Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Navigating the world of credit cards can be a maze of enticing offers and hidden pitfalls, especially for those with blemished or limited credit histories. As a seasoned personal finance expert who has dissected countless credit card terms and untangled the web of financial jargon, I bring to you an unvarnished look at one such offering in this Reflex Credit Card Review.

This card positions itself as a beacon for rebuilding or establishing credit, but is it truly a shining light or does it cast long shadows with its fees?.

In this review, we’ll meticulously examine every facet of the Reflex Credit Card—from its sky-high APR to its potential as a tool for improving your credit score. With WalletHub’s ratings in hand—ranking 1.9 out of 5 for fees and APR—it beckons the question: Does the Reflex Card merit space in your wallet? Keep reading; this analysis aims to demystify that very quandary with clear-eyed scrutiny and no-nonsense guidance designed just for you.

Let’s find out together if this is friend or foe in your fiscal journey.

Reflex Credit Card Review Key Takeaways

- The Reflex® Platinum Mastercard® is designed to help individuals with limited or bad credit histories improve their credit scores by reporting monthly to major credit bureaus.

- Cardholders face high annual fees ranging from $75-$125 in the first year and up to $10 per month thereafter, along with a high APR of 29.99%.

- While offering potential instant approval and no security deposit requirement, the card’s low initial credit limit and restricted increases may not suit everyone’s financial needs.

- Alternatives to consider include secured credit cards with lower fees and interest rates, as well as credit builder loans that can also help build positive payment history.

- Despite its ability to aid in building or improving a credit profile, evaluating all associated costs against your financial goals is crucial when deciding if the Reflex® Platinum Mastercard® is worth it for you.

Overview of the Reflex® Platinum Mastercard®

Who Benefits from the Features of the Reflex® Platinum Mastercard®?

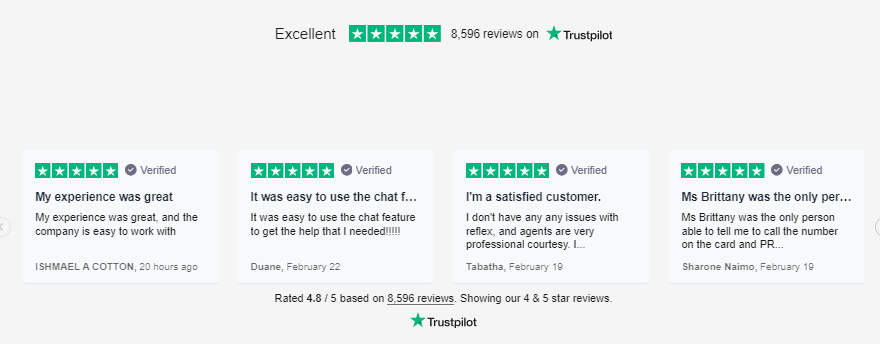

The Reflex Card emerges as a beacon for individuals and small businesses striving to navigate the turbulent seas of credit building or recovery. Swift like digital money transfer, this plastic companion does not demand a security deposit while vigilantly relaying your financial conduct to Experian, Equifax, and TransUnion monthly.

It’s akin to having a steadfast ally in the quest for an enhanced FICO score, potentially unlocking doors to more favorable mortgage rates or superior terms on auto loans.

What Sets the Reflex® Platinum Mastercard® Apart in Credit Building?

Embracing those often sidelined by traditional financial institutions due to past credit missteps or scant history, the Reflex Mastercard offers instant approval odds online for qualified aspirants with a checking account at their disposal.

You’re looking at an initial credit line that can embolden your purchasing power while serving as a tool for constructing a robust credit foundation—a critical stepping stone towards securing substantial personal loans or business credit lines down the road.

Pros and Cons of the Reflex® Platinum Mastercard®

When considering the Reflex® Platinum Mastercard®, it’s important to weigh the benefits and drawbacks. Pros include its focus on building credit, potential for instant approval, and reporting to major credit bureaus.

However, cons such as high annual fees, a high APR, and the requirement of a checking account may give some individuals pause.

