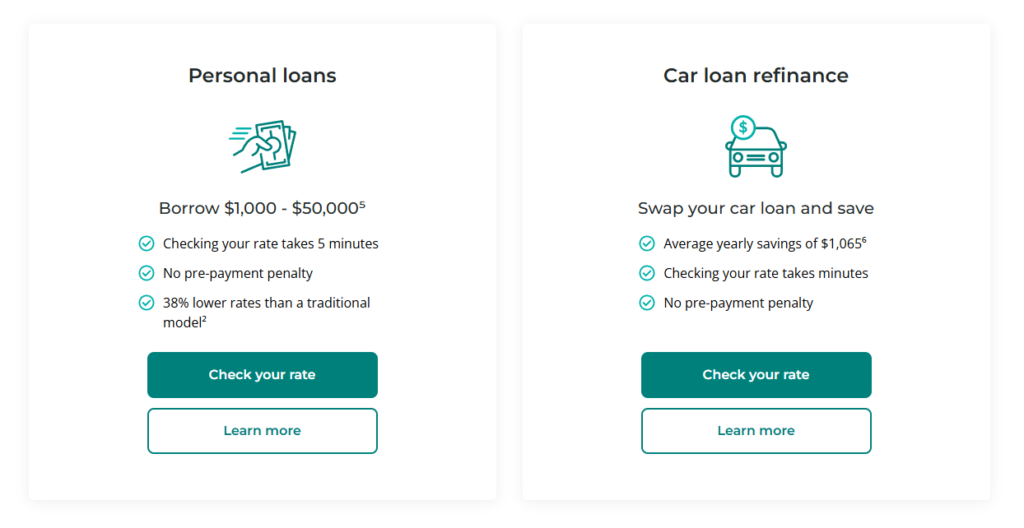

Upstart personal loans offer borrowers amounts ranging from $1,000 to $50,000. This flexibility fits different needs and budgets. The annual percentage rate (APR) set by Upstart varies widely, from as low as 7.80% to as high as 35.99%.

Loans can last up to 60 months, giving borrowers time to pay back.

Origination fees for these loans can go up to 12%, taken directly out of the loan amount before a borrower receives it. If payments are late, Upstart charges $15 or 5% of the overdue amount, depending on which is greater.

These terms ensure that borrowers understand the costs upfront.

Pros of Choosing Upstart for Bad Credit Loans

Upstart offers lower credit score requirements for personal loans, making it more accessible to individuals with bad credit. Its fast funding times ensure that you can get the money you need quickly and without hassle.

Lower Credit Score Requirements

Upstart stands out because it lets people with credit scores as low as 300 apply for loans. This is good news if your credit isn't great. The company uses AI to check applications, which helps more people get approved.

In fact, Upstart approves 43% more loans than other lenders that only look at credit scores.

This means even if you've had trouble getting a loan from other places, Upstart might say yes. They give many loans to people who don't make a lot of money or haven't borrowed much before.

About 28.9% of their loans go to folks in communities that don't have a lot of money.

Fast Funding Times

When you get approved for an Upstart personal loan, the funds can be available as soon as the next business day. Positive consumer reviews highlight ease of application and satisfaction with the speed of funding and customer service.

The application process involves prequalifying via a soft credit inquiry, which takes about five minutes.

Flexible Loan Amounts

After discussing the fast funding times, let's explore Upstart's adaptable loan amounts. This lending platform provides access to loan amounts between $1,000 and $50,000. The repayment period for these loans can be either 36 or 60 months, offering borrowers a time frame that matches their financial situation.

This adaptability in loan amounts enables individuals to obtain the capital they need while customizing it to their specific borrowing requirements and capacity.

The range of $1,000 to $50,000 offered by Upstart is broad enough to accommodate various borrowing needs without being overly limiting. Moreover, with options for shorter or longer repayment periods at fixed monthly installments – notably over three years (or 36 months) and five years (or 60 months), borrowers have greater control in managing their payments based on what best suits their financial capabilities.

