Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

In the quest for financial wellness, your credit score is a pivotal ally, opening doors to opportunities from favorable loan terms to dream homes. Yet many wonder if services like MyFICO truly unlock the potential of their credit insights or just add another dent in their wallets.

With years of scrutinizing credit-related offerings under my belt, I’ve seen my share of promises and pitfalls within this industry.

In this MyFICO Review we position oursselves as a beacon for those navigating the murky waters of personal finance; it’s not merely about tracking numbers but understanding the very DNA of your financial identity.

What sets this review apart is its focus on whether MyFICO stands as that rare gem providing clarity amidst confusion—worth its weight in gold—or if it’s simply sailing on hype.

Ready to delve deeper? Let’s unfold the mystery.

Myfico Review Key Takeaways

- MyFICO is a specialized division of Fair Isaac Corporation offering credit monitoring, detailed FICO score reports, and identity theft protection designed to help individuals and small businesses manage their financial health.

- The company offers various service plans with features such as regular updates from 1-Bureau or comprehensive 3-Bureau reports, alerts on changes in your credit profile, dark web surveillance for enhanced security, and accessible educational resources to understand credit management better.

- Customer feedback indicates that while many users benefit from the accurate FICO scores used by lenders and the helpful tools provided for credit insight, there are concerns about the cost of services compared to other providers.

- MyFICO has an A+ rating with BBB and addresses customer complaints effectively; however, user reviews suggest contrasting views regarding pricing and some limitations in service offerings.

- Privacy-conscious users can feel secure as MyFICO prioritizes strong privacy measures like two-factor authentication and encryption protocols to safeguard personal data.

What is MyFICO?

MyFICO is a consumer division of Fair Isaac Corporation, the company behind the FICO score used by many lenders to assess creditworthiness. They offer credit score monitoring, credit report tracking, and identity theft protection services to help individuals and small businesses manage their financial health.

Overview and company information

Fair Isaac Corporation, a name synonymous with credit scores, extends its expertise to you through MyFICO. With tools designed for monitoring your credit and accessing detailed FICO score reports, this consumer division helps individuals and small businesses stay on top of their financial health.

Understanding the ins and outs of lending practices becomes simpler as MyFICO provides various score calculations that can influence auto loans, mortgages, and personal loan approvals.

You get more than just standard tracking with MyFICO; it’s about securing your financial future. Identity theft protection comes built into every plan, giving you peace of mind while navigating today’s complex fiscal landscape.

Full access to educational resources also ensures you are well informed on how best to maintain or improve your excellent credit standing or work towards building good credit from the ground up.

MyFICO Services

MyFICO offers a range of services including credit score monitoring, credit report tracking, and identity theft protection. If you want to learn about the benefits of using these services and how they can help you improve your financial health, keep reading.

Credit score monitoring

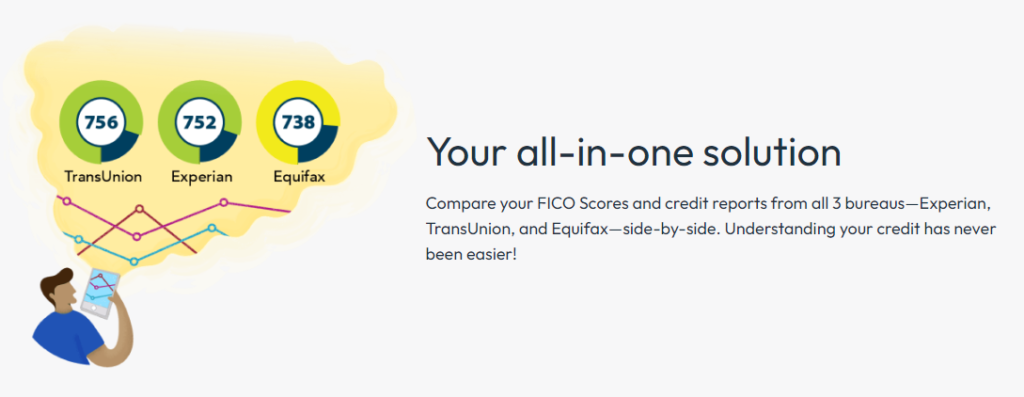

Credit score monitoring with MyFICO puts you in the driver’s seat of your financial standing. Regular updates from 1-Bureau or comprehensive 3-Bureau reports keep tabs on your credit health, alerting you to changes as they happen.

Armed with this information, you’re better positioned to build credit, manage loans more effectively, and make smarter decisions about personal and business funding.

Stay vigilant against errors that could drag down your FICO scores. With detailed insights and customizable tracking graphs provided by MyFICO services, pinpointing inaccuracies becomes simpler.

Use their prepared form letters to challenge any discrepancies swiftly and maintain an accurate reflection of your creditworthiness for everything from car loans to life insurance applications.

