Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Are you feeling shackled by the constraints of conventional business loans? You’re not alone. Many small businesses and aspiring entrepreneurs frequently grapple with the daunting requirements and prolonged processes that traditional banks demand.

As a seasoned financial consultant with extensive experience in alternative lending solutions, I’ve witnessed firsthand how innovative funding options can revitalize a company’s financial trajectory.

Enter FairFigure Capital Review– where your search for swift, flexible financing aligns with reality. With an impressive arsenal of customizable loan products and services designed to fuel growth without jeopardizing your credit health or assets, this platform stands out as more than just a lender; it’s a partner in your venture’s journey.

Keep reading to uncover how they’re rewriting the rules of business funding and why countless owners are turning to them for support—let’s dive into a financial revolution that could redefine your business strategy!

Fairfigure Capital Review Key Takeaways

- FairFigure Capital simplifies funding for businesses with a 15-minute application process and the option for same-day funding, helping you get the capital you need quickly.

- No personal guarantee is needed to secure loans from FairFigure Capital, protecting your personal assets while allowing access to funds that can fuel business growth or manage cash flow.

- Entrepreneurs benefit from an all-in-one business monitoring tool provided by FairFigure Capital, which gives insights into credit scores and budgeting advice to support financial decision-making.

- With partnerships in place with major credit bureaus, FairFigure Capital establishes a strong credibility foundation while offering competitive financing solutions even for those with limited credit history.

- Businesses earn cash back rewards on everyday expenses when they use financing options from FairFigure Capital, providing added value beyond traditional loan structures.

The Need for Business Funding

Are you looking to fuel the growth and expansion of your business? Do you need help managing cash flows to ensure stability and success in your venture? Read on to discover innovative funding solutions that can transform the way you approach business financing.

Fueling growth and expansion

Fueling growth and expansion isn’t just about having a great idea; it’s also about having the resources to bring that idea to life. With FairFigure Capital, you can tap into a reservoir of financial support that propels your business forward.

Whether it’s launching new products, entering untapped markets, or upgrading equipment, these funds play a crucial role in scaling your operations efficiently.

Securing the right amount of capital at the right time is pivotal for maintaining momentum in today’s fast-paced market. FairFigure Capital understands this urgency and offers real-time funding solutions that match your ambitions.

Imagine being able to inject capital into your projects within 24 hours of approval—this speed ensures you never miss an opportunity for expansion or competitive advantage because of financial constraints.

Managing cash flows

Keeping your business’s finances in check is crucial, and that’s where managing cash flows comes into play. With FairFigure Capital, you maintain a steady stream of capital to cover daily operations without dipping into personal assets or worrying about poor credit holding you back.

Smooth out the ups and downs of seasonal sales or unexpected expenses by leveraging flexible credit options designed for businesses just like yours.

Securing funds through FairFigure Capital can mean quick access to cash that helps bridge gaps when inventory needs buying or payroll is pending. Offering same-day funding, this innovative financing solution empowers you to make informed decisions on how best to utilize financial resources for sustaining and growing your venture.

And with the added perk of cash back rewards, every dollar spent working towards your business goals turns into future savings – making sure every bit of capital works as hard as you do.

FairFigure Capital: Innovative Funding Solutions

Looking for innovative funding solutions for your business? FairFigure Capital offers a quick and easy application process, as well as a wide range of financing options tailored to businesses of all sizes.

Quick and easy application process

Getting started with FairFigure Capital’s financing options doesn’t take all day. Businesses can breeze through the application process in just 15 minutes. Fill out a simple form, have a brief chat with a funding advisor to explore your options, and you’re on your way to signing a funding agreement that matches your needs.

Need funds fast? After approval, you could see capital injected into your business within 24 hours. Say goodbye to lengthy waits and hello to quick financial support that keeps pace with the speed of your business growth.

With FairFigure Capital, securing funding for your ventures is straightforward and swift, removing obstacles between you and the pursuit of success.

Wide range of financing options for all business sizes

FairFigure Capital offers a wide array of financing options suitable for businesses of any size. Whether you’re a small startup or an established enterprise, FairFigure has tailored solutions to meet your specific funding needs.

This includes lines of credit, business loans, and other financial products designed to fuel growth and expand your operations.

