Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

💳 FIT Mastercard Credit Card- How To Get Instantly Approved For FIT Platinum Mastercard Review📞 Ready to get answers? – Schedule your call – https://houstonmcmiller.net/phone-consultation/ 💳 FIT Mastercard Credit Card- How To Get Instantly Approved For FIT Platinum Mastercard Review

Posted by Real Houston Mcmiller on Thursday, November 21, 2024

Finding the right credit card can be challenging. The Fit Mastercard has a one-time processing fee of $89 and an annual fee of $99. This article will explore its features, fees, and how it could fit your financial needs.

Keep reading to learn more.

Key Takeaways

- The Fit Mastercard welcomes those with lower credit scores, aiming to help rebuild or establish credit. It carries an $89 one-time fee and a $99 annual fee for the first year.

- This card has a high APR of 29.99% for all purchases and cash advances, making it essential to pay off balances monthly to avoid extra costs.

- It doesn’t offer balance transfer options but provides tools like a free monthly credit score check to track your credit improvement progress.

- After the first year, there’s a $6.25 monthly maintenance fee adding up to $75 annually, on top of other fees making cost management important for users.

- Comparisons with other cards like Capital One Platinum and OpenSky Secured Visa highlight differences in fees, APRs, and benefits helping users make informed choices based on their financial situation and goals.

Overview of Fit Mastercard

The Fit Mastercard is made for individuals and small businesses needing a fresh start or improvement in their credit journey. It opens doors to various features, while considering different credit histories.

Accepted Credit Scores

Credit scores can feel like a barrier to getting the credit card you need. Good news—Fit Mastercard is accessible for individuals with lower credit scores, making it an option for those working on improving their financial situation.

This card caters to a wide range of credit histories, even if yours isn’t perfect.

For small businesses and individuals aiming to fund their ventures or needs without stellar credit, this card offers a chance. It’s important to keep in mind that while Fit Mastercard welcomes applicants with less-than-ideal scores, responsible use is key to building your credit over time.

Fit Mastercard Annual Fee

The Fit Mastercard has an annual fee that may vary based on your creditworthiness. Here’s a breakdown of what you could expect:

- Standard Annual Fee – Everyone starts with a $99 annual charge. This is the fee you pay for the privilege of using the card.

- Variable Fees – Depending on your credit situation, this fee can range between $75 and $125 after the first year. The exact amount gets determined by how the card issuer views your credit history.

- First-Year Total – In your initial year, add the one-time processing fee of $89 to the annual fee of $99. That means you’ll be out $188 before even using your card.

- Subsequent Years – After the first year, besides the annual fee, don’t forget about the monthly maintenance fee of $6.25 which totals up to an additional $75 per year.

This breakdown illustrates that while the Fit Mastercard offers opportunities for those with less-than-perfect credit to build their score, it comes at a significant cost due to various fees, including a substantial annual fee.

Fit Mastercard APR on Purchases

Fit Mastercard comes with a high APR for purchases. Understanding this rate is key for managing your credit effectively.

- The APR is set at 29.99% for all purchases. This means interest can add up quickly if you carry a balance.

- No introductory APR offer exists for new cardholders. From the start, the 29.99% rate applies.

- This APR also applies to cash advances, making it costly to take out cash against your credit line.

- Interest charges start accruing immediately on cash advances—there’s no grace period like there is with purchases.

With such rates, paying off your full balance each month becomes crucial to avoid steep interest charges. Carrying a balance will significantly increase the overall cost of any purchases made with the card.

Fit Mastercard Balance Transfer

Understanding the ins and outs of balance transfers can save you a lot. Here’s a closer look at what to expect with the Fit Mastercard.

- Balance Transfer Availability – The card does not offer balance transfer options. This means you can’t move debt from another credit card to your Fit Mastercard to potentially save on interest.

- Alternative Strategies – Since transferring balances isn’t an option, consider other ways to manage existing credit card debt. A different card might be more suited for consolidating debt under a lower interest rate.

- Focus on Repayment – Use the Fit Mastercard to make new purchases wisely while paying off other balances. This approach can help improve your credit score over time by demonstrating responsible credit use.