Credit report tracking

Keeping an eye on your credit report is crucial, and MyFICO makes this task easier. With its services, you can monitor all the vital details that impact your financial health. You’ll get alerts about changes in your credit reports and scores from Experian, TransUnion, and Equifax.

This means you won’t miss any important updates that could affect your ability to secure loans or funding for your business.

MyFICO’s detailed insights give you the power to understand exactly what influences your score. A graph reflects how it fluctuates over time while a breakdown helps pinpoint which factors are helping or hurting you most.

Whether it’s payment history or debt levels affecting your score versions, MyFICO’s tracking tools help identify areas for improvement so that maintaining good credit becomes less of a challenge and more of a strategic advantage in managing finances.

Identity theft protection

MyFICO offers identity theft protection as a part of their subscription plans, providing an essential safeguard for your personal and financial information. With the rise in cyber threats and data breaches, it’s crucial to have reliable protection against identity theft.

MyFICO’s service includes features such as dark web surveillance, credit monitoring, and alerts for any suspicious activity. By leveraging these tools, you can stay proactive in protecting your identity and preventing potential financial harm.

In addition to monitoring services, MyFICO provides form letters to dispute inaccuracies in credit reports. This simplifies the process of addressing any discrepancies on your report, saving you time and effort while ensuring that your credit history remains accurate.

Ultimately, by incorporating identity theft protection into their offerings, MyFICO aims to equip individuals with the necessary resources to secure their financial well-being in an increasingly digital world.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Pricing and Plans

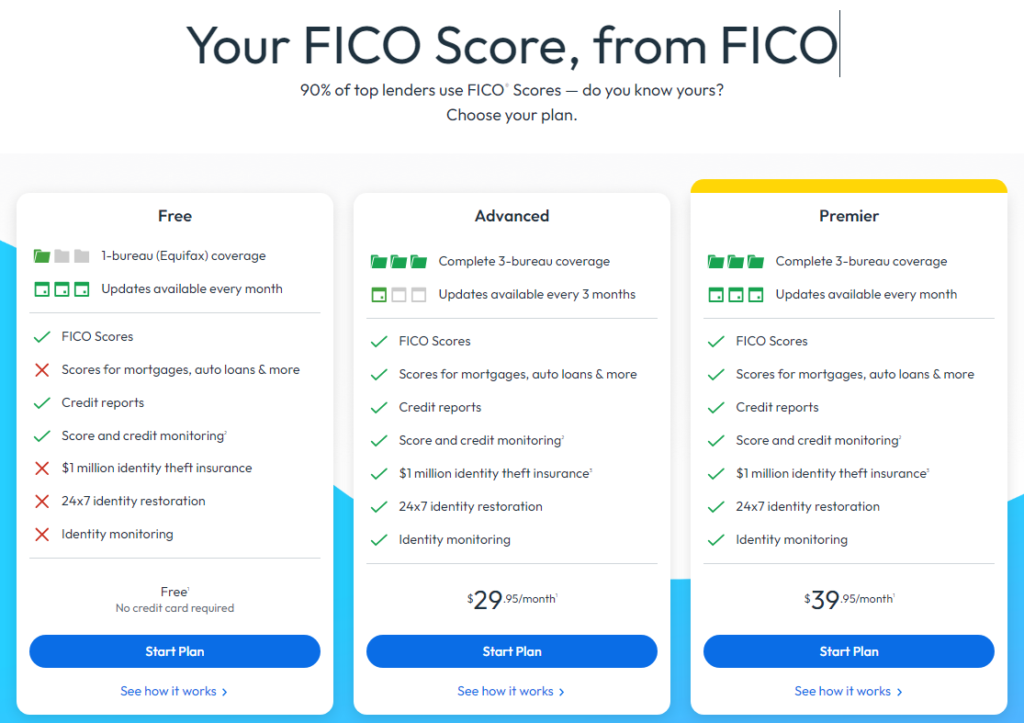

MyFICO offers a range of pricing plans, including a free option with limited features and more advanced paid plans. These paid plans provide additional services such as credit score monitoring and identity theft protection, but it’s essential to weigh the costs and benefits before making a decision.

Free plan option

The free plan option from MYFICO provides access to a limited range of credit monitoring tools, including identity restoration support and lost wallet protection. However, this plan does not include key features like FICO scores and credit report tracking that are crucial for comprehensive financial management.

While the free plan offers some basic security measures, it lacks the in-depth insights provided by higher-tier plans. If you’re seeking a more thorough understanding of your credit health and potential identity theft risks, it may be worth considering one of MYFICO’s paid packages to access their full suite of services.

Advanced plan features

The advanced plan features of MyFICO provide comprehensive credit monitoring and report tracking services. Here are the key features included in the advanced plans:

- Monitoring credit reports at all three bureaus – FICO Advanced and FICO Premier offer continuous monitoring of credit reports at Equifax, Experian, and TransUnion, providing a comprehensive view of your credit activity.