With FairFigure Capital’s diverse range of financing options, you can confidently pursue the capital that aligns with your business goals. From quick access to cash to manageable repayment plans, their offerings cater to various business requirements.

Whether it’s managing day-to-day cash flows or investing in long-term growth initiatives, they have financing structures suited for every stage of your business journey.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Why Choose FairFigure Capital?

Why should you choose FairFigure Capital? Well, with the ability to compare multiple loan options at once, same-day funding available, and cash back rewards for businesses, FairFigure Capital offers innovative and hassle-free financing solutions for your business.

Compare multiple loan options at once

Easily compare multiple loan options at once through FairFigure Capital, providing you with a hassle-free way to evaluate various financing choices in one place. This allows you to efficiently weigh the pros and cons of different funding options and select the best fit for your business needs.

Accessing multiple loan offers simultaneously empowers you to make an informed decision that aligns with your financial goals and growth strategy. FairFigure Capital streamlines the process, saving you time and effort while ensuring that you secure the most suitable business funding solution available in the market today.

Same-day funding available

Get funded quickly with FairFigure Capital’s same-day funding options. Once approved, businesses can receive the capital they need within 24 hours without the hassle of personal guarantees or extensive credit checks.

Say goodbye to long waiting periods and secure the funds you require for growth and stability.

FairFigure Capital prioritizes your business needs, offering a seamless application process that takes as little as 15 minutes to complete. With same-day funding available, you can address urgent financial requirements and propel your business forward without unnecessary delays or complications.