- Checking Other Fees – Be mindful of other costs like the annual fee and monthly maintenance fees which could impact your budget.

- Credit Improvement Tools – While you can’t transfer balances, this card offers a free monthly credit score check, helping you track your credit improvement progress.

Each point guides you in managing finances better with the specific features of the Fit Mastercard in mind, pushing towards smarter money decisions without relying on balance transfers.

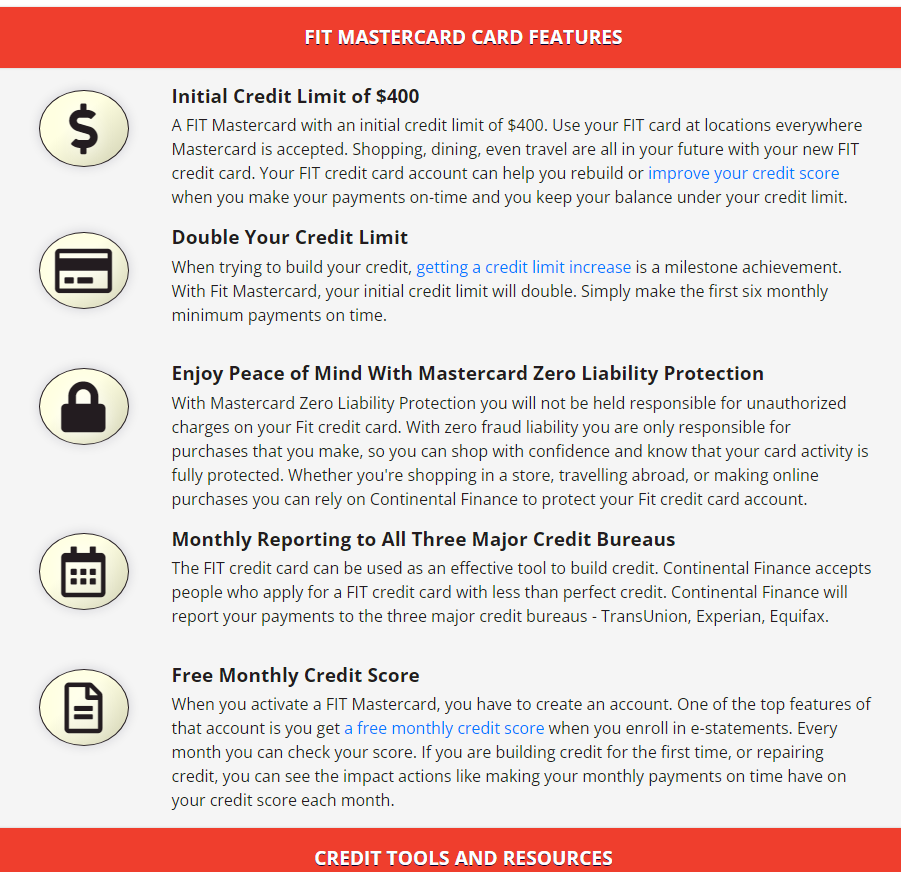

Fit Mastercard Features and Benefits

Here’s a concise summary of the Fit Mastercard’s features and benefits, laid out in a straightforward table for easy comparison. This format aims to provide clear, actionable information that’s especially useful for individuals and small businesses considering this credit card option.

| Feature/Benefit | Description |

|---|---|

| Accepted Credit Scores | Caters to a range of credit scores, including those rebuilding credit |

| Initial Credit Limit | $400 starting limit, with potential increases over time |

| Annual Fee | Varies by creditworthiness, $75 – $125 |

| APR for Purchases | 29.99% on both purchases and cash advances |

| Initial Processing Fee | One-time fee of $89 for account setup |

| Monthly Maintenance Fee | $6.25, after the first year |

| Foreign Transaction Fee | 3% of each transaction in U.S. dollars |

| Fraud Liability Coverage | Protects against unauthorized transactions |

| Free Monthly Credit Score Check | Enables monitoring and tracking of credit score improvements |

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

This table highlights the key features and fees associated with the Fit Mastercard, providing a clear overview for anyone considering the card as a tool for credit improvement or for its credit access benefits.