- Detailed insights into credit data – The advanced plans offer unique insights regarding credit data, including quarterly or monthly reports and scores. This allows you to stay informed about changes in your credit profile.

- Identity theft monitoring – FICO Advanced and FICO Premier plans include identity theft monitoring, providing an extra layer of security for your personal information.

- Additional features beyond the basic package – With the advanced plans, users have access to form letters to dispute inaccuracies in credit reports, making disputes easier and more manageable.

- Historical tracking graph and score breakdown – MYFICO provides a historical tracking graph showing how your score has changed over time, as well as a breakdown of factors affecting your score—empowering you with actionable insights to improve your creditworthiness.

How Accurate is MyFICO?

When it comes to accuracy, MyFICO has been compared to other credit bureaus and has received mixed reviews from users. While some users have found their scores to be fairly accurate, others have reported discrepancies between their MyFICO score and scores from other bureaus.

It’s important to consider user experiences and do a thorough comparison before relying solely on the accuracy of MyFICO for your financial decisions.

Comparison to other credit bureaus

Understanding how MyFICO stacks up against other credit bureaus is critical for those of you keen on managing your credit efficiently. As you navigate the path to optimal financial health, let’s examine MyFICO’s services in relation to its competitors with an analytical lens.

| Feature | MyFICO | Credit Karma | Experian |

|---|---|---|---|

| Credit Scores Provided | FICO Scores | VantageScore | FICO & VantageScore |

| Number of Bureaus | 1-Bureau & 3-Bureau options | 2 Bureaus (TransUnion & Equifax) | 1-Bureau (Experian) |

| Score Insight Details | Score factors & historical tracking graph | Limited insights into score factors | Score factors & alerts |

| Plan Options | Basic, Advanced, Premier Plans | Free | Free & Paid Options |

| Credit Report Tracking | Yes | Yes, but less detailed | Yes |

| Identity Theft Protection | Available on Advanced & Premier Plans | Not Available | Available on Paid Plans |

MyFICO shines by offering both 1-Bureau and 3-Bureau credit reports, allowing you a comprehensive view not provided by Credit Karma’s 2-Bureau limit. With detailed insights including historical tracking graphs, MyFICO outpaces Experian’s offering of only score factors and alerts. However, Experian provides both FICO and VantageScore, a versatility not found in MyFICO’s singular focus on FICO scores. Price-conscious individuals may gravitate towards Credit Karma’s free services, but MyFICO’s paid plans deliver extensive features for those seeking in-depth analysis and protection.

User experience and reviews

Users of MyFICO have reported high levels of satisfaction with the immediate access to scores and reports, detailed credit insights, and FICO Score Simulator feature. The easy-to-read credit reports with a breakdown of credit factors have been particularly praised for their clarity and helpfulness in understanding their financial standing.

Additionally, the availability of form letters for disputing inaccuracies in credit reports has provided users with practical tools for improving their credit accuracy.

Many users have also appreciated the actual FICO scores used by loan officers, along with the reliable credit monitoring and alerts offered by MyFICO. This has given them peace of mind knowing that they are receiving accurate information that aligns with what lending professionals use when making important financial decisions.

Customer Complaints

Many users have expressed frustration with MyFICO’s customer service and billing practices, leading to numerous complaints filed with the Better Business Bureau. Additionally, there are mixed reviews regarding the accuracy of credit scores provided by the service.

BBB complaints and ratings

Understanding the customer satisfaction and reputation of MyFICO is pivotal for you, especially if you are in pursuit of improving your credit scores or maintaining your financial health. With an A+ rating from the Better Business Bureau, MyFICO stands out as a service with a strong track record.

| BBB Aspect | Details |

|---|---|

| Rating | A+ |

| Accreditation | Yes, MyFICO is BBB accredited. |

| Customer Reviews | Typically positive, with emphasis on accuracy and usefulness of credit information. |

| Complaint Resolution | MyFICO addresses complaints effectively, a factor contributing to their high BBB rating. |

| Common Issues | Issues, when they occur, often revolve around billing or service misunderstandings, which are generally resolved satisfactorily. |

| Trust Factor | An A+ BBB rating signifies a high level of trust and consumer confidence in MyFICO services. |

MyFICO’s commitment to resolving customer issues is reflected in the A+ rating, reassuring you of its dedication to service quality and client satisfaction. For individuals and small businesses aiming for credit excellence, MyFICO’s BBB standing underscores its reliability as a credit monitoring partner.

User complaints and reviews

Moving from BBB complaints and ratings to user complaints and reviews, it’s essential to consider the experiences of actual customers. Many users have voiced concerns about the high cost of MyFICO plans, finding them unreasonably expensive compared to alternative credit monitoring services.