Pros: Designed for building credit, potential for instant approval, reports to all major credit bureaus

Want to kickstart your credit journey or give it a boost? The Reflex® Platinum Mastercard® could be the tool you need. This card is specifically designed to help individuals and small businesses establish or rebuild their credit profiles.

With each on-time payment, your responsible use is reported to all three major credit bureaus – Experian, Equifax, and TransUnion. That means every swipe of your card can contribute positively to your overall credit history.

Eager for some quick results? You might find that the Reflex® Platinum Mastercard® offers potential for instant approval upon application. Forget about waiting weeks to know if you’ve been approved; this feature allows you quickly move forward in building or repairing your credit without delay.

Keep in mind that establishing a solid credit foundation can unlock doors to more favorable loan terms and increase opportunities for funding down the line – making this card a strategic choice for proactive planners aiming for long-term financial strength.

Cons: High annual fees, high APR, requires a checking account

The Reflex® Platinum Mastercard® hits your wallet hard with substantial annual fees ranging from $75 to $125 in the first year alone. From the second year, expect to fork out up to an additional $10 per month, which means yearly costs could soar between $195 and $245.

These fees can be a significant burden for individuals and small businesses striving to manage their finances effectively.

This card also packs a punch with a high APR of 29.99%, substantially above many other credit options on the market. Such an interest rate can quickly inflate your borrowing costs if you carry a balance, making this card an expensive choice in the long run.

Moreover, having a checking account is mandatory for using the Reflex Card, limiting flexibility for those who prefer or need alternative payment methods for managing their accounts and monthly payments.

Understanding the Fees of the Reflex® Platinum Mastercard®

What are the annual fees, interest rates, late fees, and foreign transaction fees associated with the Reflex® Platinum Mastercard®? Are these fees worth it in light of the card’s benefits?

Annual fees

The Reflex® Platinum Mastercard® charges an annual fee ranging from $75 to $125 for the first year, and then up to $10 per month thereafter. This cumulative amount increases significantly in the second year and beyond, totaling between $195 and $245 annually.

For individuals or small businesses with limited or no credit history, this combination of initial annual fees followed by monthly charges could make the Reflex Card a less attractive option compared to other similar cards on the market.

Interest rates

Considering the Reflex® Platinum Mastercard®? You’ll need to carefully assess its interest rates. With a regular APR of 29.99% (Variable), which is notably higher than the average penalty APR, it’s crucial to weigh this aspect against potential benefits before making any decisions.

WalletHub gave the Reflex Card a low rating for APR, with an Editor’s rating of 2.0 out of 5 – a clear indication that this could significantly impact your overall cost and financial strategy when using this card.

Late fees

Late fees with the Reflex® Platinum Mastercard® can quickly add up, significantly impacting your overall credit card balance. It’s essential to ensure timely payments to avoid these charges and maintain financial stability.

With hefty late fees in place, it’s crucial to stay organized and on top of your due dates.

A checking account is required for making monthly payments, so be sure to have a reliable system in place that allows you to manage your finances effectively. Setting up automatic payments or creating calendar reminders can help you avoid late fees and keep your credit card account in good standing.

Foreign transaction fees

The Reflex Platinum Mastercard charges a 3% foreign transaction fee on each transaction in U.S. dollars, making it less cost-effective for international travel. This fee can add up significantly, especially for frequent travelers or those who make large purchases abroad.

If you often conduct transactions in foreign currencies or frequently travel outside the U.S., this additional charge may impact your overall credit card expenses unexpectedly.

Consider comparing this fee with other similar credit cards to ensure that you are getting the best value for your spending when using the Reflex Platinum Mastercard internationally.

Advertisment Disclaimer: The products featured here may include paid promotions. Though this can affect coverage, it does not impact the objectivity of our recommendations, which remain impartial. Our partners support site operations but don’t influence our unbiased reviews.