Cons of Upstart Personal Loans

Upstart personal loans may have higher interest rates for lower credit scores. There are also additional fees that borrowers should be aware of before applying.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Higher Interest Rates for Lower Credit Scores

When your credit score is lower, Upstart personal loans may come with higher interest rates. The annual percentage rate (APR) for these loans can range from 7.80% to 35.99%. Some customers have expressed dissatisfaction with the high rates offered, as indicated in negative reviews of Upstart loans.

Additional Fees

Upstart charges origination fees up to 12%, which they deduct from the loan amount. If you make a late payment, you could face a fee of $15 or 5% of the overdue amount, whichever is greater.

In 2023, the Consumer Financial Protection Bureau received 116 complaints about Upstart’s personal loans.

Unique Features of Upstart Loans

Upstart loans stand out with their AI-powered approval process, which speeds up the application and decision-making. Plus, there's no prepayment penalty, giving borrowers more flexibility in managing their repayments.

AI-Powered Approval Process

Using artificial intelligence (AI), Upstart automates 84% of its loan approvals. The AI model considers 1,500 variables from over 4 million repaid and ongoing loans. It's undergone 23 updates in the first quarter of 2023.

Upon partnering with nearly 100 banks and credit unions, over half of its loans are funded by Cross River Bank in New Jersey.

The AI model isn't static; it undergoes continuous improvements based on real-time data to enhance precision in matching borrowers with lenders for a seamless borrowing experience.

No Prepayment Penalty

Upstart loans don't have a prepayment penalty. This means borrowers can pay off their loans early without facing extra fees. This is particularly beneficial for those with bad credit, helping them save on interest and manage their debt more flexibly.

The absence of a prepayment penalty sets Upstart apart because it allows borrowers to improve their financial situation by paying off their loans ahead of schedule. It's a distinctive advantage that provides flexibility and potential savings for individuals looking to enhance their financial health through Upstart loans without fear of incurring additional costs.

Customer Experiences with Upstart

Customers praise Upstart for its fast service and ease of the loan application process. Some customers have voiced criticisms about their experiences with customer service.

Positive Feedback on Quick Service

Upstart received a high customer service rating of 4.8 out of 5, and its eligibility for loans also scored 4.8 out of 5. The company has an impressive Trustpilot score of 4.9 out of 5 stars, based on a substantial number of ratings (46,495).

Users have expressed satisfaction with the quick funding process and prompt customer service through positive reviews.

The ease of application and swift funding were highlighted in these positive consumer reviews, contributing to the favorable perception of Upstart’s fast service delivery.

Criticisms on Customer Service

Transitioning from positive feedback on quick service, some customers have criticized Upstart's customer service. Negative reviews often mention dissatisfaction with high offered rates and income verification issues.

The Consumer Financial Protection Bureau received 116 complaints regarding Upstart’s personal loans in 2023, which raises concerns about the overall experience for borrowers seeking assistance or clarification from the company.

Comparing Upstart to Other Lenders

Upstart stands out for its lower credit score requirements and fast funding times, setting it apart from traditional banks. When comparing with other online lenders, Upstart's AI-powered approval process and lack of prepayment penalty give it a unique edge in the lending market.

Comparison with Traditional Banks

Traditional banks typically have stringent credit score requirements, making it challenging for individuals with lower scores to secure personal loans. In contrast, Upstart has a notable 43% approval rate higher than traditional credit score-based lenders as of 2023.

This suggests that Upstart's approach to assessing borrowers' creditworthiness differs significantly from the standard practices employed by traditional banks, providing more opportunities for individuals with diverse financial backgrounds to access personal loans when needed.

Furthermore, while traditional banks operate independently, Upstart partners with nearly 100 banks and credit unions. This strategic collaboration expands the reach of its loan services and enhances accessibility for applicants seeking financial assistance.