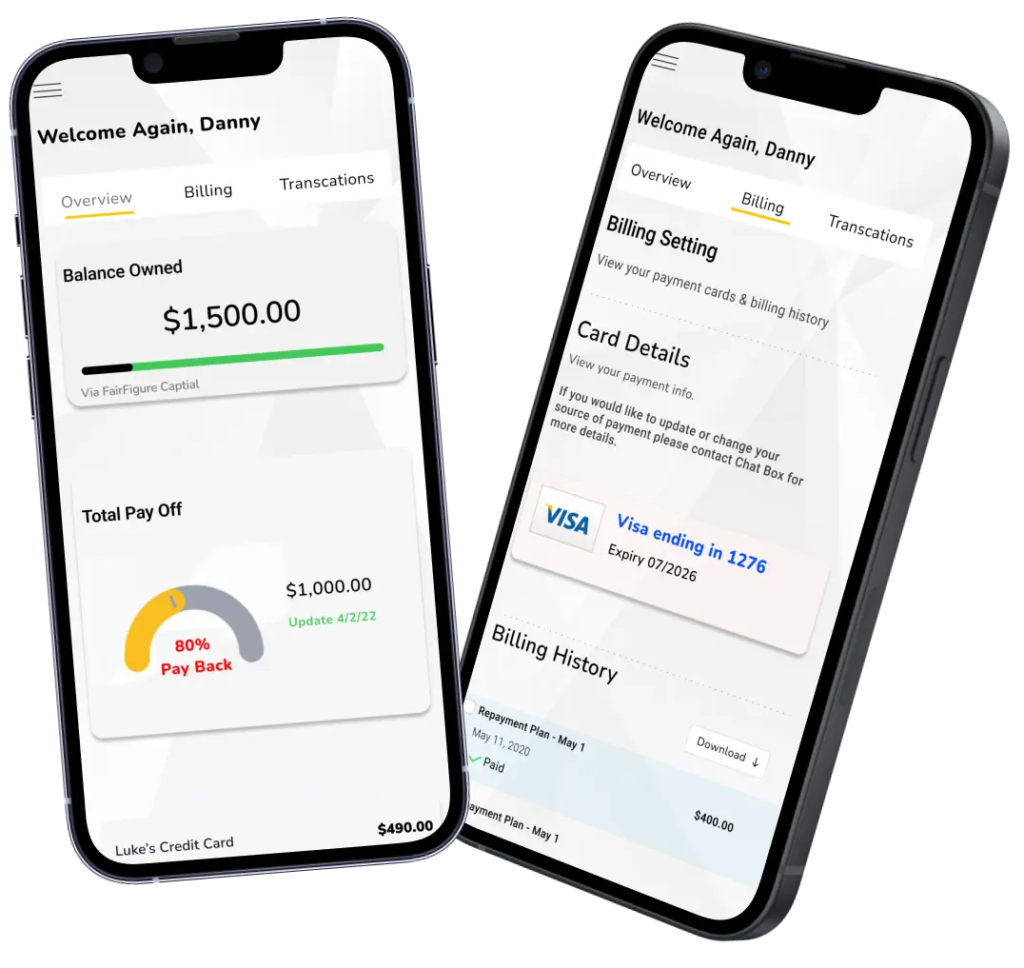

Cash back rewards for businesses

If you’re excited about the prospect of same-day funding, you’ll be thrilled to learn that FairFigure Capital also offers cash back rewards for businesses. This means that on top of accessing quick capital, your business can earn money back on everyday expenses.

With this unique feature, not only do you benefit from flexible credit options and an easy application process, but you also get rewarded for regular company spending.

Businesses looking for financial stability could find these rewards beneficial as they help offset costs and contribute to overall financial management. Plus, by leveraging a credit card that provides cash back incentives, small business owners can make their money work even harder for them.

Unique Features of FairFigure Capital

What makes FairFigure Capital stand out from traditional business loans? From no personal guarantee required to an all-in-one business monitoring tool, discover the unique features that make it a game-changer in business funding.

No personal guarantee required

FairFigure Capital offers a breath of fresh air for businesses in need of funding by eliminating the requirement for a personal guarantee. This means that you can secure the financing your business needs without putting your personal assets at risk.

With FairFigure Capital, you can access the capital you need to fuel growth and manage cash flow without the burden of providing a personal guarantee.

Moreover, FairFigure Capital provides innovative financing options that cater to businesses of all sizes, offering same-day funding without requiring a personal guarantee. Whether you’re a new business looking for initial funding or an established entrepreneur seeking quick capital injections, FairFigure Capital has got you covered with hassle-free application processes and flexible financing solutions—all without needing a personal guarantee.