Limitations of the Reflex® Platinum Mastercard®

Is the Reflex® Platinum Mastercard® the best option for you? Here are some limitations to consider:

– Low initial credit limit

– Limited credit limit increases

Low initial credit limit

The Reflex Card may present a hurdle for some individuals and small businesses with its low initial credit limit. This limitation can restrict your purchasing power, especially if you are in need of immediate funding or looking to make substantial purchases on the card.

As a result, it’s important to consider whether this initial limitation aligns with your financial needs and goals before applying for the Reflex Card.

Furthermore, the combination of annual and monthly fees associated with the Reflex Card could amplify the impact of a low initial credit limit, ultimately making it less appealing for those seeking access to additional funds without facing significant upfront expenses.

Limited credit limit increases

Limited credit limit increases may pose a challenge for individuals and small businesses seeking to grow their purchasing power. This restriction means that even with responsible card use, you may face limitations on how much your credit limit can increase over time.

It’s important to consider this aspect when evaluating if the Reflex Platinum Mastercard is the right fit for your financial needs, particularly if you anticipate requiring higher spending capacity in the future.

The limited credit limit increases associated with the Reflex Platinum Mastercard could impact your ability to make larger purchases or manage fluctuations in expenses effectively.

Use Case Scenarios

Are you wondering if the Reflex® Platinum Mastercard® is a good fit for your financial situation? Whether you have limited credit history, are looking to rebuild bad credit, or want to improve your credit score, this section will help you understand the practical applications of this card.

Check out our use case scenarios and find out how it could work for you.

For those with limited or no credit history

If you have limited or no credit history, the Reflex® Platinum Mastercard® may provide an opportunity to kickstart your credit journey. This card is designed for individuals who are seeking to establish or rebuild their credit.

While it does come with high annual fees and interest rates, it offers potential instant approval and reports to major credit bureaus – essential elements in building a positive credit history.

When considering this card, keep in mind that the combination of annual and monthly fees may not be ideal for those with limited income or resources. However, if used responsibly, the Reflex Card can serve as a tool to demonstrate your ability to manage credit effectively and pave the way toward accessing more favorable financial products in the future.

For those with bad credit looking to rebuild

Rebuilding your credit can be a challenging journey, but the Reflex® Platinum Mastercard® offers a potential path forward. Despite its high annual fees and APR, this card is designed specifically for individuals with bad credit looking to improve their financial standing.

By utilizing the Reflex Credit Card responsibly and making timely payments, you have an opportunity to demonstrate improved creditworthiness over time. With no minimum deposit required and regular reporting to major credit bureaus, this card offers a chance for those with bad credit to rebuild their financial reputation.

If you’re ready to take proactive steps toward rebuilding your credit, consider whether the Reflex® Platinum Mastercard® aligns with your goals and budgetary constraints.

For those who want to improve their credit score

Improving your credit score is crucial for accessing better financial opportunities. The Reflex® Platinum Mastercard® can support this goal by reporting your account information to major credit bureaus each month.

Timely monthly payments on the card can contribute to boosting your credit score, making it a viable option for those seeking to improve their creditworthiness.

Additionally, if you have limited or bad credit history, the Reflex® Platinum Mastercard® provides an opportunity to begin building a positive credit profile. By responsibly managing your card and making regular payments, you can demonstrate reliability and may see enhancements in your overall credit score over time.

Alternatives to the Reflex® Platinum Mastercard®

Are there other credit cards with lower fees and interest rates that you might consider? What about secured credit cards or credit builder loans as alternatives for building or rebuilding your credit?

Similar credit cards with lower fees and interest rates

The Discover it® Balance Transfer Card offers a 0% intro APR for 18 months on balance transfers and has no annual fee. It also provides 5% cash back on everyday purchases at various locations each quarter, along with unlimited 1% cash back on all other purchases.

Another alternative is the Capital One Platinum Credit Card, which does not charge an annual fee and can be suitable for those looking to build or rebuild credit. Additionally, the card may offer a lower interest rate compared to the Reflex® Platinum Mastercard®, making it a more cost-effective option in terms of fees and interest rates.