Fit Mastercard Fees and Costs

The Fit Mastercard comes with a detailed breakdown of fees and costs, crucial for budgeting. Check out the table to get clear insights on what you’ll pay—covering everything from initial processing to monthly maintenance.

Initial processing fee

Getting a new credit card involves costs, and the Fit Mastercard is no exception. One key expense is the initial processing fee.

- Charged once, this fee is $89.

- It’s payable before you can use your card.

- This amount doesn’t count toward your credit limit or any outstanding balances.

- Consider it an entry cost for accessing the credit line offered by Fit Mastercard.

This fee is crucial for individuals and small businesses looking to fund their operations or build credit. While it adds to the upfront costs of obtaining the card, knowing about it helps in financial planning.

Annual fee

The Fit Mastercard charges an annual fee, which varies based on your creditworthiness. This fee is a crucial aspect to consider for those managing personal finance or small business funding. Here’s a detailed breakdown:

- For the first year, expect to pay an annual fee of $99. This upfront cost is part of starting your journey with the Fit Mastercard.

- After the initial year, the annual fee could range between $75 and $125. The specific amount depends on how the card issuer assesses your credit management over time.

- The variation in the annual fee after the first year provides an incentive to improve and maintain good credit behavior, as better credit scores may lead to lower fees.

- Keep in mind, these fees are separate from other charges like monthly maintenance fees or one-time processing fees, adding to the overall cost of holding this card.

- Importantly, even if you’re building or repairing credit, weigh these costs against potential benefits like fraud liability coverage and free monthly credit score checks.

Each point illustrates a distinct aspect of the Fit Mastercard’s annual fee structure, guiding individuals and small businesses in their financial planning and decision-making processes.

Monthly maintenance fee

Paying attention to fees is crucial, especially for those looking into credit options. Let’s talk about the Fit Mastercard monthly maintenance fee:

- After the first year, you’ll start paying a $6.25 monthly maintenance fee. This adds up to $75 per year.

- This fee is separate from the annual fee and processing fee.

- It kicks in after your first 12 months of card use.

- The fee helps cover account servicing and access to credit management tools.

- Keep in mind, this fee applies even if you don’t use your card frequently.

Staying informed helps you manage your expenses better and make smarter financial decisions.

Pros & Cons of the Fit Mastercard

| Pros | Cons |

|---|---|

| Unsecured credit card, offering a starting credit line of $400 without a security deposit. | One-time processing fee of $89. |

| Free monthly credit score check, aiding users in monitoring their credit improvement. | High annual fee ranging from $75 to $125 based on creditworthiness. |

| Fraud liability coverage, providing a layer of security against unauthorized transactions. | Monthly maintenance fee of $6.25, adding up over time. |

| Accessible to individuals with various credit scores, broadening its applicant pool. | APR for purchases and cash advances stands at a steep 29.99%. |

| Higher credit limit than most subprime cards, giving room for larger purchases. | Foreign transaction fee of 3%, making it less ideal for international use. |

| Lacks rewards, such as cash back or points, that other cards offer. |

Comparing the Fit Mastercard with Other Credit Cards

See how the Fit Mastercard stacks up against others like Capital One Platinum and OpenSky Secured Visa—find out which card offers the best deal for you.

Fit Mastercard vs Capital One Platinum Credit Card

Choosing the right credit card can make a big difference in managing your finances, especially if you’re working on building or repairing your credit. Let’s compare the Fit Mastercard with the Capital One Platinum Credit Card to help you decide.

- Fees:

- The Fit Mastercard has a one – time processing fee of $89, while the Capital One Platinum does not charge any such fee.

- Fit also imposes an annual fee of $99, whereas Capital One Platinum has no annual fee, making it more cost-effective over time.

- Both cards report to the three major credit bureaus – Experian, Equifax, and TransUnion. This feature helps in building your credit score.

- Capital One offers additional tools like CreditWise to monitor your credit score for free, which is not available with the Fit Mastercard.

