Finding the right way to borrow money can be hard. Yendo Credit Cards stand out by reporting to Experian and Equifax, helping you build credit. This article will guide you through choosing the best car equity loan, focusing on benefits and risks.

Keep reading for essential tips.

👉 Apply now to Yendo Credit Card👈Yendo Credit Card eligible vehicles that can be used as collateral include:

- Cars.

- Light-duty trucks.

- Vans.

- Sport utility vehicles.

Furthermore, the vehicles must meet these requirements:

- Must be 1996 or newer.

- Must be in working condition.

- Must be owned, leased or purchased with an auto loan.

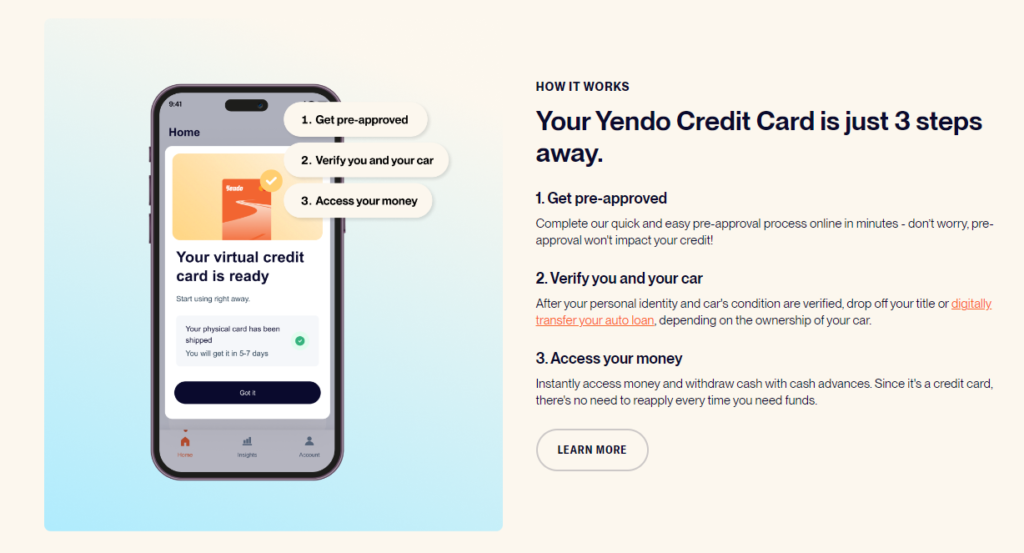

To be approved for the Yendo card, you’ll need to upload pictures of the car in the Yendo app, then drop the title off at one of Yendo’s partner locations or mail it to Yendo via FedEx. (Yendo covers the shipping costs.)

Your credit limit on a Yendo card will depend on the year, make, model and condition of your vehicle and will range from $450 to $10,000. If Yendo determines that the credit line wouldn’t be at least $450, you can’t get the credit card. Only one vehicle is allowed per credit line.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Key Takeaways

- Car equity loans use your car as collateral and offer fast access to cash, with amounts ranging from $450 to $10,000.

- You can apply easily through a smartphone app, get pre-approved quickly, often in just 15 minutes, and receive funds rapidly.

- These loans report to major credit bureaus like Experian and Equifax which can help improve your credit score by making timely payments.

- The interest rate for these loans is often high at 29.88% APR, but they provide flexible repayment options including minimum monthly payments of either $50 or 3% of the total balance.

- It’s crucial to carefully choose a lender by considering their reputation, transparency about fees and rates, customer service quality, and reporting practices.

Understanding Car Equity Loans

Car Equity Loans allow you to use your car as collateral for a loan. They provide quick access to cash and often have flexible repayment options.

How Car Equity Loans Work

Car equity loans use your vehicle’s value to give you credit. You get money based on how much your car is worth without needing a cash deposit.

- Your car’s equity determines the credit limit, giving you access to funds between $450 and $10,000.

- You can apply for this loan via smartphone, making it easy and convenient.

- The approval process for these loans is quick, with pre-approval possible in just 15 minutes.

- After approval, you receive a virtual card within 30 minutes, ensuring fast access to your credit.

- A physical yendo credit card arrives in 3-7 days if you prefer having something tangible.

- Initially, your credit line is limited to 40% of the approved amount but won’t exceed $1,500 until the title is sent.