Secured credit cards

Secured credit cards offer a practical solution for building or rebuilding your credit. By providing a deposit as collateral, you can demonstrate financial responsibility and improve your creditworthiness over time.

These cards are particularly valuable if you have limited or poor credit history, as they often come with lower approval requirements compared to traditional unsecured credit cards.

Additionally, using a secured card responsibly by making on-time payments and staying within the credit limit can help boost your credit score. Some secured cards also report to major credit bureaus, allowing you to establish a positive payment history.

Moreover, while exploring secured card options, it’s essential to consider factors such as annual fees, interest rates, and any potential rewards or benefits offered by the card issuer.

Credit builder loans

Credit builder loans are an effective tool for establishing or rebuilding credit. By taking out a credit builder loan, you can make small monthly payments to build a positive payment history.

These timely payments are reported to the major credit bureaus, which can help improve your credit score over time.

Furthermore, credit builder loans typically don’t require a good credit score for approval, making them accessible to those with limited or poor credit history. This accessibility provides an opportunity for individuals and small businesses in need of funding to establish a positive financial track record and access better financing options in the future.

Reflex® Platinum Mastercard® Review Conclusion: Is the Worth the Fees?

Is the Reflex® Platinum Mastercard® Worth the Fees?

After carefully analyzing the Reflex credit card, I have concluded that this card may be beneficial for those with limited or bad credit history. However, it’s essential to weigh its advantages and drawbacks before making a decision.

Expert Analysis of Blog Topic’s Core Features or Mechanisms:

According to financial expert Rachel Robinson, the Reflex® Platinum Mastercard® provides valuable opportunities for individuals aiming to improve their credit score. By reporting account information monthly to major credit bureaus, it contributes positively to achieving long-term financial goals.

Addressing Safety, Ethics, and Transparency:

Rachel emphasizes that while utilizing this card can aid in building credit, users should remain mindful of its high annual fees and APR. Moreover, transparency in disclosing such costs is vital for ethical consumer engagement within the financial industry.

Integration into Daily Life or Specific Contexts:

For practical use, Rachel advises using the Reflex Card as a tool for responsible spending rather than relying on its high interest rates. She suggests setting small automatic payments from a checking account connected to it and monitoring expenses diligently.

Balanced Evaluation: Pros and Cons:

The Reflex Card offers potential benefits for improving one’s credit standing by facilitating positive activity reported directly to major bureaus each month. Nonetheless,.

its marked disadvantages lie in substantial annual fees and high APR when compared with other market options like secured cards or lower-fee alternatives.

Final Verdict or Recommendation:

Considering all aspects discussed here today alongside personal circumstances relating

to your current financial position—an accountable approach must guide your decision on whether investing in this card aligns with your long-term objectives.

FAQs

1. What makes the Reflex Credit Card stand out in 2024?

The Reflex Credit Card offers features designed for those building credit scores, including reporting to major credit bureaus and the potential for an increased line of credit over time.

2. Does owning a Reflex Credit Card come with high fees?

Owners of the Reflex Mastercard should be mindful of its fees, such as variable APRs, maintenance fees, and possible cash advance charges, all crucial when evaluating its worth.

3. Can I earn rewards or cashback with the Reflex Credit Card?

Currently, the card focuses on helping users improve their credit rather than offering rewards or cashback incentives that can be found with some other credit cards.

4. How does customer service compare for Visa versus Mastercard options like Reflex?

Both Visa and Mastercard provide reliable customer service; however, individual experiences may vary depending on the issuer’s services like Citibank or Wells Fargo associated with your card.

5. Is it easy to manage my Reflex Mastercard account online?

Yes, managing your account is straightforward—you can log in through your web browser or use apps available on platforms like Android to check balances and activity anytime.

6. What should I consider before applying for a loan or additional line of credit alongside my Reflex Card?

Before applying for extra loans like student loans or auto insurance lines of credit while holding a Reflex card, review the terms carefully. Reflect on interest rates and your ability to meet payments without deepening debts.