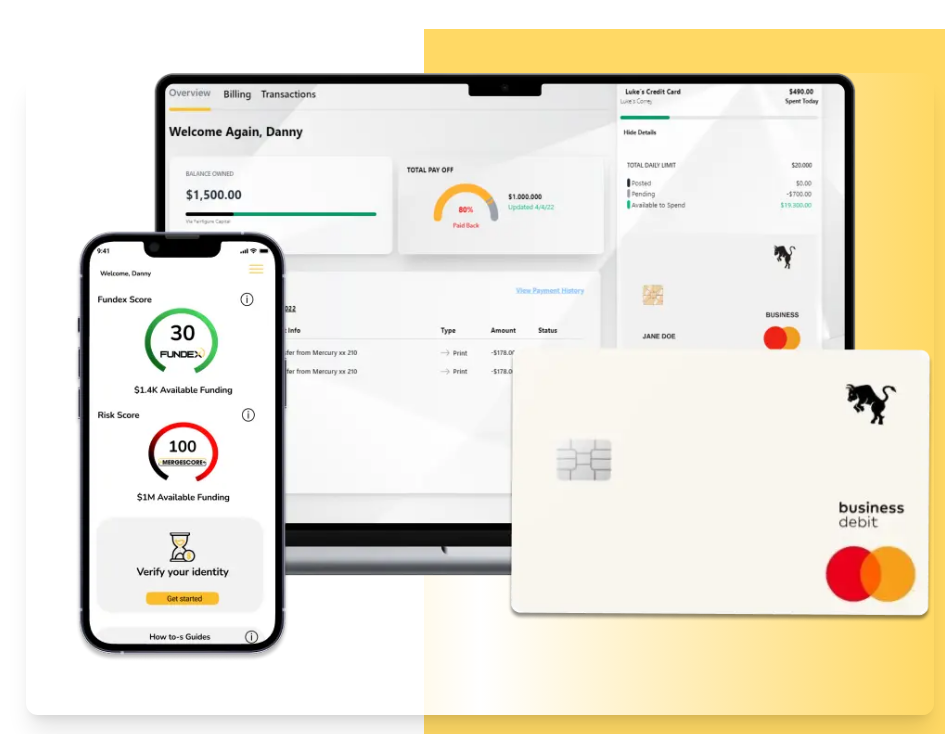

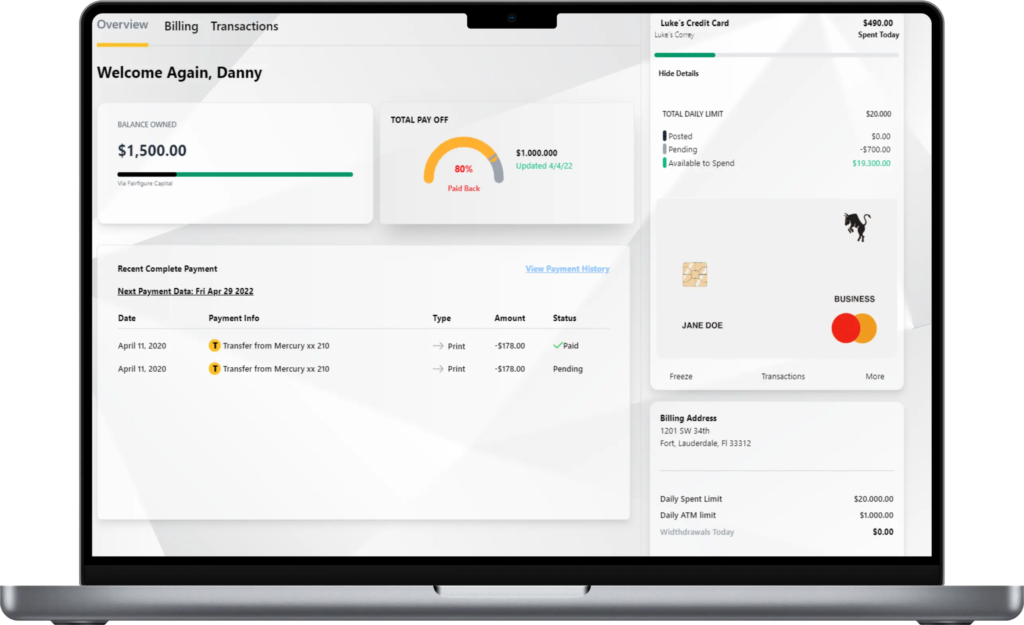

All-in-one business monitoring tool

FairFigure Capital empowers entrepreneurs and business owners with an all-in-one business monitoring tool designed to simplify financial management. With this tool, you can effortlessly check both your personal and business credit scores, gaining valuable insights into your creditworthiness.

In addition to tracking credit scores, the tool provides expert budgeting advice tailored to help you make responsible financial decisions for your business. This invaluable resource enables easy access to real-time funding options, allowing you to stay ahead of your financial needs and opportunities for growth.

By leveraging strategic partnerships with leading credit bureaus, FairFigure Capital ensures that the all-in-one business monitoring tool offers comprehensive visibility into your credit profile and helps establish the credibility needed to secure funding.

No hard credit checks necessary

Transitioning from the all-in-one business monitoring tool, it’s essential to note that FairFigure Capital offers a unique advantage for individuals and small businesses in need of credit and funding.

With FairFigure Capital, you can access funding without undergoing hard credit checks, making it easier for entrepreneurs with poor credit to secure the financial assistance they require.

This means that even if you have struggled with your credit history in the past, you still have opportunities to obtain crucial business capital through FairFigure Capital’s innovative financing solutions.

Eliminating the need for hard credit checks opens doors for new businesses looking for funding, empowers business owners in need of quick funds, and supports entrepreneurs with limited credit history.

Establishing credibility through credit bureau partnerships

FairFigure Capital solidifies its credibility through strategic partnerships with leading credit bureaus, including Equifax, Fundex, CreditSafe, Experian, and Transunion. These alliances set the stage for enhanced financial monitoring capabilities, ensuring that businesses have access to accurate and up-to-date credit information.

Thanks to these partnerships, FairFigure Capital provides comprehensive commercial credit scores from Equifax to contribute towards building a robust credit history for businesses and strengthen their credit profiles.

The crucial role played by the credit bureau partnerships in establishing the credibility of FairFigure Capital’s services cannot be overstated. Such collaboration guarantees that businesses receive the vital information necessary for effective financial management.