Some users also express dissatisfaction with MyFICO’s basic tier, which only draws data from one credit bureau, limiting the scope of their credit monitoring. These common frustrations highlight a need for more affordable options that offer robust features without compromising on comprehensive credit report tracking.

In addition to pricing issues, some users have raised concerns about specific limitations within MyFICO’s service offerings. For example, certain individuals find that the identity theft protection provided by MyFICO falls short in comparison to standalone identity monitoring services available at lower prices elsewhere.

Is MyFICO Worth the Money?

Based on the pros and cons, as well as user reviews, you can determine if MyFICO is worth the cost for your specific credit monitoring needs. You may also want to consider alternative options that offer similar services at a lower price point before making a decision.

Pros and cons

MyFICO offers immediate access to credit scores and reports, various score calculations, and identity theft protection. It also provides detailed insights into credit scores and factors affecting them. Additionally, the FICO Score Simulator feature allows users to determine how future financial moves will impact their credit. Moreover, MyFICO offers form letters to dispute any inaccuracies in the credit report, making disputes easier. However, the cost of MyFICO can be a disadvantage for some individuals and small businesses. Also, the basic tier uses only one credit bureau, limiting its scope compared to other services that may use multiple bureaus for reporting.

Alternative options

When considering credit monitoring services, it’s important to explore alternative options that offer unique features and benefits. In addition to MyFICO, Credit Karma and Experian are viable choices for individuals and small businesses in need of credit and funding.

- Credit Karma provides free credit scores and reports from TransUnion and Equifax, as well as personalized recommendations for financial products based on the user’s credit profile.

- Experian offers credit score tracking, personalized insights, and dark web surveillance to protect against identity theft, providing a comprehensive approach to credit monitoring.

Privacy and Security

MyFICO takes privacy and security seriously, with strong measures in place to protect user data and prevent unauthorized access. This includes two-factor authentication, encryption protocols, and strict adherence to privacy policies.

App privacy and data usage

To ensure the protection of your personal information, MyFICO emphasizes strong app privacy and data usage practices. The extensive security measures and encryption protocols safeguard your data from unauthorized access.

By employing secure servers and advanced encryption methods, MyFICO ensures that your sensitive financial details are shielded from potential threats.

Moreover, MyFICO limits the collection and usage of user data to only what is necessary for providing their credit monitoring services. As a result, you can trust that your information remains safe within the confines of their platform, offering peace of mind as you navigate through your credit score journey.

How user data is linked and tracked

MyFICO collects and links user data across multiple sources to provide comprehensive credit reports and monitoring services. This includes accessing scores and reports from all three credit bureaus, indicating that user data is being linked for a holistic view of individual credit profiles.

Moreover, MyFICO’s detailed insights into credit scores and personalized advice suggest that user data is being analyzed to provide tailored financial guidance.

Furthermore, the provision of actual FICO scores used by loan officers implies that user data is utilized in generating these crucial metrics. Additionally, the support offered for disputing errors on reports, as well as assistance for identity theft cases, indicates that MyFICO uses user data to deliver personalized support and fraud protection services.

Myfico Review Conclusion

In summary, MyFICO provides comprehensive tools for monitoring credit scores and protecting against identity theft. These strategies offer practical and efficient ways to improve your financial health.

Have you considered how implementing these techniques could positively impact your credit score? You have the power to make significant improvements by taking proactive steps with services like MyFICO.

Explore further resources or professional guidance to continue enhancing your financial well-being. Remember, every small step towards financial literacy can lead to significant long-term benefits for individuals and small businesses alike.

FAQs

1. What does MyFICO offer for tracking credit scores?

MyFICO provides monitored credit reports, score updates from the major credit bureaus, and financial insights to help you understand your FICO scoring.

2. Does MyFICO include features to protect against identity theft?

Yes, MyFICO offers identity theft insurance and malware protection to safeguard your personal data from cyber threats.

3. Can I use MyFICO for more than just monitoring my credit card activity?

Absolutely! With MyFICO, you can track various accounts like savings accounts, investment accounts, student loans, and even look into personal loans or home loan opportunities.

4. Are there any educational tools provided by MyFICO to improve my credit health?

Indeed! The website equips users with resources explaining different facets of credit reporting and how they affect your score Fico while also debunking myths related to fako scores versus actual Fico credit scoring.

5. Is it easy to access my information on the go with MyFICO?

Thanks to their digital security measures, logging in safely from devices like an iPad or using browsers on MacOS is simple and secure; so managing your profile on the web is convenient anytime.

6. How does Experian Boost work within the services offered by MyFICO?

Experian Boost can contribute positively towards improving your fair or bad credit score by incorporating additional bill repayment data such as utilities or rent reporting into the overall calculation of your Fico score through consumer reporting agencies.