- This loan type offers revolving credit at a 29.88% annual percentage rate (APR), which means you can borrow again up to your limit as you pay off the balance.

- Once you pay off the balance and close the account, the lien on your car’s title gets released. You’ll get your title back within 10 days.

- Given that there are apps like yendo credit card and services available online, researching and applying for car equity loans has become easier than ever before.

- Checking reviews and customer experiences on platforms like yendo credit card reddit can help ensure trustworthy transactions.

Using a car equity loan provides a flexible financial option when you need quick cash without going through traditional banking hurdles or worrying about credit scores initially.

Benefits of Using Your Car as Collateral

Using your car as collateral for a loan brings instant benefits. You get access to cash quickly, which is crucial in unpredictable life situations. This method stands out because it allows you to tap into the equity of your vehicle without selling it.

You maintain use of your car while borrowing against its value, offering a smart way to manage financial emergencies.

Yendo credit offers fair and affordable options that respect your need for quick funds without excessive fees or interest rates. They prioritize privacy and data protection, ensuring that your information stays secure throughout the loan process.

By choosing Yendo’s approach to using your car as collateral, you gain the financial assistance you need and engage with a system designed to support rather than exploit borrowers.

Eligibility Requirements for Car Equity Loans

Getting a car equity loan might seem tricky, but it’s really about meeting some basic requirements. Here’s what you need to know if you’re considering using your vehicle as collateral for a loan.

• You must be at least 18 years old. This is the legal minimum age for entering into financial agreements in the U.S.

• Living in the U.S. is a must. The loan services are designed for U.S. residents.

• Having a working smartphone allows you to manage your loan application and communications efficiently.

• A valid government-issued photo ID proves your identity and is essential for completing the application process.

• Ownership of a 1996 or newer vehicle that is fully operational ensures that the collateral you’re offering has value.

• An income that can support payments is crucial. Lenders want to see that you have the means to repay the loan.

• Applying with either an SSN (Social Security Number) or an ITIN (Individual Taxpayer Identification Number) is required. It shows lenders that you have a tax identification number which can be used for financial transactions.

• Interestingly, U.S. Citizenship isn’t required to apply for a car equity loan with these lenders. This opens up opportunities for non-citizens who meet other criteria.

• Even if you have bad credit or no credit history at all, approval is still possible. This offers a significant advantage for those looking to rebuild their credit or who are just starting out.

• Currently, you can only link one vehicle per account, but there could be options for multiple vehicles in the future.

• Keep in mind that getting pre-approved does not mean your loan application will definitely be accepted. A full application must still be completed and reviewed by the lender.

• The lender requires a minimum monthly payment of $50 or 3%, whichever is greater, of your total balance.

These requirements ensure that both borrower and lender enter into an agreement with clear expectations and responsibilities. Whether it’s through yendo credit card login or direct contact via yendo credit card phone number, these points should guide your preparation before applying for a car equity loan.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Advantages of Car Equity Loans

Car equity loans offer competitive interest rates and quick cash accessibility, making it easier to access funds without credit check processes.

Competitive Interest Rates

Car equity loans provide access to funds at competitive interest rates, making it a viable financing option for those in need of quick cash. This lending solution offers the advantage of lower APRs compared to other types of loans, allowing borrowers to save on interest costs and manage their repayments more effectively.

Evaluating lenders based on their offerings is crucial, ensuring that the chosen loan comes with competitive interest rates tailored to your needs.

Moving forward from understanding car equity loans, let’s delve into the topic of “Quick Cash Accessibility.

Quick Cash Accessibility

Gain quick access to cash by leveraging your vehicle with a car equity loan. Within as little as 15 minutes, you can be pre-approved, and within 30 minutes, acquire a virtual credit card.

The process is swift, typically resulting in the issuance of a physical card within 3-7 days. Based on your vehicle details and ability to repay, credit lines range from $500 to $10,000.

With this type of loan facility available at such velocity and ease, individuals seeking immediate financial support can benefit immensely from the expeditious accessibility it offers.

No Credit Check Processes

Car equity loans do not require a credit check for approval, offering up to $10,000 at affordable interest rates with transparent terms. Even if you have bad or no credit, approval is possible as long as other criteria are met.