Consequently, Upstart's model offers a unique alternative to the limitations presented by traditional banking institutions in terms of lending flexibility and eligibility criteria within the borrowing landscape.

Comparison with Other Online Lenders

Upstart stands out among other online lenders by using artificial intelligence in their approval process, which may benefit those with low credit scores or limited credit history. Alternatives to Upstart include Discover, LightStream, and Upgrade.

Each of these lenders offers varying loan terms and requirements. Upstart's unique approach potentially allows more individuals to qualify for loans compared to traditional online lenders.

When considering multiple online lending options like Discover, LightStream, or Upgrade alongside Upstart, it is important to take note of each lender's specific eligibility criteria and loan terms before making a decision that best meets individual financial needs.

Applying for an Upstart Loan

Looking to secure an Upstart loan? The step-by-step application process and documents needed will guide you through the process. Discover what it takes to apply for a loan that fits your needs.

Step-by-Step Application Process

To apply for an Upstart loan, you start by prequalifying through a soft credit inquiry, which only takes about five minutes. After prequalification, you will need to provide the necessary documents and complete the formal application process. Here's a step-by-step guide:

- Prequalification: Fill out a simple online form to check your rates without impacting your credit score.

- Review Offers: If you qualify, you can review the loan offers presented to you along with the terms and conditions.

- Complete Application: Once you've chosen the best offer, complete the full application, including providing personal information and consent for a hard credit inquiry.

- Document Submission: Upload or submit any required documentation, such as proof of income or employment verification.

- Approval Decision: Wait for Upstart's decision on your loan application; this often occurs within one business day.

- Acceptance and Funding: If approved, review the final terms and conditions before accepting the loan offer, then receive funding directly into your bank account within one business day.

Throughout this process, keep an eye on your email and phone for any additional requests from Upstart to ensure a smooth experience.

Documents Needed

To apply for an Upstart loan, you will need to provide the following documents:

- Identification: A valid government-issued photo ID, such as a driver's license or passport.

- Income Verification: Recent pay stubs or tax returns to demonstrate your income.

- Bank Statements: Proof of your financial stability, typically the last few months' worth of bank statements.

- Social Security Number: Your SSN will be required for a credit check and identity verification.

- Contact Information: Details like your address, phone number, and email address for communication purposes.

These documents are essential in the application process to help Upstart assess your eligibility for a personal loan.

Frequently Asked Questions

What effect does Upstart have on your credit score? Can you refinance an Upstart loan? These are common questions people ask about Upstart loans.

Can you refinance an Upstart loan?

Yes, you can refinance a loan from Upstart. Refinancing with Upstart involves obtaining a new loan to settle the existing one. This may be a favorable choice if your credit score has improved since taking out the original loan or if you wish to modify the terms of your loan, such as prolonging the repayment period.

It's crucial to thoroughly assess the potential advantages and disadvantages before determining whether to refinance.

Refinancing a loan from Upstart entails adhering to specific terms and conditions that borrowers must meet, so it's vital to carefully examine these before making any decisions about refinancing.

Also, it's recommended that anyone contemplating this financial move should directly contact Upstart for precise details about their refinancing alternatives.

How does Upstart affect your credit score?

Upstart may affect your credit score when you make an initial loan application. This can result in a hard inquiry on your credit report, which might have a temporary negative impact.

However, if you manage the loan responsibly by making timely payments, it could potentially have a positive effect on your credit score over time. Keep in mind that timely repayments are key as missing payments could hurt your credit score.

Conclusion

In conclusion, Upstart personal loans offer a flexible option for people with bad credit. The company utilizes AI technology to match borrowers with suitable terms and conditions. While they have faster funding times and lower credit score requirements, it's essential to carefully consider the interest rates and additional fees before applying.

However, for those in need of quick financial assistance despite a less-than-perfect credit history, Upstart can be a viable option to explore when seeking personal loans.