- The Fit Mastercard carries a high APR of 29.99% for purchases and cash advances.

- In contrast, Capital One Platinum often offers lower interest rates for those with average credit scores.

- With the Fit Mastercard, you’ll pay a foreign transaction fee of 3% of each transaction in U.S. dollars.

- The Capital One Platinum Credit Card does not charge any foreign transaction fees, perfect for travelers.

- The starting credit limit for the Fit MasterCard is $400 after paying the initial fees.

- Capital One Platinum starts with a potentially higher limit and offers automatic credit line reviews in as little as six months.

- Unlike the Fit Mastercard, which lacks rewards, Capital One Platinum includes benefits like fraud coverage and no penalty APR.

- Fit charges a monthly maintenance fee after the first year—adding up over time.

- Capital One does not have monthly maintenance fees, reducing long – term costs.

- The Fit Mastercard is unsecured, meaning no deposit is required.

– Conversely,the Capital One Platinum card comes in both secured and unsecured versions, offering flexibility based on your credit history.

Both cards offer pathways to better credit but cater to different needs and financial situations. Carefully consider fees, interest rates, and benefits before choosing your next card to ensure it aligns with your financial goals and situation.

Fit Mastercard vs OpenSky Secured Visa Credit Card

Comparing credit cards can save you money and stress. Let’s look at the Fit Mastercard and the OpenSky Secured Visa Credit Card.

- Credit Check Requirement: The Fit Mastercard doesn’t require a good credit score, making it easier for more people to get approved. OpenSky also doesn’t perform a credit check, appealing to those with poor or no credit history.

- Security Deposit: OpenSky requires a refundable security deposit from $200, which sets your credit limit. The Fit Mastercard is unsecured, with no deposit needed but comes with an $89 sign-up fee.

- Annual Fee: Both cards charge an annual fee – Fit Mastercard ranges from $75-$125 based on creditworthiness; OpenSky has a fixed $35 annual fee, making it cheaper over time.

- APR: Both have high APRs; however, Fit’s 29.99% APR on purchases and cash advances might be steeper than what you’d find with OpenSky.

- Credit Limit Increase: With OpenSky, you can increase your credit limit by adding to your security deposit. The Fit Mastercard offers potential increases without additional deposits but requires responsible card use and payment history.

- Monthly Fees: After the first year, Fit charges a monthly maintenance fee of $6.25, which adds up over time. OpenSky does not charge monthly fees, keeping costs more predictable.

- Foreign Transaction Fees: Planning to travel? Both cards charge a foreign transaction fee of 3%, so using either card abroad will cost you extra.

- Building Credit: Both report to the three major credit bureaus – Experian, Equifax, and TransUnion – helping you build or rebuild your credit with responsible use.

- Customer Service Access – Managing your account is crucial; both offer online account management but customer service experiences might vary between issuers (Bank of Missouri for Fit and Capital Bank for OpenSky).

Each card has its strengths depending on what you need – whether it’s avoiding a security deposit or minimizing annual fees.

Fit Mastercard FAQs

Got questions about the Fit Mastercard? You’re in the right place to find your answers. Keep reading and get all the info you need.

What is the Fit Mastercard credit limit?

The Fit Mastercard starts you off with a credit limit of $400. This is after you pay an $89 sign-up fee. Your credit line has room to grow though. If you use the card wisely and make payments on time, you might get a higher limit.

Keep in mind, this card comes with various fees including annual and monthly maintenance costs. It’s crucial to manage it well to avoid getting overwhelmed by charges while aiming for a credit increase.