It’s important to note that pre-approval doesn’t guarantee final approval; a full application is required for the process.

Flexible Options for Repayment

Transitioning from the no credit check process, car equity loans offer flexible repayment options. With a minimum monthly payment of 1% of the balance or $50, whichever is greater, borrowers have room for manageable payments.

Additionally, there’s an ample 25-day window after the monthly statement to make the payment.

This flexibility works in tandem with individuals even when missed payments occur; making it more tailored towards addressing borrower needs compared to traditional loan structures.

This arrangement not only eases financial burdens but also underscores its commitment to assisting borrowers through potential challenges while ensuring seamless and hassle-free experiences.

Potential to Enhance Credit Score

Car equity loans have the potential to enhance credit scores, as they report to all three major credit bureaus monthly. By making timely payments on your car equity loan, you can demonstrate responsible financial behavior and boost your credit score.

This opportunity for building credit is especially beneficial for those seeking fair and affordable credit options during unpredictable life situations. As reported information assists in protecting against fraud and poses no interest if paid in full each month, individuals can work towards improving their overall credit standing.

Moving on from discussing the potential to enhance a person’s credit score, let’s delve into the advantages of car equity loans.

Risks Associated with Car Equity Loans

Car Equity Loans can lead to car repossession if not repaid. High rates and fees pose significant challenges for borrowers.

Possibility of Car Repossession

If payments are missed, Yendo can recover the outstanding balance as a lienholder on the car’s title. The possibility of repossession arises if the account is not brought up to date.

However, regaining possession of the car is possible by paying off the balance and closing the account; within 10 days, Yendo releases the lien and returns the title.

Challenges of High Rates and Fees

High rates and fees pose significant challenges for borrowers considering car equity loans. With a revolving credit at 29.88% APR and a cash advance rate at the same percentage with an additional 3% fee, it’s crucial to carefully evaluate the financial impact.

The annual fee of $40 adds to the burden as well. While the minimum monthly payment may seem affordable in comparison to title loans, these high rates and fees can significantly increase the overall cost of borrowing.

When seeking car equity loans, understanding these high rates and fees is essential for making informed decisions about managing finances efficiently. Considering reviews from credible sources such as Yendo credit card requirements and exploring customer experiences on Yendo credit card reviews Reddit can provide valuable insights into navigating these challenges effectively while choosing the right loan option that aligns with individual financial needs.

Effects on Your Credit Score

Car equity loans can potentially enhance your credit score as they report to three major credit bureaus every month. By responsibly managing the loan, you have a chance to positively impact your credit history and demonstrate financial responsibility.

This timely reporting to Experian and Equifax offers an opportunity for those seeking fair and affordable credit during unforeseen life circumstances. It’s essential to understand how car equity loans can contribute positively to building or rebuilding your credit standing.

The lender reports on account behavior, offering revolving credit and cash advances suitable for unpredictable life situations. This not only provides quick access to much-needed cash but also serves as an opportunity to improve your overall financial profile by establishing a positive borrowing history with regular payments reported by the lenders.

Choosing the Right Car Equity Loan

Selecting the right car equity loan is crucial when it comes to meeting your financial needs. For more details, read on.

Evaluating Lenders

When evaluating lenders for car equity loans, ensure to consider the following key factors:

- Reputation: Look for lenders with positive reviews and a strong track record in the industry, such as yendo.

- Transparency: Choose a lender that clearly outlines all terms, fees, and conditions associated with the loan to avoid surprises.

- Interest Rates: Compare interest rates from different lenders to find the most competitive option while ensuring there are no hidden charges.

- Customer Service: Assess the quality of customer service offered by different lenders, including responsiveness and willingness to address concerns or complaints.

- Reporting Practices: Select a lender that reports account behavior to major credit bureaus like Experian and Equifax, which can positively impact your credit score.

- Flexibility: Seek out lenders like yendo that offer flexible repayment options tailored towards individual financial situations and needs.

- Accessibility: Evaluate the ease of application, approval process, and cash accessibility when choosing a lender for a car equity loan.

Remember to carefully weigh these factors before selecting a lender for a car equity loan to ensure you make an informed decision that aligns with your financial goals.