Practical Use Cases of FairFigure Capital

Are you a new business in need of funding? Or perhaps a business owner looking for fast access to funds without the hassle of traditional loans? Maybe you’re an entrepreneur with limited credit history who needs financial support.

FairFigure Capital offers innovative solutions for all these scenarios and more, providing practical use cases for businesses of all sizes.

New businesses looking for funding

FairFigure Capital is the perfect funding partner for new businesses. With quick and easy access to capital, FairFigure enables you to invest in growth and manage cash flows effectively.

Whether you are just starting or looking to scale up, FairFigure offers a wide range of financing options tailored to your business needs.

You can get funded in as little as 24 hours after approval, with an application process that takes only 15 minutes. Plus, with the ability to compare multiple loan options at once, FairFigure makes it easier than ever for new businesses to find the right funding solution.

Business owners in need of quick funds

When your business requires fast access to funds, FairFigure Capital offers a same-day funding option, enabling you to address urgent financial needs without delay. Whether it’s seizing an unexpected growth opportunity or managing cash flow gaps, the quick approval process and swift funding turnaround of FairFigure Capital provide a reliable solution.

With the ability to secure funding within 24 hours after approval, you can confidently navigate unforeseen financial challenges and propel your business forward with ease.

In need of quick funds? FairFigure Capital eliminates the lengthy wait times associated with traditional loan applications, streamlining the process so you can focus on leveraging the available capital for fueling growth and sustaining your business operations.

Entrepreneurs with limited credit history

Entrepreneurs with limited credit history can still access funding through FairFigure Capital, as the company does not require a personal guarantee for its business credit card. This makes it an ideal financing solution for those who are just starting out or have faced challenges in building a strong credit history.

With straightforward minimum criteria, including $10,000 monthly revenue and 6 months in business, FairFigure Capital aims to support entrepreneurs at various stages of their business journey.

FairFigure’s commitment to providing accessible funding options is evident in its willingness to consider businesses with limited credit history. By leveraging innovative financing solutions, entrepreneurs can secure the capital they need without facing unnecessary barriers due to past financial limitations.

Fairfigure Capital Review Conclusion: Changing the Game in Business Funding

Say Goodbye to Traditional Business Loans with FairFigure Capital

Why Choose FairFigure Capital for Your Business Funding Needs?

FairFigure Capital offers a quick and easy application process, providing a wide range of financing options for businesses of all sizes. Compare multiple loan options at once and enjoy same-day funding available.

What Makes FairFigure Capital Unique?

No personal guarantee required, an all-in-one business monitoring tool, no hard credit checks necessary, and the establishment of credibility through credit bureau partnerships are some unique features that make FairFigure Capital stand out.

How Can You Use FairFigure Capital in Your Business?

FairFigure Capital is ideal for new businesses looking for funding, business owners in need of quick funds, and entrepreneurs with limited credit history.

Discover how FairFigure capital is changing the game in business funding.

FAQs

1. What is Fairfigure Capital and how does it change business loans?

Fairfigure Capital offers an innovative capital card that serves as a line of credit for businesses, eliminating the need for traditional loans with collateral requirements.

2. Can startups benefit from Fairfigure’s offerings?

Absolutely! Startups can leverage Fairfigure’s user-friendly financing solutions to manage their business finances more effectively without worrying about strict credit limits and strenuous security audits.

3. Does Fairfigure report to credit reporting agencies?

Yes, Fairfigure participates in credit reporting which means using the capital card responsibly could strengthen your business’s credit profile over time.

4. How does Fairfigure keep my sensitive information safe?

Data protection is top priority at Fairfigure; they use encryption tools like SSL certificates to secure your transactions against phishing or malicious websites on the internet.

5. Are there any additional benefits to using a Fairfigure Capital Card?

Indeed, customers enjoy rewards programs alongside web hosting services and domain name service protections like Cloudflare and Let’s Encrypt that shield you from spammers while enhancing web performance.

6. Is account management complex with a Fair figure Capital Business Card?

Not at all – managing your account is straightforward thanks to its user-friendly interface designed for busy entrepreneurs seeking efficiency in innovation-driven funding solutions.