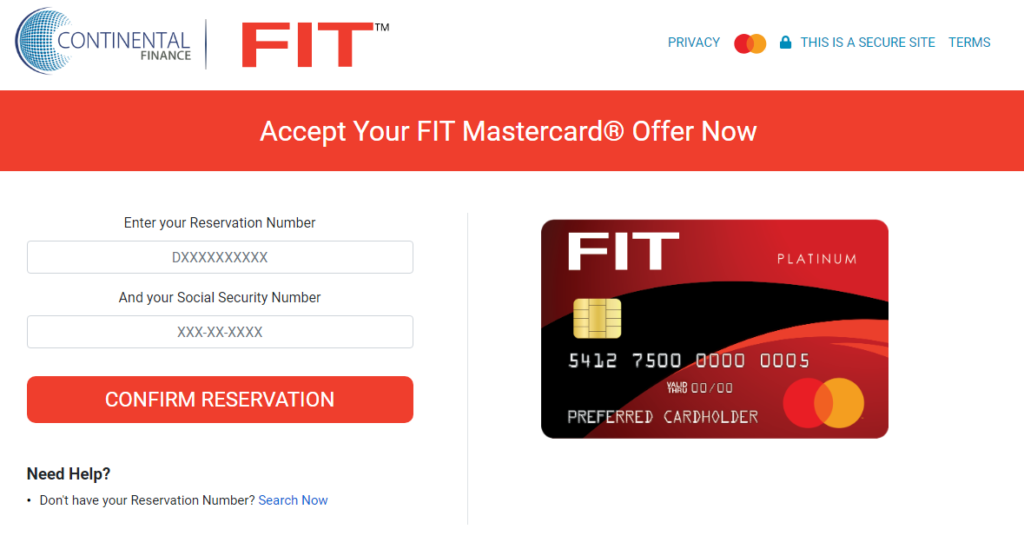

Does the Fit Mastercard have pre-approval?

Yes, getting a Fit Mastercard starts with pre-approval. This means you can check if you qualify without hurting your credit score. It’s a simple process that requires some basic information from you.

Once you fill out the form online, you’ll quickly find out if you’re pre-approved. This step is great because it gives you an idea if the card is right for you before going through the full application process.

Pre-approval doesn’t guarantee final approval, though. After this step, further checks into your credit report happen. Your financial situation gets a closer look to decide on your actual approval and credit limit.

Keep in mind, even with pre-approval, reading all terms carefully is crucial to understand what comes next in the application process.

What credit score is needed for the Fit Mastercard Credit Card?

The Fit Mastercard Credit Card caters to a wide audience, not limiting itself to high credit scores. It’s designed for individuals and small businesses working on building or rebuilding their credit.

A specific credit score minimum isn’t set in stone. This makes the card accessible even if your score isn’t perfect.

Approval chances improve with better credit, but the card mainly targets those with less-than-ideal scores. Keep in mind, regardless of your starting point, using this card responsibly can help enhance your creditworthiness over time.

Conclusion

Choosing Fit Mastercard might be a smart move for some, especially those working on credit improvement. Yes, it has fees—think $89 sign-up and up to $125 annual—but it also offers fraud protection and monthly credit score checks.

No rewards or cash back here, but a higher initial credit line than many others is a plus. Before you decide, weigh these features against the costs. Is it your financial fit? Only you can say.

FAQs

1. What makes the Fit™ Platinum Mastercard® stand out?

The Fit™ Platinum Mastercard® shines with its easy approval process for those building credit, providing a chance to improve credit scores by reporting to major credit bureaus—Experian, Equifax, and TransUnion.

2. Are there any fees I should know about with the Fit Mastercard?

Yes, keep an eye on annual fees, cash advance fees, and APR (annual percentage rate). These are standard but crucial to understand how much you’ll pay for using the card.

3. Does the Fit™ Platinum Mastercard® offer rewards like other cards?

While it focuses more on building or repairing credit rather than rewards, it does come with benefits like MasterCard Zero Liability Protection against unauthorized transactions.

4. Can I use this card everywhere?

Absolutely! The Fit™ Platinum Mastercard® is accepted wherever MasterCard is—a global reach that includes millions of locations worldwide.

5. How does owning a Fit™ Platinum Mastercard® help my credit score?

By making timely payments and keeping your credit utilization low, this card reports your good habits to credit bureaus—gradually boosting your score over time.

6. Is there support for managing my account easily?

Definitely! With online payment options and 24/7 access to your account details through logging in from anywhere—you’ve got control right at your fingertips.