Analyzing Interest Rates and Fees

Analyzing interest rates and fees is crucial when considering a car equity loan. Here are important factors to consider when evaluating the potential costs of a car equity loan:

- Annual Percentage Rate (APR): It’s essential to examine the APR, which includes both the interest rate and any additional fees. A lower APR signifies lower overall borrowing costs.

- Origination Fees: Some lenders charge fees for processing the loan, impacting the total amount you pay back.

- Late Payment Penalties: Understanding the penalties for late payments is vital as it can significantly impact the cost of the loan.

- Prepayment Penalties: Certain loans impose fines if you repay the loan early, potentially influencing your decision-making process.

- Additional Charges: Consider other potential charges such as appraisal fees, document preparation fees, and credit report fees that may be associated with securing a car equity loan.

Considering these factors helps in making an informed decision about choosing a car equity loan that aligns with your financial situation and goals.

Reviewing Loan Terms and Conditions

- Thoroughly review the interest rates, fees, and repayment terms to ensure they align with your financial capabilities.

- Pay attention to any hidden charges or penalties for late payments.

- Understand the consequences of defaulting on the loan, including potential repossession of your vehicle.

- Check for any limitations or restrictions on how you can use the loan funds.

- Ensure that the terms and conditions are transparent and clearly outlined to avoid any misunderstandings in the future.

- Verify if there are any special provisions for early repayment or refinancing options.

- Consider seeking clarification on any unclear clauses by directly contacting the lender’s customer support before finalizing the agreement.

Understanding these essential aspects of the loan terms and conditions will help you make an informed decision about your car equity loan.

Exploring Repayment Options

When evaluating repayment options for car equity loans, it’s essential to consider factors that can impact your financial stability. Yendo offers various flexible and convenient methods to help borrowers manage their loan repayments effectively:

- Autopay Service: Yendo provides an easy autopay service through their app, ensuring timely payments without the hassle of manual transactions.

- Flexible Payment Terms: Borrowers can benefit from minimum payment options, allowing them to pay either 1% of the balance or a minimum of $50, making monthly payments more affordable compared to other options.

- Missed Payment Assistance: Yendo works with individuals who may have missed payments, providing support up to 25 days after the monthly statement date.

- Customizable Repayment Plans: Borrowers have the flexibility to customize repayment plans that suit their financial situation, enabling them to manage their loan effectively.

- Convenient Minimum Monthly Payments: The minimum monthly payment offered by Yendo is more affordable when compared to traditional title loans, providing borrowers with a sustainable repayment option.

- Personalized Assistance: Yendo tailors its repayment assistance to individual needs, helping borrowers navigate complex financial situations and work towards regaining stability.

Checking Reviews and Customer Experiences

When considering car equity loans, it’s essential to review and consider customer experiences and feedback. Here are the factors to consider when checking reviews and customer experiences:

- Transparency: Look for lenders with a track record of transparent dealings and clear communication regarding loan terms and conditions.

- Customer Service: Evaluate reviews on promptness, friendliness, and helpfulness of customer service in addressing queries and concerns.

- Flexibility: Assess customer experiences relating to the flexibility of repayment options, including early repayment without penalties or additional fees.

- Trustworthiness: Consider reviews mentioning trustworthiness, reliability, and integrity of the lender in adhering to agreed-upon terms.

- Online Experience: Review feedback on the overall online experience, from application to approval process, highlighting ease of use and clarity of instructions.

Checking reviews and customer experiences is vital in making an informed decision on choosing the right car equity loan for your financial needs.

Conclusion

In conclusion, car equity loans offer quick cash with competitive interest rates. However, there are risks such as the possibility of car repossession and high fees. When choosing a loan, evaluate lenders and carefully review terms and conditions to make an informed decision that fits your financial needs.

Always prioritize privacy and data protection when seeking a borrowing option for unpredictable situations.

FAQs

1. What is a car equity loan?

A car equity loan lets you borrow money against the value of your vehicle.

2. How do I find the best car equity loan?

To find the top car equity loan, compare different lenders. Look at their interest rates, terms and customer reviews or complaints.

3. Are there any complaints about Yendo’s car equity loans?

You should research online for any Yendo reviews or complaints before deciding to take out a car equity loan with them.

4. How can I avoid issues with my car equity loan?

Avoid problems by understanding all terms before signing for your loan and making payments on time. Always check for lender reviews and complaints too!